Business Project of Tesla

The full text of Tesla’s consulting report “Business Project of Tesla” is provided below. The current problems that Tesla is facing are the focus of this chapter. Tesla, Inc., headquartered in Austin, Texas, is an electric vehicle and sustainable energy firm. It was founded in 2003. Tesla, which has a varied product portfolio, offers both consumer and corporate items.

This category includes items such as electric vehicles and batteries, as well as solar panels and solar roof tiles. Tesla is the world’s most valuable automaker, as well as one of the world’s most valuable enterprises, having a market capitalization of about $1 trillion dollars.

It dominates both the battery electric vehicle and plug-in electric vehicle markets in terms of market share, accounting for 16 percent of the plug-in electric vehicle market and 23 percent of the battery electric vehicle market, respectively.

Tesla Energy, a subsidiary of the corporation, is a key player in the US photovoltaic market, having developed and installed solar systems for more than a decade through its subsidiary Tesla Solar. Tesla Energy’s electricity storage systems are expected to reach 3 gigatonnes of watt-hours (GWh) in 2020, making the company one of the world’s largest battery suppliers at the time.

Tesla (TSLA) reported earnings and revenue for the second quarter that were better than expected, according to Wall Street analysts. Following sales of $12 billion, the electric vehicle pioneer announced an all-time high net profit of $1.1 billion, marking a new milestone for the corporation. However, following the release of the firm’s financial results report, the company’s stock price jumped slightly, according to the company’s website.

Tesla’s quick share price climb, according to investors, will be slowed in the short term by a range of variables, including the company’s high valuation, competition from “colonizers”, a major exposure to China and bit coin, and higher raw material costs, among others.

Read more: Business Project of Nike

Challenges and Problems Client is facing

High Valuation

Wall Street is skeptical of both positive and bad corporate news. Mr. Market is “over optimistic”, according to Benjamin Graham, when estimating the worth of publicly traded companies. Mr. Market can be overconfident, resulting in stock prices well below their true value.

Many analysts believe Tesla’s stock is currently overvalued. Tesla’s intrinsic value is $160.11, a significant discount to the stock’s present price because the business is predicted to achieve only 12.41 percent return on equity over the next 12 months.

Competition from Colonizers

When Tesla’s supremacy in the electric vehicle market was first established, traditional automakers posed little of a threat to Tesla’s dominance. Because General Motors, Ford, Volkswagen (VWAGY), and Toyota are all pursuing opportunities in the electric car business, this is no longer the case.

EVs may be delivered to the public by this set of “colonizers” of the EV sector, who have the manufacturing knowledge, skills, and distribution networks to do it. The emergence of new EV competitors may put Tesla’s sales and profit margins at risk as a result of pricing competition. This is something that Wall Street is paying close attention to in the quarterly financial statements (See Electric Vehicle Stock Comparison on Tip Ranks).

China Exposure

Because of China’s severe air pollution, there has been a rise in demand for Tesla vehicles. Tesla’s position as the world’s first maker of electric vehicles accounts for more than a quarter of the company’s total sales.

A large presence in the Chinese market, on the other hand, raises some issues, including as rivalry from Chinese invaders such as Nio (NIO), Li Automotive (LI), and Xpeng (XPEV), all of which have strong government support. Experts believe that China’s ban on high-tech firms will play a role in the race to catch Tesla in the future.

Exposure of Bit coin

CEO of Tesla Elon Musk is a big fan of the crypto currency bit coin. For this very reason, the CEO decided to make an investment in digital money. Its $1.5 billion investment in bit coin at the beginning of March was valued at $2.48 billion at the end of March, compared to $1.5 billion at the start of the month. Bit coin’s volatility, on the other hand, comes with its own set of dangers.

The volatility of digital money is exacerbated by accounting regulations that designate it as an intangible asset with an unlimited life cycle. Distress losses will be incurred in the reporting period if its fair value drops below its carrying value due to this change in valuation.

When the fair value of an asset rises, companies suffer an increase in impairment losses. This loss cannot be recovered until the asset is sold. Because of its involvement with cryptocurrencies, Tesla lost $23 million in the second quarter of this year (See Bit coin Stock Comparison on Tip Ranks).

Rising Material Costs

Tesla and other traditional vehicle manufacturers are suffering from severe material shortages as a result of supply chain interruptions induced by the COVID-19 pandemic in China. According to projections, this will slow Tesla’s frantic development pace.

Even as Musk cranks up production of his vehicles, global shortages of semiconductors continue to be a major source of concern. According to our supply chain, “for the remainder of this year, our growth rates will be determined by our supply chain’s slowest component”, and that slowest portion is comprised of a broad range of semiconductors.

