Business Project of Samsung

Samsung Electronics is a global leader in consumer electronics and a dominant player in the premium smartphone market. Its flagship Galaxy S series is central to both revenue and brand identity, showcasing the company’s technological innovation and market leadership.

The launch of the Galaxy S24 series was positioned as a major advancement, with customers expecting stronger performance, longer battery life, and seamless integration of hardware and software features. Meeting these expectations is critical, as flagship devices directly influence customer loyalty, competitive positioning, and financial performance.

Shortly after the release, users of the Galaxy S24 equipped with the Exynos 2400 processor began reporting significant battery drain following the One UI 7 software update. Reports described rapid depletion even in idle mode, suggesting a power management inefficiency linked to background processes. Despite routine troubleshooting by users, the problem persisted, creating customer dissatisfaction and reputational risk.

This challenge reflects a wider trend in the technology sector, where increasingly complex integration between hardware and software can introduce performance issues during updates. At the same time, consumer demand for battery efficiency is growing due to both lifestyle needs and heightened awareness of energy use.

Sustainability policies and e-waste regulations are also pressuring manufacturers to extend device lifecycles and avoid premature replacements. Addressing battery performance is therefore not only a technical necessity but also a compliance and brand-protection priority.

The report will analyse the challenge, its impact on stakeholders, and potential solutions. Using frameworks like PESTLE, Porter’s Five Forces, and Mendelow’s Matrix with secondary data, it will develop strategic recommendations. The goal is to provide actionable measures that resolve the technical issue while safeguarding Samsung’s competitive edge and reputation.

Read more: Business Project of Apple

Challenge and Issues the Client is Facing

The Galaxy S24 series, particularly the Exynos 2400 variant, has faced a persistent battery drain issue following the rollout of the One UI 7 software update. Users have reported that battery levels decline rapidly, even when the device is idle, with notable overnight losses in charge.

Technical analysis from independent reviewers attributes the problem to inefficient background processes embedded within the update, where system services and certain applications remain active unnecessarily, leading to continuous power consumption.

Crucially, this issue remains unresolved even when standard optimization measures are applied, such as enabling power-saving modes, restricting background activity, lowering display brightness, or disabling non-essential features. The persistence of the fault points to a systemic inefficiency in the update’s power management framework rather than user error or isolated configuration problems.

This situation reflects a broader trend within the global smartphone industry, where increasingly complex integration between hardware and software heightens the risk of performance issues after major updates. As device capabilities expand and manufacturers push for rapid innovation cycles, the margin for error in software rollouts has narrowed.

Post-launch faults now attract immediate consumer attention, fuelled by the speed and reach of online reviews and social media. For premium models like the Galaxy S24, customer expectations are especially high, and tolerance for such problems is minimal.

Concurrently, battery performance has emerged as a core competitive advantage, ranking alongside camera quality and processing power as a deciding factor for consumers. The ability to deliver consistent, reliable endurance is now a market differentiator, with underperformance in this area carrying significant reputational and financial consequences.

The reputational risks for Samsung are substantial. Negative experiences shared on community forums, review platforms, and in technology news outlets can erode brand trust. For a flagship release, persistent dissatisfaction not only threatens immediate sales but can also influence purchasing behaviour for future product launches, potentially shifting customer loyalty towards competitors.

The implications extend beyond consumer perception. From an environmental and corporate responsibility perspective, unresolved battery drain issues may prompt premature device replacement, undermining Samsung’s public commitments to sustainability and e-waste reduction. Such outcomes could be perceived as inconsistent with the company’s CSR agenda, which prioritises product quality, durability, and environmental stewardship.

Addressing this issue is not just a technical requirement but a strategic imperative. Effective remediation is essential to restoring customer confidence, protecting Samsung’s competitive position, and aligning with its sustainability commitments.

Conversely, failure to act swiftly risks damaging long-term brand equity, weakening market share in the premium segment, and reducing the effectiveness of future flagship launches. The challenge is as much about safeguarding corporate reputation and strategic objectives as it is about resolving a technical fault. Ultimately, the outcome will signal to stakeholders whether Samsung can maintain the operational agility and innovation leadership expected of a global technology pioneer.

Purpose of the Report

The primary aim of this report is to evaluate the root causes of the Galaxy S24 battery drain issue affecting the Exynos 2400 variant after the One UI 7 update, assess its impact on key stakeholders, and analyse the wider strategic implications for Samsung Electronics.

