Leading Through Digital Disruption of Meezan Bank.

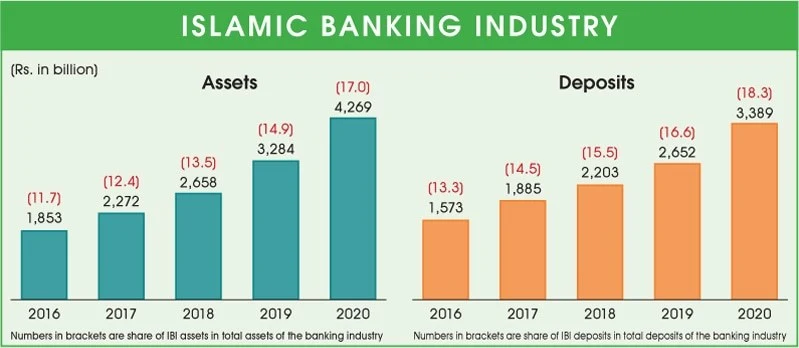

Meezan Bank Limited being the largest and the first full-fledged Islamic bank of Pakistan plays a strategic role in the country’s banking industry. Praised for strictly following the Islamic finance principles, the bank has been showing sustainable and solid growth as well as customer base.

Nevertheless, financial services industry is still in the process of transformation due to the processes that took place at the technological level, which require an immediate shift to keep up with the competitors.

Meezan Bank is not only competing against other conventional and Islamic banks, but is also challenged by the growing fintech players offering unique digital solutions that are directly targeting domains that are specific to banking industry.

The operational environment in the bank is characterized by a relatively increased demand for integrated, customer-centered digital banking solutions. The legal requirements thus impose a further challenge given the nature of the Islamic finance, which means that Meezan Bank has to be careful in its use of technology while keeping to the Shariah laws. These factors underline the importance of the systematic approach to the process of digitalization.

This report examines the current state of Meezan Bank for its ability to adapt to dynamics created by digital disruption. It suggests a framework for the introduction of new technologies, creation of a digital mindset, and leadership models compliant with the rules of Islam.

The report will provide valuable insights and concepts that will help Meezan Bank continue its growth and improve the competitive status it enjoys in the context of the existing digital environment.

Task 1: Scanning and Reviewing Disruptive Technologies

Opportunities in Digital Transformation for Meezan Bank:

Expanding Islamic Banking Services Digitally:

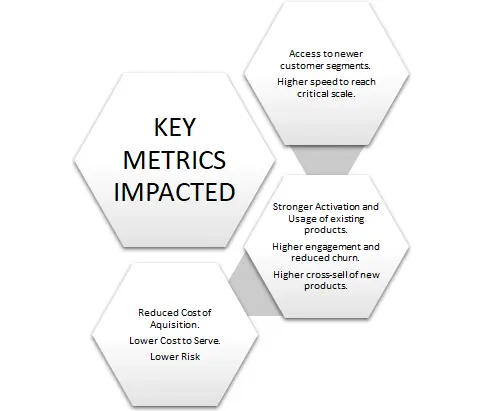

The digital transformation means a lot for the Meezan Bank in the context of delivering the Shariah compliant product through digital platforms. Mobile banking is yet another opportunity to go over the bank customers, especially in those regions where fully equipped branches cannot be provided. New opportunities within a Sharia-compliant digital environment include wallets and payment systems tailored to Islamic clients with exhaustive knowledge of technologies.

These tools provide a smooth connection on the operation of financial flows in compliance with the rules of Sharia, which govern Islamic banking. For instance, the launch of an application that links the digital payment system to Shariah-compliant products and services would help expand the financial inclusion while cementing the bank’s position in the Islamic fintech revolution.

Enhanced Customer Experience Through Personalization:

The use of data analytic techniques and artificial intelligence allows Meezan Bank to provide relevant services that meet the needs of the customers thereby increasing its customer satisfaction. Artificial intelligence technologies allow for customer data analysis that enables providing customers with proper shariah-compliant financial products.