Purpose of Report

Tesla is currently experiencing a number of issues, which is the purpose of this paper to shed light on those issues. It is the goal of this consultancy report to highlight the difficulties that the customer is experiencing, as well as the solutions that have been proposed.

Through the identification and resolution of specific issues, this study adds value to the bottom line of the company’s shareholders. It expresses my point of view on the issues that Tesla has been dealing with since 2021, and it is available for download here.

Impact of Research on Stakeholder

The implication of Tesla’s business strategy is as follows:

As a result, Tesla’s products are viewed as a dramatic departure from conventional wisdom. By producing an aspirational high-end vehicle and then launching an affordable Model 3 sedan, Tesla was able to initially penetrate the luxury market, before expanding into the middle class and mainstream markets with the Model 3 sedan.

Tesla would need to review its supply chain and production planning in order to ensure the company’s long-term viability and success, which would demand a significant adjustment in strategy. Tesla also aspires to be an ecologically friendly business from a strategic standpoint, in order to reap more benefits from government and regulation.

As detailed below, all of Tesla’s strategies emphasize the company’s core value and priorities the company’s focus and involvement with its stakeholders:

Customer

Tesla, as mentioned earlier, aims to enter both high and medium markets with its Model 3 sedan, which will be available at a reasonable price. Because Tesla’s revenue is influenced by its customers, the quality of its products and the product price level of Tesla are highly regarded by Tesla customers. This need necessitates the company’s efforts to lower the cost of automobile batteries in order to lower their worth.

Supplier and Alliance Partner

Tesla must rely on major brake discs and battery technologies from Europe and Japan, as well as for partnerships and cooperation with those global suppliers, in order to maintain its position as the world’s leading electric car manufacturer. All of these corporate partners have a strong hand in the success of the company equally.

Investors

An important part of Tesla’s early life was the contribution made by investors to his success. They, along with other businesses, are important to the capitalization and flow of the firm. In addition to being shareholders, investors are always concerned about the profit and growth of the company.

As a result, Tesla’s corporate social responsibility (CSR) is focused on long-term plans aimed at transforming the automotive industry. Investor interest is in line with the decision to allow other organizations to use Tesla’s patents to boost Tesla’s growth by increasing the value of energy products and goods. This is done to increase the number of energy-efficient products and services.

Government

For Tesla, the goal is to establish a sustainable vehicle sector, which is why the government is also playing an essential role as a stakeholder group. Governments are worried about the company’s compliance with state laws, and how it contributes economically to the state’s overall growth. Tesla’s ambitious global expansion plans and stellar track record precisely meet these government requirements.

How they Influence each other?

Using the stakeholder analysis described above, we can identify the primary stakeholders who are directly responsible for determining the company’s overall strategic direction. With Tesla’s current client focus, new market entrants will have an easier time breaking in. In order to maintain client satisfaction, the company offers free charging, software, and broadband connection.

The success of a firm is contingent on the cooperation of all of its members. Their collaboration allows for the timely innovation, manufacturing, and provision of services. The majority of Tesla employees are happy with their jobs. Investors and stockholders deserve to be given more consideration. Tesla has made significant investments in its long-term growth strategy.

This company is no longer profitable, and the losses are only growing in magnitude and frequency. Investors may become impatient and lose interest as a result of this. The interests of shareholders must be taken into consideration while developing a strategy for generating returns and improving investor sentiment.

Evaluation and Analysis of Secondary Data

PESTEL Analysis

Political Factors

This area of Tesla Inc.’s PESTEL/PESTLE Analysis focuses on how governments affect firms and the macro-environment. A wide range of societal influences, including government agencies, have an impact on businesses and sectors. Trade restrictions, for example, can have a negative influence on the production and profitability of a sector. The following political external issues have an impact on Tesla and the automotive and energy solutions industries:

- Electric vehicle subsidies from the government (opportunity)

- New trade agreements at the global level (opportunity)

- Most major markets are experiencing political stability at this time (opportunity)

As a result of government subsidies, Tesla Inc. will be able to increase its profits even further. It has a direct effect on the company’s operations and products’ potential to cut carbon emissions.

Economic Factors

PESTEL/PESTLE Analysis of Tesla Inc. This component of the PESTEL/PESTLE Analysis addresses the macroeconomic consequences of current economic conditions. All of the aspects that have an impact on the automobile business, including market development, trade levels, currencies, and other factors, are included in this list.