The analysis will lead to the development of actionable, evidence-based recommendations to address the current challenge and strengthen Samsung’s resilience against similar issues in future product cycles.

This investigation holds strategic importance in safeguarding Samsung’s brand equity and maintaining its competitive position in an intensely contested global smartphone market. By addressing the technical problem and its reputational consequences, the company can prevent future erosion of customer trust, protect sales of upcoming flagship models, and reinforce its commitments to product quality and sustainability.

The report will rely on secondary data drawn from technical assessments, industry reports, market analysis, and consumer feedback. Analytical depth will be supported by applying management frameworks such as PESTLE, to situate the challenge within external market forces; Stakeholder Mapping, to assess varying interests and influence; and Value Chain analysis, to identify process points for improvement. These tools ensure that recommendations are both technically viable and strategically aligned.

Stakeholder Analysis

Stakeholder Identification & Categorisation:

The Galaxy S24 battery drain issue involves a complex network of internal and external stakeholders whose roles, influence, and interests shape the scope and urgency of the response.

Internal stakeholders include:

- R&D teams – responsible for diagnosing and resolving the software-level inefficiencies in power management.

- Software engineers – directly engaged in code-level fixes to One UI 7 to restore optimal battery performance.

- Product managers – balancing technical priorities with market timelines to protect brand perception and revenue targets.

- Marketing teams – tasked with managing communication strategies to mitigate reputational damage.

- Customer service teams – serving as the first point of contact for complaints and managing user frustration.

- Executive leadership – accountable for strategic decisions on remediation, resource allocation, and public positioning.

External stakeholders include:

- Customers – directly affected by reduced device performance, with high expectations for flagship quality.

- Suppliers – particularly chipset and component manufacturers, whose hardware integration must align with Samsung’s software updates.

- Retailers and distributors – reliant on strong product reputation to maintain sales momentum.

- Regulators – overseeing compliance with product safety, e-waste, and consumer protection standards.

- Investors and shareholders – sensitive to brand image, sales performance, and risk exposure.

- Technology media – influential in shaping public perception, often amplifying consumer dissatisfaction.

Power–Interest Analysis:

Applying Mendelow’s Power/Interest Matrix provides a strategic view of how stakeholders should be prioritised:

| Level of Interest | ||||||

| Level of Power | High | Low | High | |||

| Keep Satisfied: Investors and shareholders Suppliers | Manage Closely: Executive leadership Regulators Customers | |||||

| Low | Monitor: Technology media Retailers | Keep Informed: R&D teams and software engineers Customer service teams | ||||

Stakeholders can be grouped by power and interest. High power and interest, executive leadership, regulators, and customers must be managed closely for their impact on strategy, compliance, and reputation. High power but low interest, investors, shareholders, and suppliers should be kept satisfied for their financial and operational influence.

Low power but high interest, R&D, engineers, and customer service should be kept informed of their role in solutions and customer relations. Low power and low interest, technology media and retailers, require monitoring, as their influence spikes mainly during controversy.

Power sources vary: customers wield reputational power through public reviews; regulators possess legal enforcement capabilities; executives and investors exert financial and organizational control; and engineers hold specialized technical knowledge essential for resolution.

Impact of Research Findings on Stakeholders:

The report’s findings will have distinct implications for each stakeholder group. For executive leadership and investors, robust evidence on root causes and resolution costs can inform strategic decisions on resource allocation and risk mitigation. R&D and engineering teams will benefit from insights that focus remediation efforts on the most impactful technical solutions, reducing trial-and-error cycles.

For customers, a credible, data-backed action plan can rebuild trust and reduce attrition to competitors. Regulators may interpret research findings as evidence of proactive compliance, potentially limiting regulatory intervention.

Suppliers could use these insights to refine integration protocols, preventing similar issues in future product cycles. Retailers may leverage resolution progress to reassure consumers, stabilising sales performance.

Relative importance is highest for customers, executives, and regulators, as their combined influence directly determines reputational recovery, market stability, and legal compliance. Without alignment across these groups, implementation of recommendations risks delay or ineffectiveness.

Effective stakeholder management requires a tiered approach that prioritises high-power, high-interest actors while ensuring transparent communication with technically engaged but less influential groups. This balance will be essential for both resolving the immediate S24 issue and strengthening Samsung’s operational resilience.

