Leading Through Digital Disruption of HDFC Bank

Housing Development Finance Corporation (HDFC) Bank Limited is the largest Indian private bank based on assets and is recognised as one of the main leaders in the digitalization of banking services. According to the recent stats, HDFC Bank has become the seventh most valued lender in the world.

Having a market capitalization of roughly $151 billion or Rs 12.38 lakh crore, HDFC Bank is now ranked seventh in the global ranking as a lender, surpassing giants like Morgan Stanley and Bank of China. Currently, the market capitalization value of the bank is placing it in the position of digital innovation that is used to boost operational performance, increase customer satisfaction, and experience steady business development This report aims to critically appraise HDFC Bank’s opportunities and threats in managing digital disruption. This involves examining emerging technologies, building the digital workplace environment, and getting the right leadership models for change.

This report centres on the impact of disruptive technologies including AI and 5G on HDFC Bank, examining how to keep up a proficient digital culture through innovation and collaboration, including the application of leadership strategies that support digital transformation.

Task 1: Scanning and Reviewing Disruptive Technologies

Key Opportunities in Digital Transformation

HDFC Bank operates in a rapidly evolving financial landscape, where digital transformation has unlocked several key opportunities. The key opportunities in digital transformation of HDFC Bank, India is presented in Table 1 below.

Table 1: Key Opportunities in Digital Transformation

| Key Opportunities | Technology Used | Description |

| Customer Insights | Big Data Analytics | During the analysis of customer data, banking organisations use various methods and algorithms to offer better services and financial products. |

| Operational Efficiency | Robotic Process Automation (RPA) | Technologies of automation are deployed to relative back-end procedures which in turn cut down transaction time and errors. |

| Market Expansion | Mobile and Internet Banking | The services provided by digital banking platforms help HDFC Bank reach and expand to rural and urban regions to meet the needs of its clients for financial services. |

Challenges in Digital Disruption

Despite its progress, HDFC Bank faces challenges in adapting to a digitally disruptive environment:

- Cybersecurity Threats: The increasing use of digital platforms can risk data privacy and security since more and more organisations tap the online market to deliver their services.

- Competition from Fintech and Global Players: New developments in online payments are being led by players such as Google Pay and Apple Pay among others are redefining customer expectations of digital payment solutions.

- Talent Gap in Emerging Technologies: The rapid development of technologies demands the retraining of experienced and recruitment of talented employees in the fields of AI, IoT and blockchain.

Digital Transformation Objectives for HDFC Bank

To navigate disruption effectively, HDFC Bank has outlined several strategic objectives:

- Optimize Internal Operations: Modified processes will be used to put IoT and RPA to work and bring great changes to operational efficiency.

- Enhance Marketing Effectiveness: Introduce AI algorithms to deliver personalised, targeted campaigns.

Expand Digital Channels: Broaden access to banking services in areas where it is hard to accomplish due to poor physical access to branches through mobile and internet banking services

Task 2: Deploying Emerging Technologies

Digital Business Agility Model

The Digital Business Agility Model offers a framework through which organisations can remain competitive in unstable environments. It comprises three interconnected components i.e., Hyperawareness, Informed Decision-Making and Fast Execution

Hyperawareness:

Constant analysis of internal and external conditions so that organisational changes, customer trends, and threats can be easily detected. For example, using up-to-date data collected from transactions to either look for signs of fraud or shifts in customers’ behaviour.

Informed Decision-Making:

Using analytical data and accurate information to achieve good and timely decisions. At HDFC Bank, such leveraging could mean improving credit scoring models based on information technologies or the analysis of marketing promotions.

Fast Execution:

Efficient systems so that prompt action can be taken with improvements and advancements. Through automation and high-speed connectivity, customers having relationships with HDFC Bank can experience efficient delivery of financial products or services.

Proposed Technologies for HDFC Bank

To achieve agility and maintain a competitive edge, HDFC Bank should adopt the following emerging technologies:

Artificial Intelligence and Machine Learning (ML) – Hyperawareness & Informed Decision Making

AI can detect fraud as the AI systems in real-time process an enormous amount of transactional data identifying any irregularities that may result in fraudulent schemes. Furthermore, the ML algorithms work through credit risks of customers, or through selling related products, thus assessing customer behaviour by using predictive analytics. AI-based solutions include chatbots such as EVA – which HDFC Bank has already adopted; add value because they help the clients in the first instance.

AI generates hyperawareness since it can process large datasets in the search for valuable information. It also enhances decision-making by creating predictive models to support operation and strategic choices. Companies such as JPMorgan Chase of America have adopted AI fraud detection to reduce fraud transactions that cost billions every year. Likewise, HDFC Bank’s “EVA” chatbot has already handled a lot of queries and has saved a lot of manual intervention and enhanced client response times.