For example, the rate of expansion of the company’s solar panel business is dictated by the rate of growth in the market for solar energy. Among the external economic factors that have an impact on the automotive market are the following:

- Lowering the overall cost of the battery (opportunity)

- Reducing the cost of renewable energy sources (opportunity)

- Fears regarding the economy’s long-term viability (threat)

The lower cost of Tesla’s batteries has a positive impact on the company’s bottom line. The company’s electric car offers serve as an excellent illustration of how this external issue has an impact on pricing. The drop in the cost of renewable energy sources is also taken into consideration as an external component in this PESTEL/PESTLE analysis. The firm is expanding as a result of the increasing popularity of renewable energy solutions.

Social Factors Influencing Tesla Inc.’s Business Environment

Employees, customers, and investors of a company are all impacted by social trends and situations that have an impact on the organization’s macro-environmental environment. The PESTEL/PESTLE Analysis carried out by Tesla Inc. assesses how the company’s target markets match with social trends.

As a result, the company’s executives must take steps to maximize the benefits of external situations such as these for the company’s bottom line. The following external sociocultural elements are critical to the success of Tesla’s company.

Low-carbon lifestyles are becoming increasingly popular, as seen by the following statistics:

- A rising preference for renewable energy sources as a source of electricity (opportunity)

- Growing the income distribution in developing countries is important (opportunity)

According to the findings of this corporate analysis, the international vehicle sector has a great deal of room to grow. Due to the growing popularity of low-carbon lifestyles and the growing demand for renewable energy for customers, companies such as Tesla Inc. they benefit from this practice.

Technological Factors

This section investigates the impact of technology on the company’s external or macro-environment using the PESTEL/PESTLE Analysis. It is vital for Tesla to develop technologies that will enable the company to expand its automotive and energy solutions businesses.

For instance, materials engineering technology determines the efficiency and cost-effectiveness of batteries. The following external technology elements have an effect on Tesla, Inc.’s vehicle business:

- Rapid advancement of technology (opportunity & threat)

- Increased use of automation in the workplace (opportunity)

- Online mobile systems are becoming increasingly popular (opportunity)

When it comes to technology in this business examination, it’s a two-edged sword. Tesla has an opportunity to develop its product technology in light of the increasing rate of adoption. The same external issue, however, poses a threat to the firm in the form of potential obsolescence of technologies used in its items.

Environmental Factors

This section of the PESTEL Analysis of Tesla, Inc. focuses on the influence of ecological conditions on the global business’s remote or macro-environment. A company’s manufacturing methods are influenced by environmental trends, for example. Tesla’s market is affected by the following environmental elements not controlled by the company:

- Changes in the Earth’s climate (opportunity)

- Enhancing environmental initiatives (opportunity)

- The criteria for trash disposal are increasing (opportunity)

PESTEL / PESTLE believes that genetic engineering will play a significant role in Tesla, Inc.’s industrial sector. For example, a corporation may decide to upgrade its electric vehicles as a result to environmental concerns, greater environmental activities, and worsening waste disposal conditions.

It is believed that the company’s electric vehicles, batteries, and solar panels are ideally equipped to deal directly with these external difficulties associated with the company’s sustainable and ecologically beneficial products. This PESTEL / PESTLE research phase reveals that Tesla has a vast expansion space due to the unique nature of its goods.

Legal Factor

Part of the PESTEL/PESTLE Analysis looks at how regulatory elements affect the larger environment at a distance. Legal frameworks have a significant impact on business decisions and growth. Regulations given forth by state and federal governments govern the Tesla 4P or marketing mix. For the organisation, HR and business alliances are also regulated by the legislation. Tesla, Inc.’s corporate strategy must take into account the following unrelated legal issues:

- The expansion of patent protection across national borders (opportunity)

- Regulations on the consumption of energy (opportunity)

- The United States regulates the sale of automobiles by dealerships (opportunity & threat)

Considering expanding international patent protection, Tesla has the ability to safely develop its operations abroad. As a result of these energy consumption requirements, the company’s electric vehicles and energy solution products have a potential to be promoted through this PESTEL/PESTLE analysis.

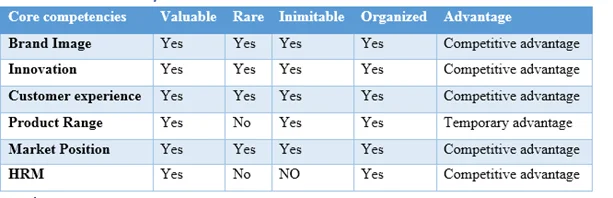

Tesla Motors VRIO Analysis

Brand Image

That Tesla is well-liked by the general public is a major advantage for the corporation. As a result, it’s a noteworthy differentiator among the company’s competitors, who are few and far between. In spite of the fact that there are other automakers producing electric and hybrid vehicles, Tesla has created a unique ownership model.