Evaluation and Analysis

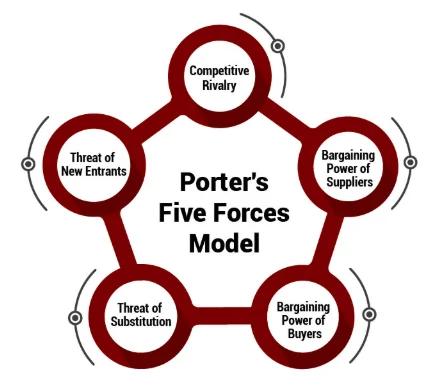

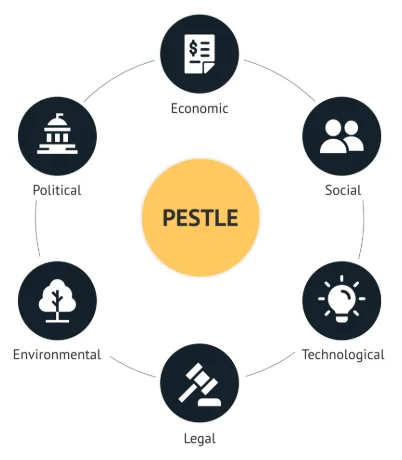

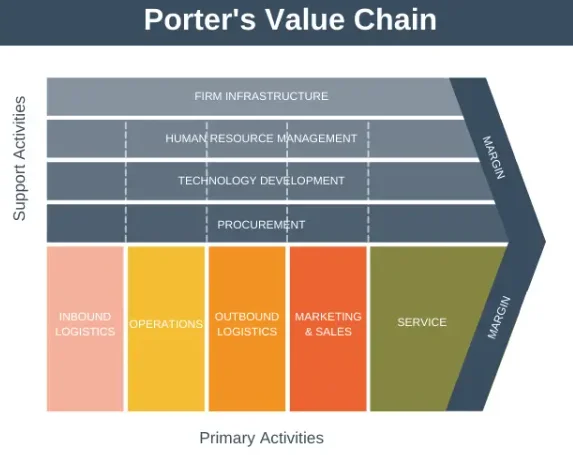

This section critically examines the Samsung Galaxy S24 battery drain issue within its broader strategic and operational context. Using secondary data, it applies Porter’s Five Forces, PESTLE analysis, Porter’s Value Chain, and sentiment analysis to explore industry dynamics, macro-environmental factors, internal processes, customer perceptions, and data limitations.

The analysis provides an evidence-based foundation for the recommendations, showing how technical faults intersect with market forces, stakeholder expectations, and long-term brand resilience.

Industry Context & Market Forces:

Competitive Rivalry:

The global premium smartphone market is characterised by intense rivalry among a few dominant players, notably Apple and Samsung itself. Product cycles are short, with each competitor seeking to differentiate through hardware capabilities, software features, and ecosystem integration. In such an environment, the Galaxy S24 battery drain issue amplifies competitive pressure, as it undermines a key performance attribute, battery life, that has become a critical purchase driver.

Academic studies highlight that in saturated, innovation-driven markets, any product quality lapse can quickly shift market share to rivals with comparable offerings. Apple’s tightly integrated hardware–software model reduces exposure to post-launch technical faults, which further raises the relative threat to Samsung’s position. The pace of technological convergence also diminishes differentiation windows, intensifying the urgency of issue resolution.

Threat of Substitutes:

Substitute pressure is growing as consumers gain access to alternative devices that prioritise energy efficiency, including mid-range smartphones with optimised power consumption and emerging technologies such as AI-assisted battery management.

Wearables and hybrid devices can also divert consumer spending away from premium smartphones if perceived performance value declines. From a strategic standpoint, battery performance is no longer a secondary feature but an explicit selection criterion.

The risk for Samsung lies in customers substituting not only brand but also device category, particularly if they perceive better longevity or reliability elsewhere. In the context of sustainable consumption trends, substitutes that market themselves as eco-efficient could leverage the S24 issue to capture environmentally conscious segments.

Supplier Power:

Samsung’s reliance on key component suppliers, particularly for chipsets such as the Exynos 2400, creates vulnerability in its supply chain. High technical specificity and integration requirements limit the number of viable suppliers, increasing their bargaining power.

While Samsung has some vertical integration capacity, dependence on external component optimisation for software compatibility constrains its ability to rapidly isolate and resolve such battery drain issues. Scholarly evidence shows that in high-tech industries, supplier bargaining power is heightened when components are specialised and switching costs are high. Unless collaborative quality control processes are strengthened, supplier-side constraints could perpetuate post-launch performance risks.

