How to manage liquidity and finances in commercial banks?

In this report, the role of liquidity, as well as financial management in commercial banks, is defined. Commercial banks are the banks that refer to financial institutions as accepting deposits, offering basic financial products, and being privy the checking account services.

The activities of commercial banks become raised from time to time because people open the accounts in the banks for the saving of money, running the daily life operations, and ensuring about the money is protected.

The financial performance of commercial banks depends on the process that leads the greater activities in the future. As liquidate the financial projections, the saving of account and individual’s abilities can be classified to maintain particular areas of success. Various financial products observe the most planned areas and determine the bank’s progress in the future.

This dissertation topic is about the ways to manage liquidity as well as finances in commercial banks. The financial department of the bank is responsible to manage the finances that come from the different areas of the business’s success. As making the various loans and saving the individual’s threats, the firm’s operations can be classified.

It is the financial institution that accepts deposits, offers checking account services, and makes loans by offering basic financial products like the certification of deposits and savings accounts. Liquidity is the process of the banking industry in which all the asses are transferred into money for financial performance.

It refers to the financial efficiency as well as the ease with which an asset or security can be converted into the process of ready cash without affecting the market price.

Financial liquidity refers to how the assets can be converted into the process of cash. To get detailed functions and organized the possible outcomes, the commercial banks can be obtained through the possible and recorded-based varieties.

Liquidity is the process that refers to the easy way to transform the asset into cash. Commercial banks face various issues in managing their finances so, they adopted the methods of liquidation to resolve these issues and crises.

This research study is about enforcing the operations and classification of business practices in the future. Cash is the most liquid form of liquidity that addition to notes and coins. The account balances and the cheques are the core planning terms that increase the business values.

Commercial banks form liquidity assets that can be quickly converted into finances due to treasury risks. Various ways help commercial banks to liquidate their operations and manage their finances. It is the measurement of the cash as well as soother assets banks have availability to quickly pay the bills for meeting the short-term business as well as financial obligations.

There is a proper measurement of capital that generate the resources to absorb the losses . Liquidity and finance management relate to the risk of earning the banking and the inability to m eat timely obligations. In commercial banks, the process of liquidity and finances affects the greater practices in terms to determine the greater practices.

The management of the banks must be ensured that sufficient funds are available at the reais ale cost to meet the potential demands from both finds as well borrowers.

This research study directly analyzes the ways of managing liquidation as well as finances in commercial banks. To evaluate the ability of the company as required to manage the greater scenarios and update the most valuable success practices.

By reviewing the different journal articles and analyzing the best experiences through the greater plans. Commercial banks develop the best ways to manage the finances as well as liquidities among the given plans.

To improve the commercial bank’s practices and generate the inability, it is necessary to manage the finances. The management of income statements, net profit, and cash flow planning through the processed plans raises collaborative decisions.

Cash is the most collaborative form that analyzes the currencies and observes the internal values. Central bank liquidity, funding liquidity, and market liquidity are three types of liquidities that increase the empirical behavior as liquidity risk that improve the collaborative plans of the businesses.

The analysis of the key theories and models is related to the topic of the dissertations. To determine the proper practices and manage the finances, the business classification strengths should be valid. This dissertation evaluates the impact of commercial bank resources as evaluated the most systematic areas in the future that can broadly change in the future.

Read more: Customer Experience Strategy of GT Bank

Research objectives, questions, or hypotheses:

This research study evaluates the core preferences of the ways used to measure liquidity as well as final cues at the corporate level of commercial banks. So, the following are some objectives, hypotheses, and research questions of the survey exists.

Research objectives:

Here are some objectives of the research study.

- To evaluate the ways to manage the liquidity as well as finances in commercial banks.

- To determine the role of liability matures and issuing more equity as managing liquidity in the commercial banks.

- To investigate the impact of granting the loans and credit functions as the agency functions to liquidate and finance management in accounting’s commercial bank.

Research questions:

Here are some research questions of the study.

- What are the ways to manage the liquidity and finances in commercial banks?

