Global Strategy of Sustainability of Sterling Bank Plc

Sterling Bank Plc is a Nigerian commercial bank with over 60 years in operation. The bank has grown from an investment bank to a full-service national bank known as ‘Your one customer bank’ with about one million active customers in 189 offices in Nigeria.

It has developed a reputation as an innovative and sustainable bank such as with the launch of Specta, an automated digital lending platform, and in focus about impact sectors, called the ‘H.E.A.R.T’ sectors (Health, Education, Agriculture, Renewable Energy and Transport). In 2024, Sterling’s Lagos headquarters was the first office tower in Africa to be powered by solar energy, making the bank a green banking leader.

The purpose of this consultancy report is to provide guidance to Sterling Bank’s global strategy and sustainable expansion to four target regions: Europe, Africa (outside Nigeria), Middle East and Asia.

This report analyses the external environment of these regions (PESTEL and industry forces) and Sterling’s internal capabilities (VRIO analysis), identifies region specific opportunities and risks, and then recommends global expansion strategies, entry modes and implementation approach to achieve profitable and sustainable growth in these regions.

Academic frameworks and up to date industry data and examples from other banks are used to support all analysis.

Read more: Global Strategy and Sustainability Report of Fonterra

Task 1 – External and Internal Environment Analysis

External Analysis:

Sterling Bank Plc has to face different macro environmental factors in Europe, Africa, the Middle East and Asia through External Analysis (PESTEL by Region). Below is a summary of a PESTEL analysis for each region.

Political:

Political stability varies across regions. Europe has predictable governance with EU wide banking regulations, but market fragmentation has been introduced through events like Brexit. Some countries in Africa are improving their governance while others are still unstable.

Regional integration is enabled by the African Continental Free Trade Agreement. Stability is found in GCC countries like the UAE and Saudi Arabia in the Middle East but conflicts and geopolitical risks elsewhere. The diversity of Asia is from stable democracies to tightly controlled one party states like China and varies in openness to foreign banking.

Economic:

Europe is a mature, low growth market, high competition and moderate inflation with bank margins having improved post 2022 on the back of rising rates. Africa has high growth potential, large unbanked populations, and a rising middle class, but inflation (~10%), currency volatility and debt risks.

Oil wealth in the GCC aids the Middle East but regional growth (~2.1%) is depressed by oil cuts and conflict, though a rebound is forecast (REUTERS.COM). Large populations and urbanization continue to make Asia the global growth engine.

Social:

Seamless digital banking is what Europe’s aging population wants. Fintech is mobile driven, and Africa is mobile driven, and Africa is young; and Africa’s demographic is young, and fintech is improving access (M-Pesa grew access in Kenya from 26% to 83%).

It has a wealthy, high expectation consumer base and a cultural emphasis on Islamic finance in the Middle East. With over 1 billion unbanked adults in Asia, there is a massive inclusion opportunity in a young and tech savvy population.

Technological:

PSD2 or open banking (EN.WIKIPEDIA.ORG) is mainstream in Europe, and neobanks like Revolut have over 50 million users. Nearly half of Africa’s 5,200 startups in 2021 were fintechs. Fintech hubs, AI, and cybersecurity are all being invested in by the Middle East. India and China are the most advanced fintech countries in the world, according to Asia.

Environmental:

Europe enforces strict sustainability frameworks. Under climate pressures, African banks are increasingly putting green lending. ESG and green bond initiatives in the Middle East, including the GCC, are on the rise. Green bond schemes are also being implemented in Singapore and Hong Kong in Asia.

Legal:

Compliance costs are higher due to Europe’s strict regulations (e.g. Basel III, GDPR), but incumbents are protected. However, Africa’s regulatory systems are evolving but inconsistent. Liberal zones in DIFC, have strict banking laws in Middle East. Asia is from open markets like Singapore to closed markets like China.

Industry Environment (Porter’s Five Forces across Regions):

The competitive forces in banking and financial services are intense across the globe, but are strong in different regions:

Threat of New Entrants:

New entrants remain a moderate threat because traditional banking has high entry barriers (licensing, capital, trust) while fintechs and neo banks have lowered barriers in segments like payments and lending.

There are more than 35 neo banks operating under e money licenses in Europe. Telco led mobile money platforms are strong disruptors in Africa. The Middle East is limited but growing in entry, Asia is open (Singapore) to restrictive (India).

Rivalry Among Existing Competitors:

The existing competitors are intensely rivaling each other. Saturated and low growth, Europe’s mature market is.

Pan African banks are expanding, and Africa’s competition is rising. Large banks are few in the GCC, but international competition is increasing. Incumbents, foreign banks and fintechs are fierce competition for Asia.