Buyer Power:

Premium smartphone buyers are increasingly informed, technologically literate, and active in online communities, giving them disproportionate influence over brand perception. Platforms such as Reddit, YouTube, and specialised review sites amplify individual complaints into collective reputational risks.

As Porter notes, buyer power intensifies when customers can easily compare alternatives, switch brands without prohibitive cost, and publicly hold companies accountable. In the case of the S24, early adopter dissatisfaction spreads quickly across global markets, creating a multiplier effect on reputational damage. This dynamic compels Samsung to act with transparency and speed to prevent attrition of high-value, loyal segments.

Barriers to Entry:

While capital intensity, advanced R&D requirements, and entrenched brand loyalty create high barriers to entry for new competitors, these barriers do not shield incumbents from intra-market displacement. In the premium segment, established players still face substitution risk from adjacent tiers if technical performance falters.

Moreover, regulatory pressures around sustainability can erode these barriers if compliance costs rise disproportionately for firms dealing with post-launch defects. This means that while the market is structurally protected from start-up disruption, strategic missteps, such as failing to resolve the battery issue, could open competitive space for second-tier brands to capture disillusioned customers.

Macro-Environment Analysis:

Political:

Samsung’s operations are highly exposed to political factors, particularly trade restrictions and geopolitical instability affecting supply chains. Semiconductor manufacturing and cross-border logistics are vulnerable to tensions between major economies, such as the US–China technology rivalry, which can delay or constrain component sourcing.

For the Galaxy S24, reliance on specific chipset manufacturing locations amplifies risk when political disputes disrupt supply routes or regulatory approvals. Software compliance regulations, including localisation requirements and security certifications, further complicate rapid updates to fix the One UI 7 battery drain. Political pressure for stronger digital sovereignty in key markets, such as the EU, could impose stricter software oversight, slowing the deployment of corrective patches.

Economic:

Economic factors compound the strategic impact of the battery issue. Premium smartphone sales contribute significantly to Samsung’s revenue forecasts, and post-launch performance problems risk short-term sales declines and long-term market share erosion. In high-margin segments, even a small reduction in unit sales has a disproportionate effect on profitability.

Consumer electronics demand is also sensitive to macroeconomic volatility; during periods of inflation or currency depreciation, customers may defer upgrades, further reducing Samsung’s ability to recover lost sales from the S24. Failure to address the problem decisively could lead to an enduring erosion of perceived value, requiring heavier discounting and promotional spend to stimulate demand.

Social:

Social dynamics heighten the reputational risk. Consumers’ growing dependence on smartphones for work, communication, and entertainment means battery performance failures are perceived as critical usability flaws. In the context of hybrid work and mobile-first lifestyles, downtime caused by excessive power drain undermines user trust more severely than in past product cycles.

Social media amplifies this dissatisfaction, enabling rapid viral spread of negative reviews. Academic research confirms that reputational crises in consumer technology spread faster and are harder to reverse when end-user frustration directly impacts daily productivity. This creates sustained reputational drag if not countered by visible, credible remediation.

Technological:

Technological trends present both opportunities and risks. Advances in AI-driven battery optimisation and adaptive power management offer potential pathways to resolving the S24’s performance inefficiency. However, the growing energy demands of 5G connectivity and increasingly complex background processes in integrated ecosystems place a higher strain on battery systems.

The One UI 7 issue illustrates the complexity of balancing performance with power efficiency in multi-layered hardware–software environments. Samsung’s competitive position depends on closing this optimisation gap before rivals leverage superior battery management as a key differentiator.

Legal:

Legal factors intensify the urgency of resolution. Consumer protection laws in major markets require devices to meet advertised performance standards, creating potential for warranty claims or class-action litigation if systemic faults remain unresolved. Warranty obligations can escalate costs if widespread repairs or replacements are necessary.

In jurisdictions with strict product liability regimes, failure to act promptly could also trigger regulatory sanctions. Scholarly evidence indicates that proactive compliance and transparent corrective action reduce litigation risk and maintain regulator goodwill.

Environmental:

Environmental considerations intersect with the S24 issue through e-waste generation and sustainability commitments. Shortened device lifecycles caused by performance defects increase the likelihood of premature disposal, counter to Samsung’s stated environmental pledges.

Regulatory frameworks, such as the EU’s Circular Economy Action Plan, are tightening obligations for product durability and repairability. Prolonged battery drain problems could therefore damage Samsung’s corporate social responsibility (CSR) credibility, undermining its appeal to environmentally conscious consumers and investors.

