Financial Decision Making of Central Asia Metals

I am a part of the Accounting and Finance team at Central Asia Metals CAML plc. I am required to write the report “Financial Decision Making of Central Asia Metals”, for the senior management of CAML plc by discussing the importance of accounting and financing functions, roles, and duties within the company concerning both reporting as well as decision-making aspects.

Accounting and finance functions are important to fulfill the entire calculation and proceed with the financial performance of the company. For developing the appropriate tools and generating success at CAML, the analysis of financial statements (its relation with the key financial elements) must be appropriate to achieve the higher roles of the business success.

The importance of accounting and finance functions:

There are various functions of accounting as well as finance that help the CAML company to improve its financial operations and get a higher reputation in the industry Record-keeping, analyzing the financial performance, and creating effective financial strategies are the key functions of accounting and financier that help to improve the organizational performance and managing the key finances of the business.

By creating effective strategies, CAML finance departments can ensure compliance and record the valid transactions that are an integral part of the business operations. Keep the transparency of the operations, analyzing the entire performance, and managing the cash flow with efficient resource allocation are the broad terms that affect the performance of the business.

Central Asia Metals is a public limited company that can manage the cash flow with the accurate implementation of accounting practices. With the efficient allocation of resources and the appropriate budgets, the business roles can be valid in the future. Keeping all the financial records and building the statuary records, CAML can manage the sales, record the key finances, and evaluate the large intentions.

Accounting and finance both functions help to ensure the financial markets are effective or transparent. These concepts are essential for economic growth and stability.

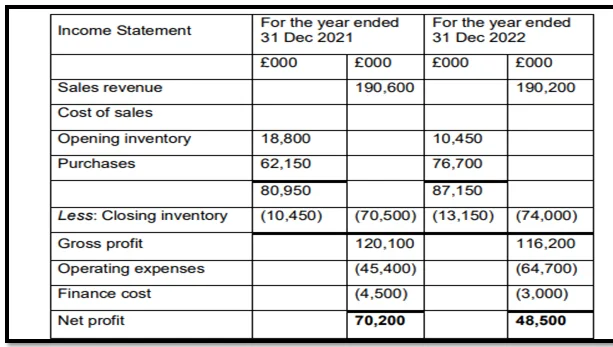

For example, the sales or revenue of the CAML company was higher in the year 2021 than in 190600 due to the higher opening inventory of 18,800 as compared to the next year 2022. Due to proper management of budgeting and accruals, the business maintains its sales. Evaluating the finance and accounting operations is important to ensure that CAML has accurate information for regulatory compliance, decision-making, and financial transparency.

It is one of the best and the useful beneficial for implementing the concepts of accounting and finance in the boundary of the business. The key to business lies within accounting and finance, and the understanding of the numbers of your company related to the broad activities that proceed with the cash flow will help to make better decisions moving forward to avoid failures in the business.

For preparing the financial reports of Central Asia Metals PLC, these functions provide information about the company’s performance to external parties like the creditors of the CAML, and the broad investors to grow the business decisions.

Roles and duties:

As the part of Accounting and Finance team, there are different roles and duties performed by the senior management staff of the CAML company.

- First of all, I can forecast the financial position and the performance of the company through the implementation of the forecasting techniques. By comparing the current financial statements and position of the company with the previous years’ data, the accounting and finance team of the company can maintain the proper records that are valid to take better eras of success. It is the beneficial, strong, and core componential terms that lead the business responses in the convenience forms. To improve organizational learning and address the better areas of success, the current functions must be addressed.

- As the accounting and finance teams’ part, I can set the proper budget that helps to manage the costs for the Central Asia Metals company. For the management of accounts payable and receivable and conducting the proper financial analysis, the accounting departments help to evaluate the financial statements of the business that address the valid responses and proceed with the business operations. For the management, accounting, and compliance operation, the role of accountant and financial management is necessary for the evacuation of the learning.

- I am responsible for managing the strategic growth of the company and generating financial statements like Income statements, Balance sheets, and Cash flow statements. Even for the management of risks and proceeding taxation, the overall financial reporting needs to be addressed. Building the financial planning, integrating the accounting operations, and compliance with the financial regulations the current establishment with the internal controls are observed.

- I can deal with the analysis of financial records and figuring out ways for improvement to financial operations. As the part of accounting and finance team, I am responsible for classifying the financial statements and recording the cash receipts with the process of the payroll. Finally, I can maintain the proper financial controls over each function of accounting and finance at CAML. This function helps to evaluate my strategic control and management practices towards continuous improvement and proceed with the business changes regards the instant operations. Providing the proper learning and addressing the change, the business should need to discuss the systemic forms. At a higher level, I make the proper plans and manage the company’s finances to make sure the business can access the cash in sustainable ways to maintain the organizational directions in the strategic growth activities

So, all of these roles and responsibilities concerning both reporting and decision-making that I performed as the part of accounting and finance teams for the Central Asia Metals public limited firm. These functions motivate me to improve the financial and accounting-related activities that proceed with the change and address the reliable activities of the firm.