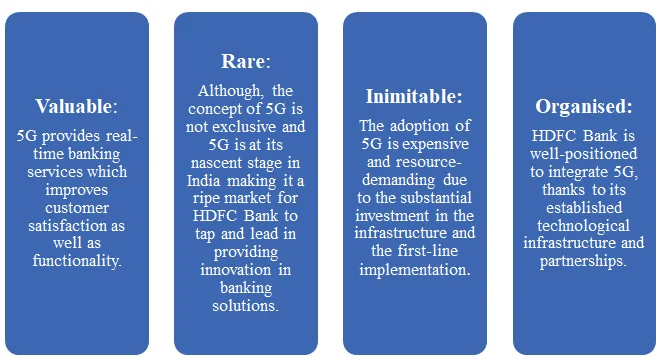

5G Connectivity – Fast Execution

5G contributes to high-speed dependable business transaction processing, thus offering quality digital banking services. Higher speeds and dependability beyond their offerings make service deliveries like fund transfers and loans through HDFC Bank’s mobile application very efficient. 5G enables fast execution through ultra-reliable and high-speed networks to complete executions.

5G also enables the efficient provision of innovative solutions targeting customers such as mobile payments and video banking. For instance, Kakao Bank has used 5-G-enabled services in countries such as South Korea to conduct real-time video banking which minimises face-to-face meetings. HDFC Bank can also similarly deploy similar 5-G technology to serve tech-savvy and distant customers.

VRIO Analysis of AI for HDFC Bank

VRIO analysis is a strategic planning tool which is designed to assist organisations in gaining a competitive edge by evaluating their capabilities and resources. The VRIO Analysis of AI for HDFC Bank is presented below.

VRIO Analysis of 5G Connectivity for HDFC Bank

The VRIO Analysis of 5G Connectivity for HDFC Bank is presented below.

Implementation Steps

To effectively adopt AI and 5G, HDFC Bank should follow these steps:

- Develop Partnerships with AI and 5G Providers

- Conduct Employee Training Programs.

- Institutional Collaborations.

- Online Training Modules.

- Pilot Projects: (Use the two technologies to run limited experiments of fraud-detection applications based on artificial intelligence and mobile applications driven by 5G networks. These pilots could be used to make further refinements and then replication the operations across all the banks in the operation of the banks).

The table below presents the benefits of the proposed technologies at HDFC Bank.

Table 2: Benefits of Proposed Technologies

| Technology | Key Applications | Impact on Agility |

| AI & ML | Fraud prevention, predictive analytics | Improves hyperawareness and decision-making |

| 5G Connectivity | Faster financial transactions | Accelerates fast execution |

Subsequently, these technological advancements can enable HDFC Bank to capture its operation cost and strengthen customer bonds while at the same time maintaining its market dominance in the digital banking system in India

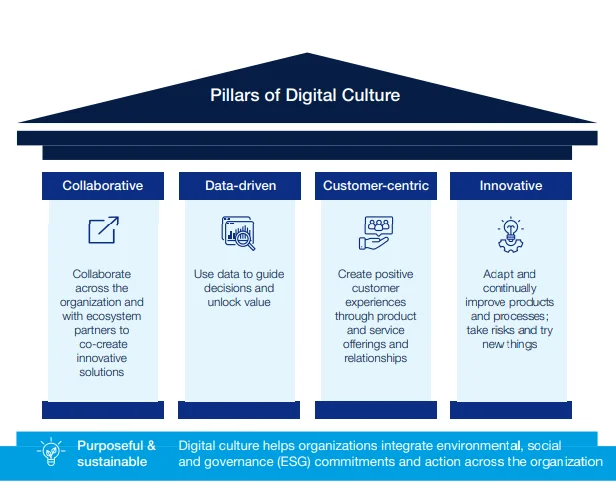

Task 3: Implementing the Pillars of Digital Culture

Importance of a Digital-Ready Culture for HDFC Bank

For HDFC Bank to remain relevant in the fast-growing competition and emerging digital financial world, digital ready culture is very essential in preparing the organisation to be customer-ready to face the digital world. It promotes innovation and collaboration: By breaking silos, a digital culture promotes in an organisation as departments such as operations, ICT and marketing collaborate effectively to develop solutions.

Further, the need for conforming to advanced analytics guarantees that the decisions made are made with the help of current customer information and the efficiency of the methods used as well as consumer satisfaction. In the course of the growth of HDFC Bank, the establishment of a robust organisational digital culture facilitates the achievement of various transformation objectives and customer expectations as the organisation elaborates on its tactics of going digital.

Collaborative

Having such options as Microsoft Teams or Slack, the bank can solve the problem of effective communication within departments and in different locations. These applications support content exchange, assignment organisation and timely information updates, concepts that foster teamwork. For instance, to enhance collaboration among its employees Citi Bank (Citigroup) uses Microsoft Teams.