Internal Operations:

Using Porter’s Value Chain framework, the S24 battery drain issue appears to originate within Samsung’s primary and support activities, particularly R&D, software integration, and after-sales service. Inbound logistics and operations rely on tightly coupled hardware–software co-development. Several reports suggest that the One UI 7 update has led to noticeable battery issues in Galaxy S24 devices using the Exynos chipset.

For example, Android Central reports that some users lose about 20% of their battery within three hours of inactivity, while posts on Samsung’s community forums mention significant drops in screen-on time even with moderate use after the update.

This reflects a gap in testing integration, where pre-release simulations may have underestimated real-world usage patterns, a risk well-documented in high-velocity consumer electronics launches.

Within operations, software testing protocols may not have incorporated enough post-market adaptive testing, where early user feedback loops inform rapid iteration. The complexity of Samsung’s global product lines compounds this, as variant-specific optimisation (e.g., Exynos vs. Snapdragon models) requires divergent testing pipelines.

Outbound logistics are less directly implicated, but after-sales service, part of service activities, has struggled to restore customer confidence swiftly, suggesting a lack of coordinated crisis management between technical teams and customer-facing channels. Weaknesses in these areas risk prolonging defect resolution, thereby amplifying negative sentiment and undermining Samsung’s premium brand positioning.

Customer Experience & Sentiment Analysis:

Customer feedback on platforms such as Samsung Community, Reddit, and technology review sites shows a recurring theme: battery drain severity even under conservative usage and power-saving modes. This indicates frustration over both the defect and the perceived slow pace of Samsung’s official acknowledgement.

These findings align with research showing that in premium technology markets, perceived responsiveness is as critical as technical resolution in shaping loyalty.

Quantitatively, spikes in complaint volume followed the staged rollout of One UI 7, suggesting a temporal correlation between update availability and negative sentiment. This supports the view that negative word-of-mouth acts as a force multiplier, accelerating reputational impact beyond the direct customer base.

User sentiment, based on available data, is skewed negative for battery performance post-update, even where overall device satisfaction remains moderate. This duality indicates that while Samsung’s hardware quality continues to be valued, trust in its software optimization has weakened.

For a brand competing on ecosystem integration, such a perception shift carries strategic risk: customer migration to alternatives perceived as more reliable in software-hardware synergy.

Limitations of Data:

While secondary data provides valuable insight into the scale and nature of the issue, its reliability must be critically assessed. First, online complaints are subject to self-selection bias, whereby dissatisfied users are disproportionately represented in public forums.

This inflates the perceived prevalence of the fault relative to the total installed base. Moreover, sentiment analysis of user-generated content is sensitive to linguistic nuances, sarcasm, and cultural differences, which can distort polarity classification.

Second, gaps in publicly available technical data limit the precision of causal attribution. Proprietary performance logs, chipset diagnostic outputs, and closed-loop testing results remain inaccessible, meaning root cause analysis relies on indirect indicators rather than definitive engineering evidence. This limitation means the issue cannot be linked with certainty only to software problems; hardware faults may also play a role.

The third challenge is timing. As the One UI 7 update is rolling out in some parts of the world, the full vision of user experiences cannot be observed yet. This lag will complicate the monitoring of change over time or measuring whether or not Samsung solutions were effective.

Such limitations must be factored into the development of a strategy. Dependence on skewed or partial data can end up diverting resources to the wrong track, and ignoring users’ feedback might hurt the company’s reputation in the future. An effective option to deal with Samsung is to integrate public user feedback with technical evaluation to come up with a greater, factual solution.

Overall, the Galaxy S24 battery drain issue stems from a combination of intense market competition, strict regulations and environmental demands, gaps in testing, and evolving customer expectations. Acting quickly, clearly, and effectively is key for Samsung to win back trust and keep its strong position in the premium phone market.

Recommendations & Conclusion: Business Project of Samsung

Strategic Recommendations:

Technical Fix & QA Enhancement:

Samsung’s top priority should be creating and releasing a focused software patch to fix the One UI 7 battery drain in the Exynos 2400 model. Before release, the patch should go through wider beta testing with users from different regions and usage habits to make sure it works in real life. Adding post-launch testing into the quality checks would help catch hidden problems early and stop them from happening again.

Customer Communication Strategy:

Being clear and open with customers is vital to limit harm to Samsung’s reputation. The company should share regular progress updates through its official channels and reach out directly to users affected. To rebuild trust, Samsung could offer extended warranties or free battery health checks. These actions follow proven crisis management steps, where fast, honest responses help keep customer loyalty strong.