As a result of its long-term business plan and focus on cutting-edge technology, Tesla has established itself as an automobile industry innovator. The brand’s reputation, sales, and monetization are all directly impacted by the company’s image. When it comes to preserving a positive public image, vehicle manufacturers place a high priority on it.

Besides product quality, the marketing strategy of a corporation has a considerable impact on the product structure and market performance of that company. Despite this, Tesla’s marketing approach does not only rely on high-priced advertising campaigns to be effective.

Assert yourself as an industry leader by establishing a reputation for constant innovation and client service. In the long run, the corporation has an advantage over the competition because of its well-earned reputation.

Technology Innovation

Using technical innovation, businesses in the automotive industry can acquire a competitive advantage in their respective markets. In order to remain competitive in the automobile business, they must devote more resources to research and development.

Vehicle manufacturing has gotten increasingly competitive, and each company must innovate in order to maintain its market position. Tesla is well-known for its dedication to innovation and for delivering high-quality vehicles that are equipped with the most cutting-edge technology available.

Tesla’s autos are more enticing because they combine cutting-edge technologies, such as the use of lithium-ion batteries, which make them more environmentally friendly. It is impossible to find any electric car (EV) with the same driving range as Tesla’s in the market’s EV category.

All in all, the organisation has been successful in introducing new products to the marketplace, which have not previously been available. Because of its technical characteristics, Tesla is a safer car brand in terms of passenger safety than the competition. Consequently, Tesla has earned a huge competitive advantage that it is unlikely that its competitors will ever be able to equal in the foreseeable future.

Customer Experience

To put it another way, the whole driving experience provided by Tesla is significantly superior to that provided by its competitors. As a result, Teslas have grown significantly more popular among electric vehicle buyers than any of its competitors.

Tesla’s luxury electric vehicles are the best on the market in terms of design, performance, and aesthetics. In addition to being safer, they also appear to be more visually appealing than the models offered by the competition.

Furthermore, Tesla automobiles have a net-zero carbon impact (CO2 emissions). People are now on the lookout for vehicles that are both ecologically friendly and efficient in terms of fuel use. With its expansion into the United States and China, Tesla is a clear indication that consumers are becoming more interested in environmentally friendly autos, as well as other green technologies.

Furthermore, Tesla automobiles do not necessitate a significant investment in terms of maintenance. Compared to conventional automobiles powered by internal combustion engines, Tesla vehicles have lower maintenance expenses.

Overall, owning a Tesla has a number of advantages, which is why the company has a market share of more than 60% in the United States of America. In general, the firm has earned a significant competitive advantage over its competitors by providing a more enjoyable riding environment. Along with the increase in popularity of Tesla automobiles comes an increase in the quality of the driving experience provided by these automobiles.

Product Range

Tesla now has a wide choice of appealing products on the market. Despite having a lesser product line than other high-end car models like BMW and Volkswagen, its product line is nonetheless active in the market it wishes to enter.

Following the Model 3, Tesla earned a considerable amount of market share as well as a major boost in global popularity. To meet rising demand, the corporation will need to expand its production capacity. Tesla Motors also introduced three new models to the market: the S model, the X model, and the Y model, all of which are more expensive than the Model 3 but still fall within the same price range.

Market Position

As a result of its success in both the automobile and electric vehicle businesses, Tesla has established a strong position in both marketplaces. It is essential for the brand to capitalize on its strong market position in order to sustain its competitive advantage. Tesla’s nearest competitors have a market share that is far smaller than Tesla’s own.

Tesla’s market position continues to improve as a result of the remarkable performance and innovation of the company’s autos. With its extensive recognition and rising sales, it has grown in popularity throughout the world. Several factors will contribute to its ability to sustain its dominant position in the market over the next few years. Additionally, Tesla’s improved reputation as a corporation is a significant factor in the growing demand for electric vehicles (EVs) around the world.

HRM

The competitive advantage of a brand is strongly dependent on its human resource resources, and this is true for every technology firm in the world. Tesla is first and primarily a technological enterprise, rather than simply a car manufacturer. It distinguishes itself from any other automobile manufacturer by placing a strong emphasis on cutting-edge technology breakthroughs. In addition to its advancements in human resource management, the corporation has increased its competitive advantage in the electric vehicle sector.

Beyond hiring and retaining exceptional employees, the organisation places a great priority on creating a positive work environment. It has been possible to cultivate an organizational culture of invention and creativity. It is essential for a company to keep a strategic focus on managing its human resources in order to sustain its competitive advantage.