For example, individual investment profiles and automated structuring of savings can be informative, helpful, and pass-compliant. Some examples from other countries, which show how AI can be implemented include the AI-based customer engagement models implemented by DBS Bank. These developments enhance the client experience while solidifying Meezan Bank’s standing as a forward-thinking organization.

Operational Efficiency and Market Positioning:

Digitalization also increases general effectiveness since it helps the bank to work on internal business processes and resource management. Tasks like account opening and customer compliance checks can be repetitive and by using automation, the processes have less chance of being done wrong and take less time to complete.

Furthermore, the next-generation decision-making devices based on AI and ML are likely to facilitate and optimize risk evaluating and credit granting in addition to maintaining compliance. By appropriating these opportunities, Meezan Bank is presented as a progressive leader of the Islamic bank, capable to face modern challenges.

Challenges of Digital Disruption in Meezan Bank:

Cybersecurity Concerns:

A major concern that Meezan Bank faces for implementing a strategy of digitalization is the issue of security of customer data. While more and more financial transactions are conducted over the internet, the risk of hacking and data leakage also rises exponentially. Screwed cybersecurity not only threatens the customers’ trust but also costs a lot in terms of both money and reputation.

The risks are particularly dangerous for Meezan Bank because ethical and regulatory requirements associated with Islamic banking are also a factor. It remains important to safeguard the Islamic aspect of such technology-related services like cloud computing since they pose certain challenges related to potential privacy breaches due to improper encryption of data. In this area, failure may jeopardise the bank’s reputation and compliance with the ethical code.

Regulatory Compliance in Islamic Finance:

Digital innovation in the Islamic banking must ensure it operates under strict regulatory processes since Sharia regulatory benchmarks are strictly adhered to, thus posing a challenge for Meezan Bank. To avoid condition of riba (interest) and gharar (excessive uncertainty), the methodologies like blockchain or AI must be integrated into the system carefully.

The ethical aspect must be carefully considered when implementing these advances, even though they can enhance operations and personal services. However, the issue comes when society demands regulation of these technologies, which slows the bank’s adoption in a market that is becoming more and more competitive. As a result, this is still a difficult balancing act that poses a serious obstacle to Meezan Bank’s digital transformation plan.

Operational Resistance to Change:

Internally, Meezan Bank must overcome several operational challenges as it transitions to a more efficient digital model. says that the acceptance of new technologies is also hampered by employee resistance, which stems from a lack of technological training and unfavourable perceptions of the likely duplication that will occur if technologies are integrated.

There is always a conflict of culture whereby those employees trained in the conventional banking systems might find it difficult to embrace the fast changes in technology. To this, specific organisational transformation initiatives such as wide-ranging training initiatives, must be affected in order to develop the workforce and engender the right culture.

Task 2: Deploying Emerging Technologies

Technology 1 – Artificial Intelligence (AI) & Machine Learning (ML):

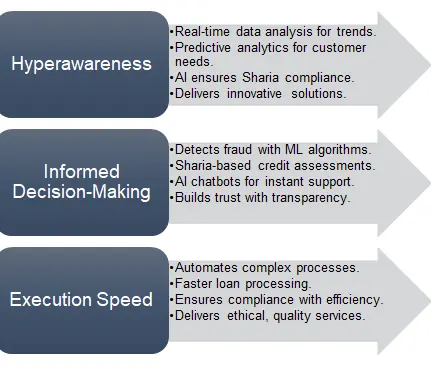

Hyperawareness:

AI and ML make it easier for Meezan Bank to process big data in real time and understand market and customers. The application of predictive analytics helps identify new needs, at the same time, elements forbidden by Sharia which are riba (interest) or gharar (uncertainty) in products are recognized. This helps the bank to be better placed in the position to meeting these demands as well as being able to present compliant innovative solutions.