- How the liquidity maturities and equity issued impact the management of liquidity in commercial banks?

- How do granting the loans and agency functions help to manage the liquidation and finance management in commercial banks?

Research hypothesis:

- liquidity and finance management through the loans and liquidity maturity is beneficial for the commercial bank’s performance.

- The finance and liquidity management by the loans and maturity is not beneficial for the performance of commercial banks.

Literature Review:

Key definitions:

Liquidity and finance management:

In accounting or finance, liquidity is the measurement of the ability of the debtor to pay the debts as and why they fall due. It is the process that expressed the ratio or the percentage of the current liabilities. It refers to the ability to pay particular debts as short-term obligations.

The ease with which one can convert assets into cash and affect the particular market value relates to liquidity operations. The financial institutions must manage the operations of the liquidity as well as the finances that generate better practices in the future.

All the activities of the business can be classified to obtain a higher level of success. Various methods are used by financial institutions to manage liquidity as well as finances because it helps to boost the reputation and serve the greater plans of the businesses.

The development of valuable plans for the business that can accomplish reaching the most sustainable practices. In this modern world, the management of finances and liquidities directly impacts the business success positively as it is the sustainable activities through foreign reliable terms.

It refers to the services provided by the banks to the customers that have their corporation to minimize the risks and optimize the interest in the form of accounts and pool funds. To evaluate the implications of liquidity and estimate financial management, banks use different plans.

Commercial banks:

The term commercial bank is a financial institution that accepts loans, and deposits and offers checking account services to customers. These types of banks are also known as retail banks as well as universal banks because they provide a wide range of services to retail customers and generate the proper services of payment related to the broad changes of the investment.

For foreign exchange services, the core functions of deposit-taking and lending are also the practices of commercial banks that increase the chances of customers gaining success. The primary function of commercial banks is to accept deposits as well as lending funds because deposits are savings, current, and time deposits.

There is a commercial bank that lends funds to its customers in the form of loans as well as advances. Commercial banks provide a variety of products and services that improve business classifications and build the most preferred areas of the business. As the cash credit and lending the business values, the operational plans can be classified in the future.

Key models and theories:

Here are some models and theories related to the topic of the research study.

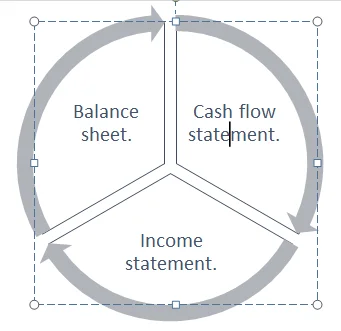

Three-statement model:

As the three-statement financial model is an integrated model that uses to estimate or forecast the income statement, balance sheet, and statement of the cash flow of the company. For evaluating the finance management plans and boosting the overall plans, the business success can be classified as related to the future.

There are three core management uses in this model to evaluate the forecasting of the data and reburied to gather the data perfuming the aspects of financial molding. This model is used to derive the company’s appropriate balance sheet, its cash flow statement, and the income statement as required to manage the operations in the future. It allows the business to track the project and its overall performance on the times.

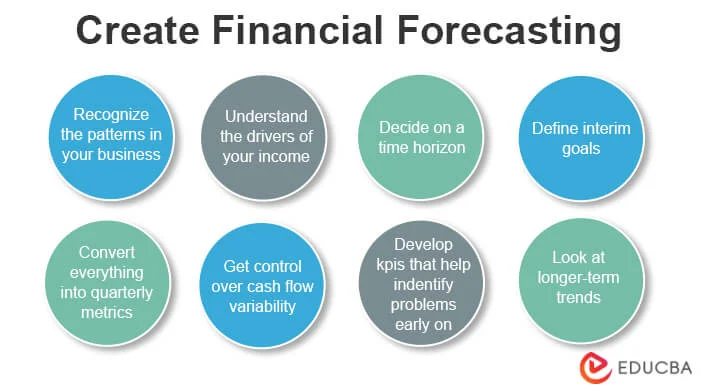

Forecasting model:

To evaluate the impact of liquidity and finance management in commercial banks, the forecasting model is also used. It is the model that predicted the company’s financial future by examining historical performance data such as revenue, expenses, and sales.