Both accounting and finance are important functions for managing finances and forecasting the organization’s greater responsiveness in the future. It is one of the most suitable and valuable eras to lead the organizational responsibilities towards reliable success matters.

Explanation of financial statements: Financial Decision Making of Central Asia Metals

In the financial statements of the Central Asia Metals, the analysis of the Statement of Income and the Statement of Balance Sheet are analyzed. These financial statements indicate the company’s position as well as its financial performance to evaluate the business’s success. Through the analysis of the income statant, the sales revenue, cost of sales, opening inventory, and the key purchases of the company that help to proceed the net profit of the business are analyzed.

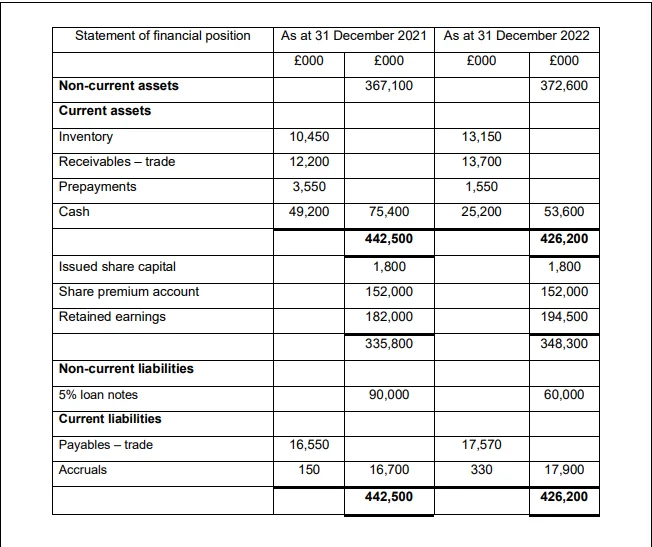

On the other hand, the statement of the balance sheet of the company depends on the assets and the liabilities with the shareholder’s capital that is needed to organize the entire functions of the business. Generating the business processes, proceeding with the values, and proceeding with the changes, the current activities must be updated in the cleared responses.

By adding the organizational learning power and managing the greater concerns, the income statement and the balance sheet must be improved through the key strategic outcomes. To manage the operations of the business and build valuable techniques, business responsiveness can be valid.

From the income statement analysis, the net profit of the company in the year 2021 was 70,200 but in the next year, it was less than the 48500 due to the lower gross profitability. In the year 2021, the gross profit rate of the CAML was 120,100 but in the next year, the gross profit rate of the company was 116200.

To raise the growth of the business and address the cleared changes, the financial statements must be updated. These activities need to be addressed to deal with the greater conveniences and manage the current process in the future.

The CAML gets less gross profitability affecting the organizational performance and builds the current responses through the strategic change in the broad forms. The sales revenue, cost of sales, and the opening inventory are the key purchases through the specific change that leads to the business intentions. The net profitability will be referred to investigate the operational concerns and manage the cleared plans regarding the clear success.

This statement will be organized to investigate the greater direction. By analyzing the components of the finances and managing the cleared resources, the business activities must be valid. The finance cost of the business leads to taking a higher position and managing the proper investigation resources in the future.

With the evaluation of the net profitability, the CAML company investigated the large operations of the cash payments and proceeded with the issue of hared capital in terms of retained earnings. Building the prepayment activities and evaluating the organizational responses to the business activities can be valid.

Operating expenses and financial costs are the stable ones to lead the organizational responses and manage the cleared roles in the business responses. With the evaluation of the statement of income, the management of the business will proceed with the operations that are actively engaged in the business responses. Through the receivable trades and managing the prepayment activities, the organizational values will be advised in the future.

On the other hand, the statement of balance sheet indicates the financial performance of Central Asia Metal Company as leading the assets and the shareholder capital through sustainable terms. Generating the organizational performance and managing the current activities, the business processes must be valid through the detailed activities as leading the organizational responsiveness.

By issuing the shared capital and managing the advanced cash, the business communication activities must be valid.

In the year 2021, the amount of total assets of the CAML firm is 442500 but in the next year, the total assets amount to be less than 426,200 due to the higher inventories and the financial trades. CAML maintains its financial position by developing the firm’s operations and addressing the considered information by dealing with the organizational roles and responsibilities.

These activities must be valid to improve the organizational functions and attract the organizational directions in the cleared strategic change. To enhance the organizational performance and manage the current responses, the business values need to be valid as dealing the organized changes.

