Executive Leadership and Governance of BHP Group

In this report “Executive Leadership and Governance of BHP Group” we discuss, Leadership structure of BHP Group Limited is a strong example of corporate governance framework that is suitable for a global, complex operation.

The Board of Directors is majority independent non-executive, and governs the company in an objective and accountable manner. Currently, Ross McEwan, a highly experienced leader who has led roles at Royal Bank of Scotland and National Australia Bank, is the Chair of the Board as of 2025.

McEwan took over from Ken MacKenzie, suggesting a strategic continuity with new leadership insight. Mike Henry, who has been BHP’s CEO since January 2020, has prioritized decarbonization, portfolio simplification and technological modernization. His time in the top job has seen BHP reposition itself strategically toward future facing commodities such as copper and nickel.

Core business areas such as operations, finance, health and safety and sustainability are overseen by BHP’s Executive Leadership Team (ELT). The ELT structure is regionally and functionally diverse, with a decentralized decision-making model that meets global governance expectations.

As a dual listed company on Australia and the UK, the company is subject to regulatory frameworks such as the ASX Corporate Governance Council Principles and the UK Corporate Governance Code.

The leadership setup within BHP is well balanced between innovation and compliance, thus enabling the company to meet stakeholder expectations in a dynamic global environment.

Read more: Leadership Paradigms of Anthony Norman Albanese

Dominant Leadership Styles:

BHP’s CEO Mike Henry is a transformational leader who has made decarbonization, automation and social responsibility the focus of his vision led leadership. Transformational leadership refers to inspiring followers to go beyond self-interest in the pursuit of a vision and organizational goals. BHP’s strategic realignment of Henry, such as divesting of petroleum assets and investing in critical minerals, is forward thinking, change oriented leadership.

However, BHP Group also reflects transactional leadership elements as it stresses on compliance, safety performance and productivity targets. Managers across operational sites have structured reporting lines and clearly defined KPIs, which promote a reward-based performance culture that is consistent with transactional theory. In high-risk industries such as mining, innovation has to be balanced by strict operational discipline and this duality is essential.

Importantly, the combination of leadership styles is conducive to both strategic innovation and performance control, but at the same time, it can cause tension between long term vision and short-term deliverables. Rigid accountability structures can compromise transformational goals unless continually aligned. Therefore, BHP must ensure that these styles are cohesively integrated to ensure cultural coherence and strategic momentum.

Management Approach:

BHP’s management approach is based on operational excellence, decentralization and people development. The company is organized in matrix structure with functional leadership (i.e., Finance, HSE) and regional asset autonomy. This allows for local challenges to be responded to in a tailored manner, while still being aligned to group wide priorities.

This approach is based on the BHP Operating System (BOS) which standardizes core processes across assets for efficiency and continuous improvement.

It fosters lean practices, measurable targets, and cross functional collaboration. Real time data usage and safety accountability is emphasized through day-to-day management, and leadership site visits and bottom-up feedback loops are frequental.

BHP’s people strategy encompasses inclusion, capability building, and leadership succession and is aligned to its ‘FutureFit’ learning programs. But matrix structures can dilute accountability and slow down decision making unless there is high levels of coordination and leadership clarity. However, BHP Group’s consistent operational performance implies that its management model is able to strike a good balance between autonomy and strategic oversight.

Application of Leadership Theories:

Transformational Leadership Theory and Blake and Mouton Managerial Grid Model can be used to critically analyze BHP’s leadership approach, which can help to understand how the company balances vision with operational efficiency.

Idealized influence, inspirational motivation, intellectual stimulation and individualized consideration are the four components of Transformational Leadership as described by Bass and Avolio. These are characteristics of leadership of CEO Mike Henry.

He focuses on sustainability, decarbonization and technological innovation, which is in line with intellectual stimulation and inspirational motivation. For example, BHP’s investment in green steel and copper projects is an example of forward-thinking leadership that is preparing the business for a low carbon economy.

However, the leadership can also be evaluated on concern for people versus concern for production at the same time, and Blake and Mouton’s Managerial Grid (1964) is equally applicable. BHP has a Team Management (9,9) style, which means it wants high performance and high people orientation. The strong commitment to employee safety, diversity and well-being shows a strong concern for people and the stringent KPIs and performance-based culture shows a strong production focus.

But these models have their challenges for practical application. A rigid operational framework built around transactional discipline can hinder the pursuit of transformational goals. In addition, the 9,9 ideal requires an even leadership but the leaders need to be very engaged and coordinated at the same time. While BHP’s leadership has been largely effective, it must constantly adjust these approaches to meet the demands of external pressures and stakeholder expectations.