To develop the guesswork and assume the many foreseen factors that can influence business performance, the firm’s values can be updated. Forecasting the financial performance of the company and generating clear valuable plans, the business stints become strongly attached.

In this modern world, the management of the commercial bank’s finances and liquidity can be done through the use of advanced technology. This model combines the key reports of the businesses that directly ensure the financial statements. You can do the strong cash position of the company by improving the business positions and its greater success parts.

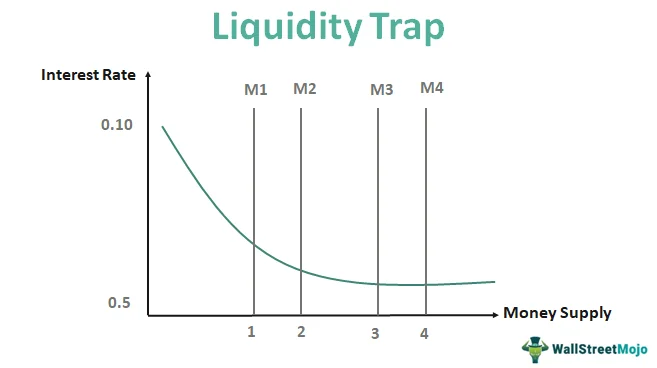

Liquidity trap theory:

According to the theory of liquidity trap, when the interest rates are very low then the customer prefers to hoard cash rather than spend as well as invest the money in the process of higher yield bonds or other types of investment.

In commercial banks, the development of strong plans and boosting the finance management practices will be improved through financial projections. When people did not spend or invest the amount at a time when the rate of unrest is low then the level of demand for the company’s core products is less.

The economy of the country is also affected by the preferred area so the business decisions. This theory can decrease the real interest rate which is known as the liquidity effect of more money as tends to lower the price of money which is equivalent to lowering the interest rate.

Liquidity maturities to manage the liquidities in the commercial banks:

Liquidity risks an event of capital loss whereas the maturity risk premium is an amount that is given by the company to the bond investors. Improving the changing of maturity is the way that improves the liquidities in commercial banks and resolves the issues that are faced by the people. So, commercial banks explore the facilities at the corporate level.

The risks of liquidity occur when there is a value of asses that may be lowered at a particular time. Shortening the maturities of the assets, improving the average liquidity of all the assets, lengthening the business practices, issuing more equity, and reducing the contingent commitments are some ways that help commercial banks to reduce the issues of the liquidities and manage them.

For managing the operations and developing the protection of the liquidities, commercial banks need to enhance the greater facilities. By using the best activities and understanding the core facilities, the firm’s reliable actions can be sustained in the future.

In developing internal growth plans and generating the best evaluation of the business strengths, the management of liquidity operations is important. To encourage the business competencies and generate the most reliable practices, the business strengths can be valid or supinated.

An important piece of managing the liquidity risk helps commercial banks to understand bank funding as a sustainable balance growth. Typically, the banks will fund the appropriate balance sheet with a mix of core deposits as well as non-core deposits funding equity manners.

Ways to manage the finances and liquidities in commercial banks (loans and credit functions):

As commercial bank financier management, different strategies and options help businesses to boost certain changes. Taking loans and improving credit functions are the key strategies that improve business decisions and update better practices through the given areas.

Mostly commercial banks deal with the management of deposits, lending certain activities, and building the core investments, through generating the higher capital of the banks, and taking the activities of off-balances. The financial management of commercial banks covers capital decisions and builds the proper use of credit functions.

This activity of the commercial bank also helps to manage the market risk and transform the core competencies as required in the future. There are a lot of operations that help commercial banks to enhance their greater practices and build the core competencies in the given areas. To develop asset-backed securities and manage valuable market risks, the business assumptions can be resources or tackled in the future.