Recommendations and Conclusion: Business Project of Tesla

According to the company’s most recent earnings report, investors who are positive on Tesla appear to be well-supported in their bets for the future. Although the positive news has already been reflected in the stock market’s valuation of the company’s stock, the promise of increasing earnings has not yet been taken into consideration. In the future, the EV pioneer will face a number of obstacles, including dealing with China and Bit coin, as well as competition from other colonizers and rising material costs.

Since its inception, Tesla, Inc.’s bottom line has steadily increased, and it is currently significantly higher than it was previously. In the development and success of his organisation, it is reasonable to claim that Elon Musk’s charisma and leadership abilities have played a key influence.

An examination of Tesla Inc. using Porter’s Five Forces, which takes the competitive environment into consideration, finds that the business is well-positioned to strengthen its worldwide automotive operations through innovation. On the other hand, according to the findings of the PESTEL/PESTLE study, organizations must constantly adapt to keep up with these trends and remain competitive.

The vehicle, battery/energy storage, and energy generation industries, among others, may be impacted by these advances. Other industries that may be impacted include the manufacturing industry. So the firm has to evaluate the commercial conditions of rival automotive manufacturers and energy solution providers.

Research was carried out by Tesla Inc. using the PESTEL/PESTLE framework, which led in the discovery of a number of prospective development paths for their company in the future, according to the corporation. The free trade agreements that allow businesses to expand their activities outside the borders of the country in which they were founded are an excellent example.

As a matter of course, it is requested that the firm expand its activities to include operations throughout the world, for want of a better language to express what is being asked. The market penetration of this company should be increased in order to attract more customers from countries other than the United States of America (USA).

Marketing efforts should be targeted at consumers who do not reside in the United States of America, according to the AMA. It is possible that by concentrating on a small number of sales attempts in a variety of different areas around the world, this method will be able to significantly reduce market-based risk.

Tesla should be motivated by the rapid expansion of the market for electric vehicles to strive to become the world’s leading producer of electric automobiles, or at the very least to become a significant producer of electric vehicles in the near future, as the market for electric vehicles continues to grow. Apart from that, there are few or no charging stations in numerous central U.S. states, and there is a general lack of information on electric vehicles in the region.

A strategic expansion of Tesla’s Supercharger network in these locations, as well as in other high-profit areas for the company, would be a wise investment move on their behalf. The car and its distinctive features will become more well-known to the general public as a result of the company’s increased marketing activities.

So they are expanding their product offerings to better serve a broader range of customers, particularly those with limited financial resources. With its recent success, the organisation has demonstrated that it is capable of achieving its primary goal of innovation while simultaneously making a good contribution to a cleaner and safer environment through the use of electric vehicles.

A strategy was prepared in advance in the event that one of Tesla’s competitors announced a new incentive or additional product for their hybrid or electric vehicle. The products of the company became better than they had ever been as a consequence of this transformation, and the products of its competitors became better than they had ever been as a result of this transition as well.

The firm is unlikely to face difficulties in drawing new consumers if it continues to cut the price of its Model 3 in the foreseeable future. Electric vehicles are more cost effective than hybrids and internal combustion engines because the pricing of electric vehicles is more elastic than that of hybrids and internal combustion engines.

Pure electric vehicles are more cost effective than hybrids and internal combustion engines because the pricing of electric vehicles is more elastic than that of hybrids and internal combustion engines. Because electric cars are so unusual, they may be employed in a wide range of scenarios due to their low cost and versatility.

Because of this, they are becoming increasingly popular. Even when the term “electric car” is spoken, the vast majority of people automatically think of a hybrid vehicle, which is quite understandable given the similarities. Remember that the Tesla plant was created specifically for the production of electric vehicles, with an emphasis on supplying high-end luxury vehicles to customers at a competitive price. This is something to bear in mind while thinking about the company’s facilities.

When it comes to Tesla’s products, demand is highly elastic, similar to demand for the overwhelming majority of other companies, despite the fact that the supply of those products is quite rigid, as is the case with the vast majority of them. With sufficient financial resources and realistic demand predictions, Tesla will be able to work through the losses it incurs while continuing to sell cars to customers.

In part, this is due to strong demand in developing countries such as China, which will allow Tesla’s high fixed costs of conducting business to be offset to some extent. This high-tech firm will need to make significant investments in research and development in the near future in order to keep up with the competition and produce automobiles that are more visually appealing in the future.

A substantial percentage of their expenditure is directed toward the rapid expansion of their Supercharger network, as they wish to eliminate a danger to their business while simultaneously improving client satisfaction with their products and services. To secure the long-term health of the organisation, I urge that they stick with their current business plan for a short length of time.