The balance sheet statement indicates the accruals and the payable trade in terms of motivating the business directions and updating the clear operations as doing the best activities. The value of accruals in the year 2021 was 16,700 but in the next year 2022 it will reach 17,900 through advanced learning and sustainable practices by determining the organizational functions and managing the best activities, the business responses need to be addressed.

Retained earnings and the payment materials through the collaboration of the other businesses, the current resources must be valid. The financial statement of the company indicates the advanced operations that are updated in the detailed era of the success and managing the key cost-related activities.

The evaluation of trade, accruals, and the share premium account through the business functions must deal with reliable operations. In the management of inventory and the sharing of the premium accounts, the organizational activities must be supported to forecast the organizational trends and retain strategic thinking. Sharing the premium accounts and proceed the inventories, the business activities need to be addressed.

For managing the organizational resources and proceed the changes, the organizational activities must be reliable through clear or accurate change practices. Proceeded the cash and investigate the higher responses, the business functions must be valued through the greater activities.

Developing effective plans related to the current functions need to be addressed. Managing the organizational performance and taking clear operations, the business functions must be reliable in the strategic change. For the issuing of share capital and investigating the operational concerns, the Statement of Balance sheet must be supportive.

Central Asia Metals is the company that develops the proper financial records and keeps the forecasting techniques in the most valuable strategic response. Dealing the organizational performance and taking the strategic values, the business growth firms need to be addressed in the cleared operations.

Calculations of financial ratios:

Return on capital employed:

ROCE = Earnings before tax and return / Total assets – current liabilities.

Year 2021: 70200 / (442,500 – 16,700) = 0.16

Year 2022: 48,500 / (426,200 – 17,900) = 0.11

Net profit margin:

Net income/revenue =

Year 2021: 70,200 / 190,600 = 0.36

Year 2022: 48,500 / 190,200 = 0.25

Current ratio:

= Current assets / current liabilities.

Year 2021: 75,400 / 16,700 = 4.51

Year 2022: 53,600 / 17,900 = 2.99

Average receivable days/ debtors’ collection period:

Average accounts receivable / revenue x 365 days.

Year 2021: 12,200 / 190,600 x 365 = 23.36

Year 2022: 13,700 / 190,200 x 365= 26.29

Average payable days /creditors collection period:

= Average account payable/ cost of goods sold 365 days.

Year 2021: 16,550 / 80,950 x 365 = 74.62.

Year 2022: 17,570 / 87,150 x 365 = 73.58.

Possible reasons, causes, and effects for changes in ratios:

- The return on capital employed of Central Asia Metals company in the year 2021 was 0.6 and in the next year 2022 it will be less than 0.11. Due to the change in total assets value, the entire success of the CAML of ROCE will be affected. It impacts the balance sheet and the sales of the company to take the valid resources in the business. CAML takes a lot of investment to proceed with the profitability and manage the financial operations of the business.

- The net profit margin of Central Asia Metals company in the year 2021 was 0.36 but next year it will be less than 0.25. Due to the higher fluctuation of the net income of 70,200 in the year 2021 and 48,500 in 2022 analyzed to take the business processes as leading the operational concerns. By developing the organizational capabilities and proceed the business forms, the business activities must be addressed in the future.

- The current ratio of Central Asia Metals indicates that the current assets and current liabilities are sustainable forms through the business responses. In the years 2021 and 2022, the current assets decreased from 75,400 to 53,600 that’s why it I the major cause or reason that affects the current ratio value of the company. 4.51% is the rate of the current ratio of CAML in the 2021 year but in the next year, it is less than 2.99%.

- The average account of reviewable days in the year 2021 was 23.56 but in the next year, it increased to 26.29. Due to the average accounts receivable days as 12,200, there are fewer days required to revenge the amounts from the creditors in year 29021. It directly affects the performance of CAML and its financial position.

- The average payable days for Central Asia Metals indicate that in the year 2021, there are 74.62 days indicated as the role of perceived business success for paying the finance but in 2022 there are 73.58 days required as the maturity for the payable of the average account. It depends on the cost of goods sold by the CAML for a whole year or 365 days.

Investment’s perspective:

From the investor’s perspective, the management of CAML company should develop more opportunities for investment by focusing on the investor, average accounting receivable, and payable trades. The company will decide to build another extraction plant in Uzbekistan within the next 5 years. The firm would need to raise 1209 million euros for this project.

From the perspective of investors, the firm should organize better changes by developing a strong relationship with the suppliers. Generating more cash and building more inventory are the key indicators that lead to business processes for the detailed era of the investigation and take the reliable process in the future.

It is one of the most reliable tools that addresses the changes and leads the organizational supportive activities in the future. The role of Central Asia Metals CAML plc for the development of investment opportunities depends on the sales revenue or the opening inventories.