Tracking the spending power to improve the finances, creating a realistic budget for the spending, and tracking the areas where the commercial banks are spending to build positive as well as valuable growth. De-Commercialized banks obtained funding from retail despite, wholesales, deposits, and debt or equity as the major sources of funds.

The company’s overall progress and its broad values can be tackled in the future to improve the funding processes. In retail deposits, the business decisions and its overall certain plans are directly boosted through finance management.

Using automation, knowing the balances, exploring the mobile application, embracing the potential earnings, and avoiding the fees, as considering the consolidated practices the business values become strong and it transforms the reliable activities.

Accepting deposits, granting loans and some advances, starting the functions of the agency, discounting the bills of exchange, and creating credits are some resources that help businesses to improve certain decisions and maintain overall success practices.

The business functions that deal with the investment as it is available to the financial resources in the way of great the business success and return on the investment as the core practices. The financial management professionals plan directly to organize the control to build the transaction in the business functions.

Research methodology:

In this dissertation, the research methodology is the process that helps to collect or gather the data for completing the study. The approach, philosophies, choice, process of collecting the data, and analysis method of the data of the research are defined in this section that improves the efforts of getting higher success and generates the essential practices as required in the future.

The research methodology is the section that organizes the process of collecting the data and analyzing it as required to deal with certain decisions. So, the timeline to complete the research is also added in this research to evaluate the final goals.

- Research approach: In this research study, there is a deductive approach is used because it related to the historical plans of the business.

- Research philosophy: There is an interpretivism philosophy of the research analyzed that helps to evaluate the past academic data on the given topic.

- Research choice: In this research study, there is a qualitative choice is preferred to collect the resources and evaluate the type of research. The reason for this type is to evaluate past resources and the given data techniques.

- Research sampling strategy: There is a non-probability sampling strategy is used in this research due to the nature and type of the dissertation.

- Data collection method: There is a secondary source used to collect the data and gather the entire information related to the topic of the research study. These sources relate to the experimental and observed data.

- Tools to collect the data: Different tools use to collect the data and gather the entire information. The journal articles, past academic papers, newspapers, commercial bank reports, and the history of finance management are used to analyze the information in this research study.

- Analyze the data: There is a descriptive analysis method is used to evaluate the results and generate the core competencies of the business plans that will help to get advanced decisions.

These elements of the research study help to mitigate the challenges and collect the most reliable data as it is effective to proceed with the actions. This section provides the proper plan as it requires managing the internal capabilities and collecting the most impactful data which proceeds the clear activities of the dissertations.

There are past academic research and journal related to the topic of the research that is used to collect the most reliable and valuable data as it is greater or more impactful in the study. With the development of certain activities and building advanced decisions, organizational competencies can be taking place. Past academic sources and the evaluation of the journal articles are used to maintain the business capabilities as it required greater decisions.

The deductive approach is used to evaluate the research and boost the most impactful technique as it is required to update the business classifications. There is a non-sampling strategy is used to evaluate the business values and update the most planned terms in the future.

Analysis:

In this research study, the role or process to manage liquidity as well as finances in commercial banks is defined. These types of banks are classified through the proper decisions and get clear techniques in the given areas of the business success.

Commercial banks are public banks that provide a variety of services to the common public and try to improve their satisfaction level. Managing the finances and the liquidity refers to the broad areas of success as it is valid to upgrade the instant plans. The banks put so much effort to proceed with the actions and transform the most reliable or valuable practices in the future.

To enhance the performance of commercial banks and generate the most relevant information, it is important to develop methods that can easily manage the finances as well as the remaining options. By determining the broad practices and improving the clear number of success, the business plans must be tackled in the future.

Liquidity and finance management are the broad terms that directly affect the financial performance of the company whether it is a bank or other financial institution. Because a bank is also a corporation due to its core operations and nature.

Liquidity arises when commercial banks want to get more cash, so the finance team decided to develop different strategies as helping for its success. Mostly commercial banks deal with the management of despises, lending the core activities, broadly investing the capitals, the runs the activities of the off-balance sheet that help to achieve higher success and maintain the advance values as required to run the overall progress of the business.