Data-Driven

The HDFC bank can also form data-driven decisions. In this regard, a real-time operation analytics dashboard can be used by HDFC Bank to closely measure business operation metrics such as operation cost, customer satisfaction, and overall profitability. This makes the data to be shared across the various teams making decision-making much more transparent and involving.

It strengthens people’s trust within teams and fosters effective and quick reactions to emerging issues. For example, Amazon has implemented data-driven analytics to enhance its operational efficiency.

Customer-Centricity

Using smart solutions, including chatbots and customer feedback forms, HDFC Bank can collect customer feedback. For example, its chatbot e “EVA”, can gather information regarding frequently asked questions to determine the deficiencies in services it offers. The customer-centric approach improves customer satisfaction through service customization and guarantees that all products developed meet customers’ requirements.

Innovation

In this case, the bank can organise internal hackathons that entice employees to come up with and implement new ideas in areas such as payments and fraud detection. Furthermore, investment in Research and Development can also enhance the rate of innovation. It would assist creativity and place HDFC Bank as a pioneer within the digital banking business sector.

For instance, the Reserve Bank of India global fintech hackathon, Harbinger 2021 is another example because they’ve motivated teams to bring innovations in the areas of fraud detection and digital payment security.

The results of the competition developed technologies such as advanced tools for monitoring fraud and payment systems based on sound. These technologies were presented by participants such as TrustCheckr and ToneTag.

Task 4: Digital Leadership and Change

Significance of Digital Leadership

This report seeks to explore the significance of digital leadership, especially as different organisations continue to seek ways by which they can effectively be in a position to achieve their goals and objectives most efficiently.

The transformation of HDFC Bank to a fully digital organisation requires effective digital leadership. Therefore, it is the leaders’ responsibility to address and overcome change resistance and promote digital literacy. In addition, it also increases team productivity and forms connections within the bank since it introduces new communication technologies and enters various partnerships with external organisations such as fintech companies.

Adopting this leadership approach in an organisation fosters synchronisation of its targets with the advancement in technology while maintaining ethically sound and consumer-orientated strategies in the integration of technology.

Recommended Leadership Styles for HDFC Bank

Agile Leadership

The principles of Agile leadership include flexibility, improvement of the process step by step, and orientation to a fast reaction to changes. It is a popular style of leaders as they often keep feedback and are thus able to shift approaches fast when addressing technological issues. At HDFC Bank, proper agile leaders can lead the pilot projects for growing solutions like AI, and 5G, among other developments, carrying trial implementations before scaling them to the bank-wide.

Also, the successful integration of customer information into the decision-making process guarantees the organisation’s alignment with the market demands.

Ethical-Tech Leadership

Ethical-tech leadership is the guidance of designing and development of technologies in a responsible, and transparent way. Technological active leaders ensure that technology is being used safely, respecting privacy, and doesn’t have bad effects towards the people and environment.

They are honest, transparent, and fair in their decisions and strike a balance by promoting progress and satisfying the needs of people and societies. In other words, it is how technology can be employed for the greater good and does not have any harmful consequences.

Ethical-Tech leaders are concerned with the proper application of technology which includes most of today’s organisations’ operational systems such as Artificial Intelligence and Predictive Analytics among others. They aim at ensuring customer loyalty by showing how data gathered is utilised and put into practice besides following set regulations.

The management at HDFC Bank should guarantee its AI-driven solutions meet the requirements of the Digital Personal Data Protection Act, 2023. Ethical leadership enables integrity in relations with the fintech firms or vendors to develop business partnerships. Moreover, HDFC Bank can use Microsoft Teams and Slack for collaboration and organising tasks in the platform in real time. Such tools incentivise interdepartmental cooperation on digital programmes.

Comparison of Leadership Styles

| Leadership Style | Key Characteristics | Contribution to Transformation |

| Agile Leadership | Adaptive, collaborative | Drives innovation and responsiveness |

| Ethical-Tech Leadership | Integrity, customer-focused | Builds trust and ensures regulatory compliance |

Conclusion

Highlight, HDFC Bank business operates in an ever-changing financial market particularly due to disruptive digital technologies. It is established that there is great potential, including the use of artificial intelligence for fraud and predictive analytics and using 5G for real-time banking experience.

These technologies are consistent with the ‘Digital Business Agility Model’, strengthening the hyper-awareness execution and decision-making strength. Still, these include cybersecurity concerns, and a talent gap to indicate the need to build a digital-first mindset and the adoption of digital leadership approaches.

To enhance digital leadership at HDFC, the proposed agile leadership and ethical-tech leadership strategies will assist the bank in addressing the challenge of resistance to change, fostering teamwork, and getting the best ethical data practices.