Data Driven Decisions for Greeting Health Limited

The report’s purpose is to support the merger and Acquisition team at Greeting Health Limited by using the data analytics and guiding the decision-making following the Insru4me.com assertions. Greeting Health Limited recently acquired Insur4me.com in a deal worth 1.2 billion dollars, which includes stock and cash payments.

The report is focused on helping the M&A Manager decide to initiate which country in India, the UK, and Mexico should be the first to execute the strategy of Market Development. Greeting Health Ltd recently acquired the performance of six healthy insurance service categories as offered by Insute4me.com. Basic Health Insurance, Critical illness Insurance, Comprehensive Health Insurance, Travel Health Insurance, and Dental Insurance with Vision are the main categories of the report’s structure.

Read more: The importance of applying managerial theories and practices in the health service sector

Presenting the Overall Project Plan for Project Delivery:

I have developed a structured plan that involves various key phases to deliver the project successfully. Greeting Health Limited starts with an understanding of business goals and prepares the data. I will represent the findings to the M&A Manager that exists senior leadership in a clear report.

Project kick-off and Understanding of Business Needs, I will perform the detailed data analysis to explore trends, complete the performance, and make recommendations. Project Kick-off and business understanding focus on examining the top management’s wants to achieve. Data collection and understanding regarding the sales and cost numbers in each country.

I will also collect data on how each of the six insurance products can perform aspects of sales, number of customers, and historical data to identify the growth trends. Data Analysis and interpretations, with reporting and recommendations, summarize all my findings in a written report.

Ensure that the Project Plan Explicitly Refers to Data Analytics:

I will use the CRISP-DM framework to make sure the project is completed and organized. CRISP-DM is one of the most commonly used frameworks in data analytics, which refers to business understanding, data understanding, data preparation, evaluation, modeling, and deployment. Business understanding works closely with the M&A Manager to understand what decisions need to be made and objectives to find out the country as best country for the Market Development strategy.

I will collect the available data about sales, customer members, and the service performance during the stage of data understanding. I will check if the data is complete and if there are any patterns regarding service performance. I will check if the data is fulfilled and evaluate more customers, but lower the sales per customer, which is an early insight worth exploring.

Data Preparation refers to cleaning or formatting the data as an important step because poor-quality data can lead to wrong conclusions. I will perform the actual analysis, and the project does not require advanced models of predictive models.

I will use basic statistical and visual analysis, which perform better. I will interpret the results and compare them to the objectives of the business. I will explore the final stage, as deployment, that involves sharing of results with the M&A manager and other decision-makers, with the best choice of the Market Development strategy.

Analyze the Value of Data Analytics and KPIs:

Key Performance Indicators are important tools for examining the business success. Multiple Key Performance Indicators that Greeting Health Limited. can use after the entire acquisitions to track the performance and make entire informed decisions.

Revenue per country, customer volume per country, revenue per customer, profitability by product, and customer retention rate are important to explore the change.

- Revenue Per Country indicates how much money is being earned in the entire country (through Python).

- Customer Volume Per Country refers to how many customers are active in each region.

- Revenue Per Customer indicates how much each customer is contributing to the sales or revenues.

- Profitability by Product is an indicator that shows which instance services are making the most profit in the future.

All of these key performance indicators help to evaluate the organizational success, maintain better productivity, and boost higher changes related to advanced practices. Data analytics can help to improve the KPIs in various ways to determine the types of services that are most popular in each country.

When it comes to profitability by core product then data analytics can compare the sales and costs for each service. Key Performance Indicators help to track how many customers are leaving each month and help to raise the customer retention rate through targeted campaigns. Product profitability and data analytics can compare the sales with the costs for each insurance service.

Key Performance Indicators KPI’s can help to operate margins and improve the effectiveness of areas where operational costs are too high, and find more efficient ways of working. Data analytics gives the firm better control over the performance and helps to make clearer or smarter decisions.

Data analytics can be used to track the synergy realization by comparing the actual rulesets against the key targets set during the acquisition planning. Data analytics as better control to build actual results against the key targets to enhance business value

Data Quality Issues and Remedies:

Issues in Data Collection, Cleansing, and Integration:

During mergers or acquisitions, when working with data among Greetings Health Limited. and Insur4me.com, there are various common issues that may affect the data quality. Data collections issues like Missing Entries, Human Errors, and Inconsistent Input Methods can occur.