Commercial banks trying to explore the world by using better finance management strategies and generating more reliable space as it proceeds the greater experiences in the future. To manage the market risk and generate the best ways to spend the greater finances, business decisions can be classified. To build up savings and pay the bills on the time of every month the commercial bank, and finance management appear.

Methods to manage the finances in the commercial bank:

Different methods develop by commercial banks to improve financial operations and manage the broad areas of success as required to manage the current values. With all the activities and the current policies that allow the business to proceed the valuable actions, the firm can tackle broad success. To enhance the organizational values and build internal practices, the organizational management can proceed in the future.

In commercial banks, the development of proper finance management directly improves the business sources and builds better areas of success. Saving the charge of banks that they are extra paying is another way that helps to boost success and build clear decisions for the business. A successful commercial bank applies the ALM concept which is derived from Asset and Liability Management. It is the broad term that helps banks to manage their finances with the analysis of their assets as well as the liabilities that arise at certain points.

The assets of the banks either fixed assets as well as non-fixed assets have the greater importance to fulfill the entire values and its broad options. To encourage the business values and update the most referred terms, the firm’s growth activities are strongly associated with the future. By developing the best activities and generating the most effective areas of success, the firm’s capabilities can be transformed.

Assets and liability management is a strategy for managing the overall balance sheet as well as the structure of the bank that should ensure the satisfactory or profitability management strategies of the stress. To control the bank risk of the management and boot the clear plans, the business decisions will be applicable in the future.

Commercial banks manage the assets or the liabilities because these are advanced options that motivate the business’s success and generate the most reflective areas of success. In the banking industry. The assets or liabilities are managed with the equity of the banks.

So, the commercial banks also trying to improve the overall equity by treating the stakeholders and boosting the market value of the shareholders. Equity rises then the assets and liabilities management also rise to manage the finances in the commercial banks. Commercial banks provide the basic services of banking as well as products to the general public.

The small to midsized businesses and the individual consumers are the major commercial bank’s financial systems that improve the overall availability through the greater plans as rises in the greater decisions. Checking and savings accounts, loans and mortgages, starting basic investments, and creating safe deposit boxes are also the key strategies that help commercial banks in their financial management areas. Banks want to get greater knowledge as it is required to improve certain decisions and update the most planned areas of success.

While at the time of managing the finances, the operation, and the services must be valuable because it defines the strengths and the clear applicable resources in the given areas of the business. Community marketing, product bundling, and teller referrals are the core strategies that improve business values and update the best strategic planning in the given areas of success.

As the premier services become increase, the overall strategic planning will be sustained or managed broadly. Commercial banks also provide the opportunity and the facility to the general public as they invest in dollars or deposit in the form of money.

Because when the dollar deposited in these types of banks then their overall revenue becomes increases and it generates a higher level of profitability that rises to determine the best actions by considering the most reliable and valuable techniques.

Commercial banks’ activities will be transformed to get the proper success and update the mostly refined era of success. All the functions of the commercial banks direct motivate the people that are associated with the given areas of financial management.

The accepting deposits, granting loans and taking some advances, agency functions, discounting the bills of the exchange, crediting the creation, and generating some other functions, the business decisions can be transformed to get the most planned and reliable tools of the business success.

Bank makes the money in the form of interest on the securities that they hold and builds the fees for the customer services like checking the accounts, starting financial counseling, and taking loan servicing with the sale of financial products like insurance as well as mutual funds.

Banks, credit unions, insurance companies, and overall investment companies are the broad areas of success that increase the values and determine e better plans in the future. Saving and investing regularly can raise the business classification and maintain the most preferred areas of success, the business strengths will be maintained.

Commercial banks provide the core opportunities to improve the funding and investment areas because these capabilities also raise valuable strengths in terms to raise the company’s values and generate the most specific area of the business decision. By using better actions and transforming the collaborative decision, the firm’s growth activities become raised as it initiates greater competency.

In this modern world, the management of the firm’s practices and generate the internal environmental plans, the firm’s core activities will be rises.