Bargaining Power of Customers:

Customer bargaining power is moderate but increasing. More digital alternatives are available to retail users, while corporate clients in Europe and Asia often multi-bank. It is targeting the Nigerian diaspora who remitted over $20 billion in 2022.

Bargaining Power of Suppliers:

Banking suppliers include depositors, wholesale lenders, technology vendors, and skilled labour. Individual depositors have little bargaining power but market conditions such as rising interest rates can pressure banks to raise deposit rates.

More powerful suppliers are talent and technology. As a result, skilled professionals and core banking software providers (such as Temenos, Finacle) tend to hold the upper hand in negotiations because they are scarce and important.

Licensing is also mandatory for market entry, and regulatory authorities also have a lot of power. To manage supplier power, Sterling will have to build a strong funding base and get tech and talent partnerships in place.

Threat of Substitutes:

In areas where payments and small loans are high, such as mobile money in Africa or super apps in Asia, substitute threats are very high. To stay competitive, Sterling must innovate and partner.

Internal Analysis – VRIO of Sterling Bank:

For Sterling Bank Plc to succeed globally, internal resources that provide a sustainable competitive advantage must be deployed. The VRIO framework (Valuable, Rare, Inimitable, Organized) is used to assess Sterling’s key resources and capabilities.

Resource based theory states that only those resources that are valuable, rare, difficult to imitate, and supported by the organization can give rise to sustained competitive advantage. A VRIO analysis of Sterling Bank is presented in Table 1 below.

| Resource / Capability | V | R | I | O | Implication |

| Digital Banking (Specta) Fast digital lending platform. | Yes | No | No | Yes | Temporary Advantage |

| H.E.A.R.T Focus & Sustainability Niche sector strategy & impact branding. | Yes | Yes | Yes | Yes | Sustainable Advantage |

| Human Capital & Culture Agile, award-winning workplace. | Yes | Yes | Yes | Yes | Sustained Advantage |

| Customer Base & Network 1M+ customers, 140+ branches. | Yes | No | No | Yes | Parity – |

| Partnerships & Funding DFI & fintech collaborations. | Yes | No | No | Yes | Temporary Advantage |

Key Opportunities and Risks per Region:

Sterling Bank Plc has its own opportunities and risks in the region that are affected by its strengths and the external environment. The African diaspora has a niche for remittances and savings in Europe, and particularly in the UK.

Sterling can also use its HEART focus to ride Europe’s ESG finance momentum and possibly come in through buying a small digital bank. But competition is tough, regulatory costs are high, and growth is slow, so targeted entry, such as trade finance or diaspora banking, is safer.

In Africa (ex Nigeria), there are opportunities to scale digital and SME lending to underbanked markets like Kenya or Ghana. Sterling’s experience in volatile conditions and focus on sustainability finance will attract international climate funding.

However, political instability, currency risk, and regulatory fragmentation are big issues. These risks are mitigated by phased entry and local partnerships.

Sterling could provide remittance services in the Middle East and Islamic finance in the Gulf and be a correspondent bank for Gulf-Africa trade. The risks are strict licensing and geopolitical volatility. This may be eased by entry via financial free zones like DIFC.

Sterling’s best path in Asia may be indirect: through partnerships, rep offices and hubs such as Singapore, to support Africa-Asia trade without heavy investment.

Task 2 – Global Strategy and Entry Recommendations

Yip’s Globalisation Drivers:

Sterling Bank Plc can now have a clear view of its internal capabilities and the external trends to shape a global expansion strategy in tune with regional realities. Using Yip’s Globalisation Drivers (market, cost, government, and competitive factors), Sterling’s international push can be understood as what drives it.

Market drivers:

Market drivers are strong. More and more, Sterling’s Nigerian clients, whether they are diaspora or corporates, are becoming global. Demand for remittances and savings (especially in Europe and the Middle East) and for supporting cross border African businesses meets global customer needs. A brand of sustainability and digital banking can be applied across regions by Sterling.

Cost drivers:

Cost drivers also support globalization. Fixed costs of platforms such as Specta can be spread over a wider customer base. Funding costs could be reduced if hard currency deposits were sourced from Europe or the Middle East.

Access to tech and talent from markets such as India may also be possible through global operations. Global expansion complicates things, but proper execution can make costs more efficient.

Government drivers:

Government drivers are favourable. African and Middle Eastern markets encourage foreign banking to promote inclusion. Basel III type regulatory frameworks ensure consistency; regional integration initiatives (AU and GCC financial agendas) reduce barriers. The UK, Ghana and Kenya welcome foreign banks.

Competitive drivers:

UBA and Access Bank are expanding across Africa and beyond. African corridors are also being entered by global banks and fintechs. Sterling is at risk of losing key clients to more global peers unless it expands.