Different departments or countries might enter data in different formats and lead to confusion later. In the data integration stage, where datasets from both firms are combined, issues like duplicated entries, mismatched formats, and conflicting information arise.

Data collection and integration help to determine the core strategy and utilize the better performance in the future. Datasets from both firms are copied, such as conflicting information, and might have the recorded revenue in various currencies in different formats.

Multiple steps can be taken to resolve the issues and use the data validation tools in Excel and Power BI. Data cleanings help to fill in the missing values and rename the inconsistent values with the use of a standards list.

Specific Data Quality Issues in Insur4mee.com Datasets Roles:

- I found various data quality issues that must be analyzed before performing the report analysis for Greeting Health Limited, after reviewing the dataset provided for India.

- There is no data for three important insurance categories, such as Dental Insurance, Travel Health Insurance, and Vision Insurance.

- Having the unusual drop in sales and customer volume for the Basic Health Insurance.

In March 2022, Basic Health Insurance shows a sharp drop in both revenue as well as customers from 1709k to 2229k customers in February to just 244k in Euros. I will directly review the data team and, depending on the confirmations, either right away or more with the removal of the entry from the final analytics.

If it is confirmed accurate and highlight the important observation for the management competencies. The sales value shows that the travel health instance in both January and February 2022 is the Same, such as 10,621k in Euros. The value is highly unlikely that remain the same in two different months due to the copy-paste errors with the placeholder value.

The Year and Month are recorded in separate ways, making it complex to analyze trends over a specific time. I will combine them into one column with a format such as “2022-01” to make it easier to use the data in charts or time-based activities.

There is no unique ID that combines them into one column with a format and makes it easier to use the data in the form of charts. The revenue is listed as “000,” which likely means the amount is the thousands of British Pounds.

I will use exchange rates to convert values into the entire consistent currency with the product names in the India datasets. Datasets seem consistent and avoid the confusion by creating a standard list of approved product category names and applying these across all entries, see the lookup or conditional rules.

How Remedies Support Greetings Health LTD’s Strategy of Post-Acquisition?

Greeting Health Limited has clean and accurate data, which is important to support the key strategic decisions. Greetings, Health Limited, to build the maker penetration and boost the chances of exploring a better presence.

Clean data sports the work of the Finance Department, which plays a vital role in tracking the synergies, performance, and cost deigns regarding the building of guidance and achieving the full value of the business presence. I will prefer the clean data techniques for Insur4me.com and deal with and stay competitive in the fast-changing Heathcote industry of insurance industry.

Data Analysis:

Table 1: Total Monthly Revenue and Customer Volume in India

| Months | Total Revenue | Total Customer Volume |

| January | 57,456 | 123,577 |

| February | 49,051 | 107,875 |

| March | 23,926 | 38,077 |

The table indicates the total revenue as well as the total number of customers for all the insurance categories, which are combined in India, and for the first quarter of 2022. Total revenue is expressed in thousands of pounds, and total customer role count is the number of active customers.

Revenue and customer volume both peak the January a gradually decrease through February, with a significant drop in March. Match figures show almost a 50% decrease in sales and about a 65% drop in customers as compared to January.

Monthly Revenue and Volume of Customers by Insurance Category:

| Insurance Category | Jan Revenue | Jan Customers | Feb Revenue | Feb Customers | Mar Revenue | Mar Cusotmers |

| Travel Health Insurance | 10621 | 19318 | 10621 | 19503 | – | – |

| Vision Insurance | 5249 | 14860 | 11109 | 34735 | – | – |

| Dental Insurance | 5860 | 29162 | 4395 | 17646 | – | – |

| Critical Illness Insurance | 20631 | 28605 | 13306 | 19503 | 7445 | 10773 |

| Comprehensive Health Insurance | 10376 | 15788 | 8911 | 13559 | 16236 | 27119 |

| Basic Health Insurance | 4639 | 5944 | 1709 | 2229 | 244 | 185 |

The table breaks down the monthly sales and customer values by various insurance categories in India for the 1st quarter of 222. Misusing values for march that can’t be discussed here properly.

Critical illness insurance generates higher revenue as well as customer volumes by insurance category in India for the 1st quarter of 2022. Comprehensive health insurance shows a steady revenue and customer growth, with a notable increase in March.