Critical Evaluation of Leadership Impact:

BHP’s leadership has achieved strategic gains via a hybrid leadership model that combines innovation and discipline. A key strength is its clarity of sustainability vision. BHP’s focus on critical minerals and low emission technologies has reinforced the company’s future relevance in the context of global energy transitions.

The inclusive culture of the leadership and prioritization of employee safety has also furthered organizational morale and employer branding. As per the 2024 BHP Sustainability Report, injury frequency has gone down and diversity metrics have improved, marking successful cultural transformation.

However, challenges persist. The current leadership style has a limitation in that it is difficult to manage organizational inertia, a common problem when transformational agendas are placed on top of deeply entrenched operational routines.

Moreover, the emphasis on performance targets may also have an unintended effect of inhibiting risk taking and creativity, especially among mid-level managers.

Leadership alignment can also be strained by the dual demands to deliver long term sustainability goals and maintain shareholder return. Some critics say that shareholder pressure can sometimes water down environmental or social commitments. This implies that the leadership is effective in setting strategy but execution can be hindered by competing priorities.

Evidence and Literature Integration:

The evaluation of BHP’s leadership approach is based on a synthesis of academic theory and company specific practices. The conceptual framework for understanding how Mike Henry’s visionary and sustainability-oriented leadership motivates employee commitment and cultural change is Transformational Leadership Theory developed by Bass and Avolio.

BHP’s green investments, portfolio realignments and safety culture are consistent with the core dimensions of the theory, particularly inspirational motivation and intellectual stimulation.

In parallel, Blake and Mouton’s Managerial Grid Model offers an explanatory lens for BHP’s high concern for both people and production. This 9,9-leadership style is characterized by the company’s strong safety protocols, inclusion programs, and operational efficiency, balancing employee welfare with performance outcomes.

Empirical evidence from BHP Group’s annual and sustainability reports demonstrates that these models are used and that safety metrics, diversity, and long-term strategic planning have consistently improved. Academic critiques however warn that although hybrid styles are effective, they need to be well aligned to prevent organizational conflict. The analysis merges theoretical insights with BHP’s real practices to provide a nuanced, evidence-based view of how leadership affects corporate performance and culture.

Task 2 – Corporate Governance and Regulation

The governance system that BHP Group Limited has developed is one that represents the size and the international scope of its operations, particularly given that it is listed on both the ASX and LSE. Most of its Board of Directors are non-executive, independent members which ensures objectivity and perspectives from a variety of angles.

Ross McEwan, Chair, leads the board which is supported by a number of important committees. The Risk and Audit Committee, People and Remuneration Committee, Sustainability Committee and the Nomination and Governance Committee are included.

Each group plays a different role in keeping the business on track — from overseeing financial reporting to making decisions about executive pay, reviewing sustainability performance, and planning for future leadership. In addition, BHP practices are in line with ASX Corporate Governance Principles (4th edition) which are aimed at promoting ethical behavior, clear reporting and accountability. BHP’s governance structure allows it to respond responsibly in an industry that is subject to constant environmental and market risks while maintaining trust with its investors and broader stakeholders.

Internal Governance Mechanisms:

The internal governance structure of BHP Group is meant to ensure transparency, integrity and effective leadership throughout the business. There are three core pillars on which it rests.

Board Independence:

- The standards outlined in ASX Principle 2 are met as the majority of board members are non-executive and independent.

- Factors like director tenure and external affiliations are used to assess independence to ensure objective oversight.

- It enables the board to challenge management and provide an independent view on strategic and risk matters.

Risk and Audit Committee:

- This is a fully independent committee that has an important role in financial oversight and risk assurance.

- They review financial statements, internal audits and compliance with regulations.

- This is especially important given BHP’s sensitivity to geopolitical risks and commodity markets.

People and Remuneration Committee:

- Oversees executive compensation and maintains pay structures that are correlated with financial performance and ESG metrics.

- Sustainability goals, safety outcomes, and long-term value creation are tied to bonuses and incentives.

Not only are these mechanisms formalities, they embed accountability and ethical leadership into BHP’s daily operations. Such robust governance is essential in a high-risk industry such as mining to protect the company’s reputation and build sustainable stakeholder trust.

External Governance Regulations:

A range of external governance regulations apply to BHP Group, in particular from the Australian Securities and Investments Commission (ASIC) and the ASX Corporate Governance Council. These bodies create the legal and normative basis that determines how BHP manages compliance, transparency and accountability.