Taken together, these drivers argue compellingly that Sterling’s global strategy should be customer driven, platform scalable, regulatory aligned and competitive. Growth is not the same as expansion, and it is vital for long term relevance in a rapidly integrating financial ecosystem.

Strategic Internationalisation Options:

There are two main international expansion strategies of Sterling Bank.

Option 1: Market Development via a Global or Standardized Strategy

This is a market development move in Ansoff’s Matrix (offering existing services (digital banking, SME lending) in new countries. It is a global strategy which replicates Sterling’s Nigerian model (OneBank, Specta) in markets such as Kenya, India or UAE with little adaptation. It allows for brand consistency, centralizing tech and product management, and economies of scale.

By lowering costs and reinforcing Sterling’s identity as a digital, sustainability driven bank, a unified platform could be created. The risk, however, is limited local responsiveness. Financial habits, languages and regulatory environments are different; a ‘one size fits all’ model may not resonate in culturally distinct markets. The balance is illustrated in HSBC’s former model: “The world’s local bank”.

Option 2: Multi-domestic Adaptation Strategy

Each market is treated as unique in here, with products, marketing and even branding being tailored to fit local norms. Sterling could focus on Islamic finance in the Middle East or agriculture finance in East Africa, both within its HEART sectors, but adapted to the local scene.

This strategy helps to enhance customer fit, compliance and competitiveness against local banks. But it’s more expensive and may dilute Sterling’s brand and make it more complicated to manage.

Comparative View:

Using the Integration-Responsiveness Grid, Option 1 has high integration and low local fit, while Option 2 has low integration and high local fit. Both are combined in a transnational strategy, which may be too complex for Sterling at the outset.

A hybrid, region by region approach is practical, standardization in culturally familiar Africa, adaptation in Europe or Asia. The brand strength, efficiency and relevance are balanced across different markets.

Recommended Market Entry Strategies by Region:

In view of regulatory conditions, market maturity and internal strengths, Sterling Bank should adopt a region-specific entry approach. The three most preferred modes are strategic partnership, greenfield subsidiary and acquisition.

Asia & Middle East: Strategic Partnerships

Alliances provide a low risk, flexible entry route in complex markets such as Asia and the Middle East. Sterling can work with fintechs or mid-sized banks in India or China to co deliver services such as remittances or SME trade finance, using local licenses and infrastructure.

Sterling can take advantage of niche customer segments in the Gulf through joint ventures with Islamic banks or fintech firms. In this mode, entry barriers are reduced but clear agreements are needed to manage control and profit sharing.

Africa: Greenfield Digital Subsidiaries

Greenfield entry via digital only banks or microfinance units is best for high opportunity African markets such as Kenya or Ghana. Sterling can use its digital strengths, such as Specta or mobile first banking, to serve underbanked customers.

Regulatory openness and cultural familiarity in East and West Africa support this model. This strategy is strong on local execution and risk controls but as it is full ownership and brand visibility.

Europe & Complex African Markets: Acquisitions

Acquisition may be the fastest way to enter in mature or tightly regulated markets. By acquiring a niche bank in the UK targeting the African diaspora or a small bank in Francophone West Africa to enter UEMOA, Sterling could have a single license. Instant scale comes with this route but requires a thorough due diligence and cultural integration to prevent inheriting nonperforming loans.

Task 3 – Strategy Implementation and Profitability

Implementing Strategy and Driving Profitability:

For Sterling Bank to ensure successful expansion, it must implement its strategy efficiently across regions by adapting operations and using strategic frameworks like the SCOR model, Porter’s Value Chain and Porter’s Three Tests.

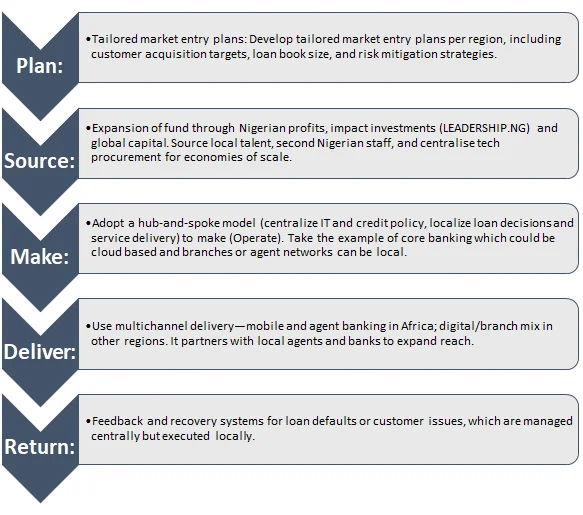

Adapting the Supply Chain in a Banking Context:

Sterling’s “supply chain” is getting money, delivering services, and managing risk. Implementation can be broken down using the SCOR model

Enhancing the Value Chain:

Porter’s Value Chain can be applied to optimize support activities. Standardize IT infrastructure (e.g., cloud-based systems), rotate high potential staff across markets to transfer Sterling’s strong culture, and centralize procurement for better pricing. Keep risk and compliance under strict central control to satisfy regulators.