Informed Decision-Making:

By identifying possible fraud cases, analysing credit risks, and providing real-time customer support through chatbots, AI/ML improves decision-making processes. They guarantee the ethical, data-driven decisions to be made while at the same time enhancing operational openness and credibility.

Execution Speed:

It eliminates difficult tasks such as underwriting where loans can be processed in minutes rather than days and all Shariah requirement met. This enhances the timely provision of services because of efficient means and the bank’s code of conduct.

Technology 2 – Robotic Process Automation (RPA):

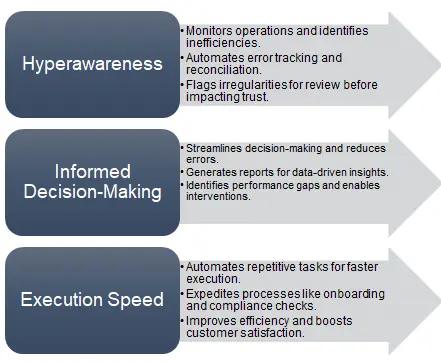

Hyperawareness:

RPA continuously monitors operations and identifies areas of unsatisfactory performance, which helps Meezan Bank become more hyperaware. It provides automated means for tracking of errors and reconciling accounts to operate with high accuracy and within legal requirements. RPA, for instance, can be crucial to preserving client confidence and complying with legal obligations since it notifies a company of suspect transactions for additional investigation.

Informed Decision-Making:

RPA assists in decision making because it introduces low levels of human error and provides detailed reports on operations performance. It offers possibilities for increasing efficiency of the performed processes and distribution of resources, so the management can make decisions based on its recommendations while adhering to Sharia.

Execution Speed:

RPA reduces the need for manual intervention by improving routine operations like compliance checks and onboarding. For example, account creation is automated which enhance efficiency in customer satisfaction and relieve employees to work more on the complex issues.

Task 3: Implementing the Pillars of Digital Culture

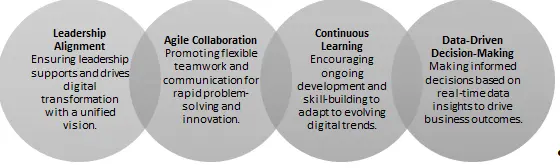

Four Pillars of Digital Culture:

Leadership Alignment:

Leadership for digitalisation at Meezan Bank involves ensuring the integration of Islamic values with technological advancements. It entails that leadership owns initiatives and relates them to the requirements of Sharia-compliant banking.

For instance, the strategic approaches which are led by CEO such as customer-focused innovation can foster commitment of the organisation and enhance stakeholders’ trust. A proper leadership orientation is very important when it comes to building a culture of change, especially within the traditional segments such as Islamic banking.

Agile Collaboration:

Integrated approach of working helps various teams in Meezan Bank’s business and IT unit to be on the same page. It can be communication tools such as the use of Slack, Trello and other social platforms which enhance real time update and organization.

Integration of digital initiatives happen with considerations for technical and operation priorities from cross-functional collaborations. Agile methods also support operations’ alignment with customers and compliance with Shariah principles, which makes it easier to create a unified approach to innovation.

Continuous Learning:

To get their employees ready for digital transformation, it’s important for companies to provide continuous learning. AI and data analytics upskilling, as well as Islamic fintech tools, makes them ready for upcoming challenges. Developed training interventions help branch workers to navigate and operate in digital banking environments effectively, with positive consequences on the quality-of-service delivery as well as ethical standard.

For instance, training on the automated arrangements of Sharia compliance increases the effectiveness and quality. Studies have shown that firms with learning orientation have it easier when it comes to responding to market signals.

Data-Driven Decision-Making:

Meezan Bank’s success requires a data driven culture. Sharia compliance, customer engagement and operational performance are tracked by visualization tools like dashboards to make informed decisions. They can, for example, highlight trends in non compliant transactions and trigger timely interventions. This approach ensures there is always accountability and precision when it comes to decision making, the decisions are based on measurable outcomes.