Developing the non-sufficient funds, overdraft the fees, building the ATM fees, and starting the late payment system with minimum balance fees are the key strategies that improve the business values through collaborative and valuable success.

Commercial banks are the proper areas that directly increase the business values and update the most preferred term in the form of rising the success and boosting the most valuable activities in the future. Creating the minimum balance fees and wire transfer fees are the broad NSF or non-stuffiest funds that use by the banks to manage the finances and generate a higher level of printability.

Ways to manage liquidity:

With the management of the finances, commercial banks also manage their liquidities as it requires getting the most planned areas and generating collaborative thinking in the future. Shorter asset maturities, improving the average liquidity of the assets, lengthening the time of getting the money, and issuing more equities are the several ways that uses by every commercial bank. Liquidity refers to the transfer of the assets of the bank into the form of cash as per the required situation.

So, the business instructions and its core values directly lead to getting the most valuable success. To enhance the business performance and update the greater practices, my stability can improve in the future. Obtaining the protection of the liquidity that arises in the banks are also the core activities that improve the business functions and manage the internal practices of the banks.

Commercial banks practicing to reduce contingent commitments through issue more equity as the broad stability and referencing terms. As an important piece of the management of liquidity, it is easy to understand how the bank is directly improving the funding through the appropriate plans and the given eras of success.

In this modern world, the management and the core competencies of the business can be obtained as required to get future practices., So, the overall success and the proper planning of the business will be applicable as per required areas and transform certain abilities in the future.

The management of liquidities arises to explore the changes and boost the most planned areas in terms to get the proper changes. In this modern world, the management of business decisions can get the broadly associated plans as it is required to deal with the future.

For managing certain operations and allowing to explore the perfect methods, commercial banks’ finance management strategies appear. Banks will fund the balance sheets with a mix of the core concepts as well as depositions through the form of equity that arises from the business functions and generate the board capabilities.

Various liquidity management strategies are adopted by commercial banks as spending some time thinking about these critical factors as it relates to the business values. Boosting the open culture, starting the infrastructure of risk management, creating strong policies, building the physical concertation strategy, notional pooling, and the overall structure are the broad strategies to manage the liquidities as well as its core operations in the future.

Reviewing the financial systems regularly, managing the inventory levels carefully, improving the accounts that are received and payable for the management practices, and minimizing the expenses are some key plans that help commercial banks to improve their business decisions and their overall availability in the future.

The risk of liquidity refers to the process of how the bank enables to meet the obligations that threaten the financial position as well as existence through the proper risk management strategies. These strategies and practices are greatly applicable to improving the broad strengths and trying to get more resources in the future.

By adopting the effect of the Asset Liability Management strategy ALM, commercial banks can promote to get broad values and update the internal strategic areas required to deal with better changes in the future. The management of liquidity by commercial banks consists of two steps that required different techniques to achieve the objectives.

The first step is to get an overview of the current as well as past cash flows and the second step is to create or design the proper plan for the expected future cash flow. The success of the business will be obtained as it is required to get more funding and generate the possible areas of success. Commercial banks mostly used the surplus of liquidity to either the providing loans as well as investing in the enhancement of the profitability o the bank.

Getting higher exposure to loans that helps to enhance the net interest margins and higher share of demands deposits keeps as cost of the funds low. As the bid-risk spreads, turnover ratios, and price impact measures are the broad changes that deal with the clear associated aspects in the future. Increasing the revenue, controlling the overhead expenses, selling redundant assets, and changing the cycle of payment are the broad areas of success that will increase the business transformation.

Commercial banks can manage the overall finances by enhancing the receivable accounts, utilizing more financing tactics, and automating digital strategies are the core plans that increase the business values. Different tools of liquidity management appear in which the arrangements, suspension, and notice period visits affect the finances of the commercial banks in the given era of success.

For dealing with certain aspects and generating the most referred areas, the bank’s growth strategies can be implemented in the future because it arises to boost certain changes and manage the greater experiences in the future. To mount the cash flow and generate the appropriate planning, different types of liquidity arise that can be executed through different steps.