Ensuring Strategic Alignment:

The Balanced Scorecard can be used to track progress by aligning financial, customer, internal process, and learning goals in each region. Sterling can also provide cross border trade finance solutions to be integrated into client supply chains.

Sterling can scale profitably and sustainably by applying global tools, codifying local learnings and keeping operations agile.

Improving Profitability: Portfolio Management & Strategic Tests

With its expansion globally, Sterling Bank Plc finds it essential to manage a diverse portfolio. Each regional unit can be classified using the BCG Matrix by market growth and Sterling’s share. For instance, markets such as high growth African markets that Sterling is gaining traction in may become ‘Stars’ and hence warrant further investment.

A likely “Cash Cow” funding expansion is Nigeria, with steady returns but slower growth. On the other hand, low growth, low share operations such as a small European unit may be “Dogs” and should be exited if not clear on improvement.

The GE/McKinsey Matrix is also used to evaluate markets by attractiveness and Sterling’s competitive strength. It is likely that parts of Africa (e.g. Kenya, Ghana) score high on both, while some European markets are less attractive and difficult to penetrate. These tools stop unprofitable expansion for the sake of ambition and not logic. In addition, Porter’s Three Tests provide additional rigor.

| Porter’s Test | Key Question | Sterling Bank Application |

| 1. Attractiveness Test | Is the target market structurally attractive (growth, margins, competition)? | Many African markets pass (high growth, low penetration). Europe is less attractive (low growth, heavy competition). Asia and Middle East vary—profitable but competitive or small. Commit fully only where growth and conditions are favorable. |

| 2. Cost of Entry Test | Is the cost of entry low enough to allow future profits? | Partnerships and greenfields are preferred for lower cost. Avoid high-cost acquisitions unless returns are clear. Start lean and scale based on performance. |

| 3. Better-Off Test | Will both Sterling and the new unit benefit (synergies, scale, diversification)? | Strong synergies in trade finance, shared digital infrastructure, and risk diversification. Expansion should strengthen group performance, not just increase size. If not, reconsider the move. |

The Attractiveness Test screens markets for growth, margins and competitive intensity (e.g. many African markets pass, saturated European ones may not). The Cost of Entry Test is to make sure that expansion investments, such as greenfield setups, don’t drain returns.

Sterling should have clear financial targets and should not overinvest in tough markets. The Better-Off Test looks at synergies such as the use of digital infrastructure or trade finance across African-Asian corridors or cheaper funding.

Operational Profitability & Execution:

Sterling should adopt capital allocation frameworks that are based on risk adjusted return targets and quit units that do not meet ROE targets to protect profitability. Margins can be boosted by prioritizing non interest income such as remittance fees, trade finance and digital payments. Revenue is maximized by a product by region approach: trade finance in the Middle East, lending in Africa, remittances in Europe.

Cost efficiency is also vital. Lowering cost to income ratios can be done by applying SCOR metrics (cost per loan, turnaround time), Porter’s Value Chain, and lean methods. Back-office operations can be standardized and AI or chatbots can be used for scale thereby improving service at lower cost.

To sum it up, disciplined expansion, strategic focus and operational excellence will lead to profitability. Sterling Bank can scale sustainably and profitably through the combination of portfolio tools and strategic tests with strong execution.

Conclusion

Sterling Bank Plc is at a critical juncture: moving from a formidable national presence in Nigeria to a global champion, with purpose, in Europe, Africa, the Middle East and Asia. The analysis in this report finds Europe is stable but low growth, Africa high opportunity but high risk, the Middle East is profitable but entry barred, and Asia is big but fierce. Sterling’s smaller scale means that it needs to specialize in a niche, but its internal strengths of fintech innovation, sustainability focus, and agile culture are valuable abroad.

A hybrid international strategy of global standardization with local adaptation is recommended. By region, entry should vary from alliances in Asia/Middle East to reduce risk (AFRICAN.BUSINESS), greenfield digital banks in high growth African markets, and targeted acquisitions in Europe or mature African regions.

For Sterling to execute profitably, they have to centralize core systems and localize delivery. SCOR and the BCG matrix will be used to allocate capital and manage performance. Expansion decisions should be guided by Porter’s diversification tests. Sterling can be profitable with cost discipline, cross border synergies and sustainable, inclusive banking, and build a global network that connects Africa to the world in impactful ways