Long-term R&D Improvements:

Samsung’s R&D agenda should integrate AI-driven power management systems capable of dynamically adapting background process priorities to minimise drain without compromising performance. Investment in simulation tools that accurately model variant-specific hardware–software interactions will strengthen pre-release reliability, addressing a structural weakness in the current development pipeline.

Sustainability Alignment:

Positioning the resolution as part of Samsung’s broader sustainability and e-waste reduction strategy will mitigate reputational harm in environmentally conscious segments. Linking the fix to commitments under the EU’s Circular Economy Action Plan could reinforce Samsung’s CSR credibility, transforming a technical failure into a demonstrable case of corporate responsibility in action.

Strengths & Weaknesses:

The proposed recommendations present several notable strengths. First, brand trust restorationis achievable through the combination of immediate technical fixes and proactive communication, both of which address customer dissatisfaction and convey corporate accountability. Second, they offer competitive differentiation, as integrating AI-based optimisation could position Samsung ahead of rivals in battery efficiency, a feature that is increasingly a decisive purchasing criterion in the premium smartphone market.

Third, CSR goal alignment is evident, with the resolution framed within sustainability objectives that reinforce compliance with regulatory expectations and resonate with environmentally conscious consumers. Finally, the recommendations provide stakeholder reassurance, as investors and regulators would likely interpret proactive resolution as a demonstration of strong governance, thereby reducing perceived risk exposure.

However, these measures also entail potential weaknesses. The most immediate concern is implementation cost, as developing robust patches, expanding beta testing, and offering compensation schemes will require substantial financial investment. There are also time-to-market risks, since longer testing phases, while improving quality assurance, could delay the final rollout and prolong negative sentiment in the short term.

Additionally, supplier dependencies may constrain Samsung’s ability to execute fixes independently, given that full optimisation could necessitate chipset-level cooperation from external partners. Lastly, there is a risk of potential overpromising, as closely linking the fix to sustainability commitments could trigger stakeholder backlash if actual outcomes fall short of these stated ambitions.

Strategic Value:

To Samsung:

These recommendations address both immediate operational needs and long-term strategic positioning. The rapid deployment of a tested patch prevents further erosion of premium segment loyalty, while AI-enhanced R&D strengthens Samsung’s innovation credentials in an increasingly commoditized market.

Transparent communication mitigates customer churn and protects lifetime value from high-spend users. Sustainability framing reinforces CSR commitments, safeguarding regulatory standing and appeal to ESG-conscious investors.

To the Industry:

By adopting a proactive, transparent approach to post-launch technical faults, Samsung could set a precedent that redefines best practice in the sector. Historically, delayed or opaque responses to performance issues have exacerbated reputational damage across the smartphone industry.

A well-executed recovery strategy could encourage broader adoption of continuous feedback loops in product lifecycle management, benefiting both consumers and industry resilience.

Conclusion:

The Galaxy S24 battery drain issue, rooted in the One UI 7 update for the Exynos 2400 variant, represents more than a technical glitch; it is a strategic stress test for Samsung’s operational agility, brand resilience, and stakeholder trust. The analysis has shown how the problem intersects with intense competitive rivalry, rising buyer expectations, supplier dependencies, and tightening environmental regulations.

The Porter’s Five Forces assessment highlighted how performance failures amplify competitive threats in saturated markets, while the PESTLE analysis revealed how macro-political and environmental factors heighten both operational and reputational risk.

The Value Chain review identified bottlenecks in testing integration and post-launch service coordination, and sentiment analysis confirmed that trust in Samsung’s software optimisation has been weakened despite continued hardware appreciation.

Addressing this challenge requires a multifaceted approach: swift and reliable technical remediation; transparent, trust-building customer engagement; sustained investment in R&D to strengthen software-hardware integration; and strategic alignment with sustainability objectives to meet regulatory and consumer expectations.

Timely execution will be decisive. Delays in resolution risk compounding reputational damage, reducing market share, and eroding long-term brand equity. Conversely, a swift, well-communicated, and innovation-focused recovery could not only restore confidence in the Galaxy S24 but also reinforce Samsung’s position as a leader in premium smartphones.

The broader lesson extends beyond Samsung: in a market where hardware and software are inseparably linked, excellence in post-launch management is now as critical as innovation at launch. Those who master both will define the competitive frontier in the next era of mobile technology.