ASIC is Australia’s principal corporate regulator and enforces the Corporations Act 2001, which requires BHP to disclose accurately, hold directors accountable and have adequate risk controls. In addition, ASIC also oversees continuous disclosure obligations, which are obviously important given the environmental and financial risks to which BHP is exposed. Violating ASIC regulations can lead to legal penalties and investor backlash, thus regulatory compliance is necessary for reputational sustainability.

In addition, BHP Group complies with the ASX Corporate Governance Principles and Recommendations (4th Edition). These eight principles are a best practice framework, and companies have to comply or explain deviations (‘if not, why not’ approach). Key principles include:

- Principle 1: Lay solid foundations for oversight and management

- Principle 2: Ensure an effective, diverse, and independent board

- Principle 3: Instill an ethical, legal, and responsible corporate culture

- Principle 4: Protect the integrity of financial and nonfinancial reporting

- Principle 7: Risk can be recognized and managed through proactive systems.

BHP’s annual governance disclosures confirm that it complies strongly with these principles. For example, TCFD guidelines are followed by its climate related financial disclosures, which meet Principle 7.

By aligning with external regulation, BHP does not only comply with the law, but it also enhances investor confidence and stakeholder legitimacy. Yet geopolitical shifts are ongoing and ESG standards are evolving, meaning external governance expectations are likely to become more intense and ongoing.

Academic Framework Application:

Agency Theory is used to critically analyze BHP’s corporate governance as it tackles the inherent conflict between shareholders (principals) and company executives (agents) in the sense that their interests are not aligned. BHP has put in place robust oversight mechanisms to mitigate agency risks.

The executive actions, financial integrity and enterprise risk are monitored by its Risk and Audit Committee composed of independent directors. BHP’s performance based executive remuneration strategy is also overseen by the People and Remuneration Committee and aligns incentives with long term shareholder value through ESG and financial targets.

Stakeholder Theory complements this by acknowledging the need for corporations to address the needs of a broader group than shareholders. This is shown by BHP Group through its sustainability initiatives, Indigenous engagement strategies and environmental governance policies. This reflects the company’s commitment to wider accountability in line with the Global Reporting Initiative and ASX Corporate Governance Principles.

These frameworks together show that BHP’s focus is on both financial control and social responsibility. Yet, achieving an effective balance between shareholder returns and stakeholder interests is a dynamic challenge, especially in high impact industries such as mining.

Company Compliance and Governance Practice:

BHP Group has a formal commitment to best practice governance by consistently adhering to the ASX Corporate Governance Principles (4th Edition). The company discloses its board composition, independence, diversity and ethical conduct through its annual Corporate Governance Statement. The Committees are clearly structured and the Code of Conduct has standards on anti-bribery, workplace safety and responsible supply chains.

However, there are past incidents that make one wonder about the practical efficacy of governance. Joint venture operations in Brazil led to the 2015 Samarco dam disaster, which caused significant environmental damage and loss of life. Investigations suggested that operational risk monitoring and due diligence oversight were weak.

BHP responded by revising internal risk frameworks and expanding sustainability reporting. In more recent times, the company’s culture has been challenged by reports of workplace sexual harassment at Australian mine sites and the launch of a Respectful Behaviors campaign and new grievance mechanisms.

These responses are steps in the right direction, but they also demonstrate a recurring governance gap: converting board level policies into site level accountability. Overall, BHP’s compliance efforts are structurally sound, although continued enforcement, ethical leadership at all levels, and cultural change initiatives to embed governance values throughout the organization are needed to ensure effectiveness.

Critical Evaluation of Effectiveness:

Overall, BHP’s governance architecture is in line with international standards, and has improved in transparency, stakeholder engagement and board oversight. Independent committees, clear reporting structures and policy frameworks strengthen investor confidence and regulatory compliance.

Yet, real world events like the Samarco disaster and internal misconduct cases show limitations in risk management and cultural implementation. The challenges here indicate that there are formal structures, but execution does not happen at the operational level. This remains a vulnerability as head-office governance and on-site behavior continue to be out of sync.

BHP must concentrate on governance integration to improve effectiveness by ensuring that ethical standards and risk controls are not just in strategy documents, but in daily operations. Stronger mechanisms for internal accountability, more diverse leadership, and transparent monitoring across global sites are needed.

Task 3 – Risk Management

BHP Group operates its business in a highly volatile global mining environment where environmental, regulatory and operational risks are inherent to its business model. The company is subject to amplified risk from climate volatility, resource scarcity and mounting scrutiny from stakeholders and regulators as it pivots towards future facing commodities like copper and nickel.