Five steps help the commercial bank to manage liquidity as cash flow planning. gathering the data, reconciliation the cash, positioning the cash, analysis of the data, and management of the bank and signatory activities are the key decisions that directly help to take broad decisions and organize the most reliable plans.

Reducing the debt, avoiding higher-interest financing, earning the level of interest, and managing the inventory, with the reduction of overheads are the key processes that help to take certain decisions. Cash flow management is the process that arises by the capital areas and the most valuable planning s as required in the future. To reduce the overheads and build proper inventory management, the firm’s growth practices will rise.

Discussion:

Liquidity is the process of measuring the cash as well as other asset banks that have available to quickly as paying the bills and meet short-term business as well as financial obligations. Capital of the business is the measurement to fulfill the e entire organizational convenience and absorb the losses as integrate better decisions in the future.

Cash flow planning and cash flow monitoring are the two types that motivate commercial banks to improve their overall performance and build the appropriate plan as required in the future. The discussion about the cash flow operations and managing the instant growth activities, the firm’s preference becomes increased.

With the use of organizational capabilities and updating the most proper plans, the entire operations of the business can be exceeded. The cash and liquidity management directly exceeds the cash reconciliation and the cash positioning due to the bank signatory management. Businesses directly refer to updating the most superior plans and trying to achieve the most reliable accuracy in the future.

Commercial banks reduce debts, avoid higher-interest financing, earn the level of interest, stay on top of invoicing, and manage the proper inventory that proceeds the actions or the better decisions in terms to proceed with the business decisions.

Through the use of organizational planning and enhance internal practices, the overall practices can be updated in the future. By staying on top of inspiration and earning a higher level of interest, the business classification can be improved.

At the root of the crises of liquidity, there is a widespread mismatch among the banks as well; as the businesses to resulting the lack of cash and other liquid assets appear as needed. The negative economic shocks or normal cyclical changes in the proceeding economy directly help to get strong decisions in the given terms.

Liquidity reflects the financial institution as the ability to fund and meet the financial obligations it is necessary to meet the needs as well as withdraws of the customers to compensate for the fluctuations of the balance sheet. To provide the fund’s growth for the entire profit and manage the finances, the commercial banks will proceed with the greater activities.

There are a lot of activities and operations that proceed by the commercial banks as per required and most sustainable area of the business classifications. In this modern world, the management of the business can classify to get the valuable plans and update the most reliable activities as per required in the future.

With the given or most reliable decisions, the business strengths can be classified in the future because out deals at the certain and most reliable growth term. The spread of bid risk, ratios of the turnover, and the impact of prices as it measures directly improve the business capabilities and achieve long-term performances.

To proceed the certain values and build the current activities, the firm decisions can be valid and maintained in the future. Arrangement of the pricing structure is also the best method that utilizes by commercial banks to improve the business classification and update the most referral elements in the given plans.

To build the proper risk management strategy, the business strengths can be taken place and obtained greater achievement in the future. The analysis of current assets with current liabilities directly defines the current ratio of the business activities.

As getting the quick ratio and generating the receivable accounts, the credit sales as the average receivables will be provided in the future. By increasing revenue, controlling overhead expenses, selling valuable assets, and enhancing receivable accounts, the business classification tools can be valuable or achievable in the future. Utilizing the finance tactics, revisiting the debt obligations, and automating the go digital strategy will raise the proper decisions to accomplish the broad objectives.

Commercial banks must provide the best decisions and organize certain terms in the given areas of success. As automate digital techniques and utilize finance operations, business capabilities will be strongly held in the future. By controlling the overhead expenses and enhancing certain revenues, business decisions can be transformed into the given aspects.

Primary measures of liquidity as the net working capital that currently ratios or build the quick ratios in terms to proceed the sustainable actions. The LCR is calculated as the higher quality liquid asset through the total net cash flow over the period of 30-day stress. Various internal factors that affecting the liquidity of the banks including the capital base, deposit base, and a higher level of management of the quality as the demand for the balance sheet exists. So, the commercial bank easily manages the finances as well as liabilities that proceed or are broadly managed in the future.