Organizational Strategies to Foster Digital Culture:

Use Academic Models:

Kotter’s Change Model can be used by Meezan Bank for cultural shifts management. It is a framework of creating urgency, forming the coalition, and conducting incremental change in reinforcing new behaviours.

For example, you start using AI powered sharia compliance checks with some employees slowly, by gradually implementing the digital tool, so it doesn’t break and disrupt operations. It’s great for the bank to celebrate small wins as this reinforces the fact that digital initiatives have a positive impact on the bank’s mission and vision.

Collaboration Platforms:

The fostering of a digital read culture requires central platforms for data sharing and teamwork. Microsoft Teams makes it easy to communicate with ease as it is across departments making the digital strategies more efficient.

In addition, these platforms also allow for the sharing best practices and the digitization of projects in compliance with Sharia. Meezan Bank will create an environment, where employees remain engaged and unified in digital transformation by fostering transparency and collaboration.

Task 4: Digital Leadership and Change

Digital Leadership Style 1 – Agile Leadership:

Relevance to Meezan Bank:

Meezan Bank must follow agile leadership in order to be able to face the changes in the dynamic financial environment and also to respond to both market and regulatory changes. It facilitates a flexible approach to digital solutions, like mobile banking applications that are customer centred and Sharia compliant. The bank can respond quickly to the trends in customer expectations and front-end technology, by being agile.

Mechanisms for Collaboration:

Frameworks like Scrum or Kanban help to forge cross departmental collaboration and ensure the business and IT teams work in coordination with one another. It helps for progressive step up because digital projects are going to both the customer needs and Islamic ethical standards. Such collaborative effort is essential for achieving a state of equilibrium between compliance and innovation.

Digital Leadership Style 2 – Ethical-Tech Leadership:

Relevance to Meezan Bank:

Meezan Bank’s ethical-tech leadership is the guarantee that the bank’s digital transformation is consistent with Islamic values. In this style, leaders put transparency and responsibility while adopting technologies. For instance, ethical AI tools can be used for instance to improve lending decisions maintaining fairness and Sharia contravention. It establishes trust among customers and stakeholders.

Building Networks:

In addition, ethical tech leaders are advocating coalitions and partnership with Islamic fintech startups for co creation of innovative and compliant financial solutions. These collaborations allow the bank to merge leading technology with its mission to remain an ethical bank. This puts Meezan Bank in a somewhat unique position as a pioneer of ethical digital finance.

Conclusion

This report critically examined the readiness of Meezan Bank for digital transformation, highlighting critical opportunities and challenges while navigating a dynamic financial environment. There is a huge opportunity to utilize AI and data analytics to deliver more personalized Islamic banking services that are Sharia compliant, and still provide great customer experience.

Despite this, a successful transformation faces challenges such as cybersecurity threats, regulatory limits and resistance to organizational transformation which should be tackled strategically.

Practical solutions for these challenges emerge with hyperawareness and decision making through AI/ML, and operational efficiency through RPA. For Meezan Bank to fully utilize these technologies, it must enact a strong digital culture that entails data driven decision making, agile collaboration, continuous learning, and leadership alignment with Islamic principles.

This helps build agile leadership that encourages adaptability as well as ethical tech leadership which aims to ensure that innovations related to Islamic finance are aligned with Islamic finance standards, subsequently building trust and a competitive advantage.

In order to sustain growth, to take the route of ethical banking practices, Meezan Bank should focus on customer oriented digital tools and integrate innovative solutions with them. Preserving the bank’s reputation while increasing its operational agility can be done by a deliberate alignment of digital initiatives with Sharia principles.

By applying these strategies, Meezan Bank will be positioned as a leader of Islamic digital banking and open the path to sustainably engaging success in a highly competitive environment.