Summary of Exploratory Calculations:

The average monthly revenue and the cost volume give the overall scale of business activity. Critical Illness Insurance product leads in revenues and customers, as a steep decline in March lowers the average and raises the variations.

Current fields of study help to examine the actual interaction and boost the valuable process regarding instant change. The step decline in March lowers the average with enhances the variation standard deviations. Variability suggests the possible seasonality and data irregularities through the actions as they proceed through the changes and maintain the business roles.

Market development strategy, product focus, data gaps, and seasonality are the broad values to help examine the change and determine the performance-based problems. Investigating these areas will help to decide the performance issues as temporary and structural aspects.

Data Charting and Commentary:

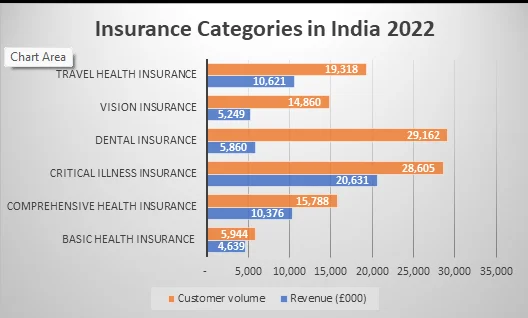

Comparison of Revenues and TEDs of Insurance Category in India:

Basic Health Insurance, Comprehensive Health Insurance, Critical Illness, Dental Insurance, Vision Insurance, and Travel Health Insurance are key perspectives and the insurance categories that help to boost the entire practice through the specific categorized roles.

Critical Health Insurance and Dental Health Insurance are important to uphold the values and build clear activities because it has higher commitments and values. Indian insurance categories help to determine better plans, boost the advanced areas of success, and utilize better comments.

All of these figures help to summarize the key metrics for total sales and customers in Indian. The average monthly and customer base indicates the recognized and sustainable positions. Vision Insurance Revenue pikes the February, while Dental Insurance as well as Travel Health Insurance remain stable, which allows for building changes, maintaining the committed roles, and exploring better productivity in insurance categories.

India is a strong market for the insurance categories that have a large population, which consists of both young as well as old people. Critical Illness Insurance underperforms the consistency and could be a candidate for divestments, as rereading the act is crucial to examine strategic success.

Visualization of data trends enables the Mergers and Acquisitions team to make evidence-based decisions on which country and product lines to prioritize in the integration process. The Indian health insurance sector can build advanced values and reach the proper audience that precedes the changes, examines the core values, and builds higher plans.

Conclusion and Recommendations:

Conclusion:

The analysis of revenue as well as customer volumes in the 3 key countries, such as the UK, Mexico, and India, follows the various conclusions. India shows the highest sales and customer volumes in the health intake categories, although win the noticeable functions. India suggests a large and potentially growing market with some instability that needs to be managed.

Mexico and the UK should be compared to India’s performance, but early indications point towards the business roles regarding instant values. India has a large customer base and diverse product uptake, making it a favorable market to leverage Insure4me.com’s presence for growth and cross-link opportunities.

Critical Illness Instance directly concretizes the largest market share of sales and the customer volume as highlight the entire flagship product with the strongest market demand. On the other hand, comprehensive health insurance also indicates there strong and steady growth as make it another key product to focus on market penetration.

Recommendations:

Greeting Health LTD CEO and Board should start the market development strategy in India and complement both firms’ offerings, and capitalize on the strong market presence with a larger customer base.

The brand can prioritize the investment and marketing efforts. Critical Illness and Comprehensive Health Insurance give the sales and customer strengths. The CEO should execute the rigorous tracking of synergy relations regarding the cost savings and sales growth.

Data Analytics use with the integrated data sources helps to get a unified view of products, customers, and sales. Brand can enable the cross-country comparisons and the broad designation to tailor the strategy reflectively.

Businesses can develop automated reporting with dynamic charts and enable senior management to identify emerging trends. Businesses should invest in training for Finance and Marketing teams on data analytics tools with core interpretations.

The CEO must invest in contributing to the Competitors’ Activities to anticipate the market shifts and innovate the product offerings to the customer satisfaction and retention. Indian insurance firms can ensure all the data analytics and marketing strategies for the health insurance in each country.

So, Greetings Health Ltd should invest in training for the Finance as well as Marketing Teams on data analytics tools with cleared interpretations.

A firm can encourage the cross-functional teams and collaborate the data-driven project to raise integration of success.