All commercial banks are the banks that provide facilities to the general public. It is the bank that raises the overall standards and builds the most convenient practices as required to deal with the fundamental plans. To encourage the operations and proceed with the most valuable trends, the business accomplishment becomes strong. As the broad activity or the valuable plans, the business strengths can be developed in the future.

To motivate the broad activities and boost the clear activities, the firm’s proper practices become strongly attached. In this modern world, the management of business decisions can be transformed or updated as required to manage the most valuable decisions in the future.

To encourage the organizational values and transform the broad activities, the firm’s decisions will be strongly attached. Commercial banks try to manage the liquidity as well as the finances that improve the financial performance and give more areas of success as required to get the change.

By adding greater practices and transforming the overall availability, the business refers to proceeding with the sustainable decisions as required to get the change. In this modern world, the management of the business can be exceeded or most valued as it transforms valuable operations. As the banking industry will proceed growing, the management of its core finances as well as liquidity also raise that help to manage the internal operations.

Hiring skilled and talented staff in commercial banks that can resolve the complaints of the customers and manage the proper finances as required to manage the business capabilities analyze in the future. By using the Beter elements and observing the most sustainable decisions, the organizational proper plans become increase.

To raise skilled and talented employees, the business capabilities can be strongly protected in the future. By using the core decisions and updating the internal finances, commercial banks can get higher success.

The operations and activities of the businesses that are being valued directly improve the organizational responses because it proceeds with future changes. Commercial banks directly manage the finances because it is the most effective source that helps to review the change and build the appropriate records in the future.

Different functions and activities are used that help to collaborate on the decisions and maintain the most effective decisions, and the organizational capabilities are valued. In the process of organizational success, business decisions become strongly raised as it provides the most reliable and accurate terms.

Conclusion:

In this research study, the impact of liquidity, as well as finances to manage the finances in commercial banks, are defined. Commercial banks are the general public banks that provide all the revives to the general public. With the use of business capabilities and trying to get more reliable plans, the business accomplishment will be stable. To manage the finances and the liquidities, the business growth functions can proceed in the future.

Various processes that organized by the organizational capabilities and the skilled or talented labor. While managing commercial bank activities, the skilled staff manages the finances that are required to deal with clear resources. In the organizational processes, the business decisions and their accurate plans can proceed as required to get the change in the future.

With the use of organizational practices and maintaining internal values, the firm’s core planning becomes increases. Managing the finances liquefies, and other operations that are associated with the business is reliable or valuable in the future. Various components are used that help to proceed with the broad sustainable decisions as integrated in the future.

To enhance the business decisions and organized the possible change, the firm’s capabilities become increase. To evaluate the organizational decisions and boost the most effective plans, the firm’s internal and external values can be obtained. In this research study, there is a secondary source used to collect the data and gather reliable inform action.

The journals, past research, and the reports of the commercial banks are used to boost the changes in the given terms. for managing the operations and boosting the collaborative plan, the commercial plan becomes increased. Various activities are used that improve organizational decisions and boost certain activities in the future.

To raise the organizational plan and transform the internal practices, the business strengths can be applicable in the future. Various functions and core strategies are used help to build organizational decisions and update internal values. By building organizational decisions and updating the best activities, the firm’s internal and external values can be updated. Commercial banks manage the finances as well as liquidities that raise the proceeds of activities and generate e the entire activities in the future.

In this modern world, the management of the business directly achieved higher performance and boosts the advanced strategic decisions as it gains the organizational process. There is a described analysis method is used to analyze and evaluate the data that is currently used to proceed with the most transferring actions.

The success of an organization depends on the processes to manage the finances and liquidates. As the commercial plan boosts the most reliable activities, the business decisions become sustainable. In this modern world, the management of commercial bank activities directly improves business decisions and updates greater practices as required in the future. This activity directly improves the organizational practices and transforms the certain availability of the plans.