Physical assets, and operational continuity are threatened by heightened climate related events such as floods, heatwaves and water shortages. At the same time, there are global policy shifts, such as tighter environmental and Indigenous land use regulations, that make the legal and reputational complexity greater.

In addition, the commodity prices and supply chains are fragile, and the COVID-19 pandemic and geopolitical trade disputes have exacerbated these vulnerabilities. The risks are not static; they evolve with global markets, ESG expectations and stakeholder demands.

The risk management framework of BHP is developed to monitor, prioritize and respond to these dynamic threats, which will keep the operations resilient, compliant with the regulations and will protect the long-term value of its investors and affected communities.

Identification of 3 Key Risks:

Environmental and Climate Risk:

BHP’s business model is a strategic risk to climate change. Mine sites, logistics networks and surrounding communities are directly threatened by rising temperatures, water scarcity and increased frequency of extreme weather events. Furthermore, BHP has to move away from fossil fuels due to stakeholder and investor expectations for low carbon operations.

Not mitigating environmental risks could lead to reputational harm, legal penalties, and asset devaluation. This risk is addressed by BHP through its decarbonization targets and TCFD (Task Force on Climate-Related Financial Disclosures) alignment.

Regulatory and Compliance Risk:

BHP Group has operations in a number of jurisdictions with increasingly complex and changing legal regimes. Project approvals can be affected by changes in mining legislation, tax regimes, or environmental laws, which can increase costs and even suspend operations.

For example, projects have been subject to regulatory scrutiny around Indigenous land rights in Australia. Litigation and damage to social license can arise from compliance failures. Managing this risk requires proactive legal monitoring and engagement with governments.

Supply Chain Disruption:

Geopolitical tensions, trade restrictions, cyberattacks and logistical bottlenecks are making global supply chains increasingly vulnerable. This means risks in getting critical equipment, spare parts and raw materials for BHP. Production schedules can be delayed and capital costs inflated.

The risk of this has been seen during the COVID-19 pandemic and recent maritime congestion. To mitigate this risk, BHP diversifies its supply base, employs local sourcing strategies and has scenario plans for key materials.

Application of Risk Models:

To manage strategic and operational risks, BHP Group uses structured frameworks, including the 4T’s Model and Risk Heat Mapping.

Risk responses are categorized into four strategies, which is called the 4T’s model.

- Tolerate: Accept risk where the cost of mitigation is higher than the impact.

- Treat: Reduce risk by treating: through controls, monitoring, or process improvements.

- Transfer: Shift risk via insurance or contractual arrangements.

- Terminate: Cease the activity generating the risk.

Investing in lower emission technologies, renewable energy and tailings management systems are the typical methods to treat environmental risks. Joint ventures are often used to transfer regulatory risk, and stakeholder engagement is often used to manage it. On the other hand, BHP can discontinue operations in politically unstable jurisdictions.

Risk Heat Map is a visual tool to prioritize risks by their probability and potential impact. For example, climate related risks score high on both axes and are considered ‘red zone’ priorities that must be managed by the board and mitigated continuously.

Table 1 Risk Heat Map Input for BHP Group

| Risk | Description | Likelihood (1–5) | Impact (1–5) | Risk Rating |

| Climate & Environmental Risk | Physical risks (e.g. floods, droughts) and transition risks from decarbonization | 5 – Almost Certain | 5 – Catastrophic | High (Red zone) |

| Regulatory & Compliance Risk | Changes in mining laws, Indigenous rights, tax or environmental legislation | 4 – Likely | 4 – Major | High (Orange/Red zone) |

| Supply Chain Disruption | Delays or shortages due to geopolitical tension, transport/logistics breakdowns | 3 – Possible | 4 – Major | Medium-High (Orange zone) |

While supply chain risks are lower in impact, they are frequent enough that localized response strategies are necessary.

Within BHP’s Enterprise Risk Management (ERM) system these models are integrated to allow consistent evaluation and reporting across global operations. They increase transparency, and align operational decisions with board governance and investor expectations.

BHP’s Specific Responses to Risks:

A combination of policy frameworks, technological innovation and stakeholder engagement has enabled BHP to develop targeted responses to its key operational and strategic risks.

BHP Group has committed to net zero operational greenhouse gas emissions by 2050 and has interim targets for 2030 to address environmental and climate risk. In addition, the company has invested in renewable energy projects (solar and wind farms at mine sites) and is piloting carbon capture technologies.

Water stewardship strategies and biodiversity action plans seek to avoid environmental degradation and enhance community resilience in affected areas.

BHP Group engages in proactive dialogue with governments, regulators and Indigenous communities to ensure legal compliance and social license to operate for regulatory risk. To ensure adherence to changing laws, the company keeps legal and compliance teams across jurisdictions that monitor legislation and adjust project plans as needed. In the case of heightened scrutiny around Indigenous rights, for instance, BHP has incorporated free, prior, and informed consent (FPIC) principles into its land access protocols.

However, in response to supply chain disruption, BHP has diversified its suppliers and enhanced its procurement systems to enhance visibility and agility. Logistics providers have been strategically partnered with and predictive analytics for inventory and maintenance have been more utilized to reduce lead times and operational downtime.

The company also models disruptions and tests the resilience of critical supply lines through scenario planning exercises.

These multi-pronged responses reveal that BHP is developing a risk culture and commitment to resilience, but effective implementation depends on global cooperation and internal governance consistency.

Role of the Board in Risk Oversight:

Risk governance is conducted by BHP’s Board of Directors through structured oversight and escalation protocols. The company’s risk profile, including financial, operational, environmental and reputational risks, is primarily monitored by the Risk and Audit Committee, made up entirely of independent non-executive directors.

Management provides heat maps, scenario analysis, and quarterly risk reports to the Board on a regular basis to keep them informed about material risks. Climate change or geopolitical instability are elevated to board level for review and mitigation planning as strategic risks. The board also makes sure that risk considerations are part of capital allocation, project approval and long-term planning.

BHP’s Enterprise Risk Management (ERM) framework clearly defines escalation processes. Issues are escalated through line management, executive committees and if necessary to the board when thresholds are breached.

This guarantees timely intervention and accountability. Nevertheless, recent controversies indicate that escalation protocols need to be continuously tested and culturally reinforced to prevent breakdowns in early warning systems.

Evaluation:

BHP’s risk management framework is designed to be comprehensive and integrates global standards with tailored operational practices. Board level oversight aligns with strategic goals while the use of models such as the 4T’s and heat maps provide structure. The company’s climate and supply chain strategies are forward looking and reflect a forward-looking risk culture.

However, past incidents—such as the Samarco disaster and workplace misconduct—highlight persistent gaps between risk policies and field-level execution. These suggest a need for stronger implementation and accountability mechanisms. On paper, BHP’s risk management is robust, but it has to keep evolving to meet the demands of its operations and its stakeholders.

Task 4 – Ethical Leadership

Identifying a Key Ethical Issue:

One of the most significant ethical issues that BHP faces is the way in which it deals with Indigenous land rights in relation to its mining operations on culturally important territories. BHP publicly commits to engaging with Indigenous communities and respecting their rights through Free, Prior and Informed Consent (FPIC), however, BHP’s track record shows inconsistencies between policy and practice.

An example of this is BHP’s participation in the Resolution Copper project in Arizona (a joint venture with Rio Tinto) that is heavily opposed by the San Carlos Apache Tribe. The land at the heart of the project is sacred to the Apache and legal challenges have been made to stop its transfer for mining.

The same is true of the Samarco dam disaster in Brazil, which BHP shares joint responsibility for, and which devastated the environment and the social fabric of Indigenous and riverine communities.

These incidents are indicative of a long-standing ethical dilemma: how to balance economic interests with the rights and dignity of Indigenous peoples. According to them, despite BHP’s formal commitments to ethical conduct, the company has at times prioritized operational objectives over cultural and environmental concerns. This is not a case of better communication or compensation strategies to align corporate behavior with the ethical obligations it claims to uphold, but a deeper structural change.

Why It’s an Ethical Challenge:

BHP’s problems with Indigenous land rights are ethical in nature because the social, cultural, and environmental impacts of its projects can be detrimental to vulnerable communities. Mining on Indigenous land can cause people to be displaced, sacred sites to be destroyed and community structures to be broken down, particularly without meaningful engagement.

This is an ethical violation of the principles of autonomy, equity and justice, which are core to ethical leadership and stakeholder respect.

Such conflicts have substantial reputational consequences. With increased ESG scrutiny, any breech of ethical conduct, particularly Indigenous rights, risks BHP’s social license to operate, ESG ratings, public criticism and legal penalties. For example, the Samarco disaster caused reputational damage, billions in liabilities and long-term stakeholder distrust.

In addition, these actions go against BHP’s own corporate values, including ‘respect, integrity and sustainability.’ Ethical leadership demands not only the compliance with the legal obligations but also the proactive commitment to moral accountability.

The failure to fully respect Indigenous voices undermines the authenticity of BHP’s ESG reporting and social performance claims. So, this is not just a political or operational issue, it’s a core ethical failing if left unresolved through action and reform.

Application of Ethical Models:

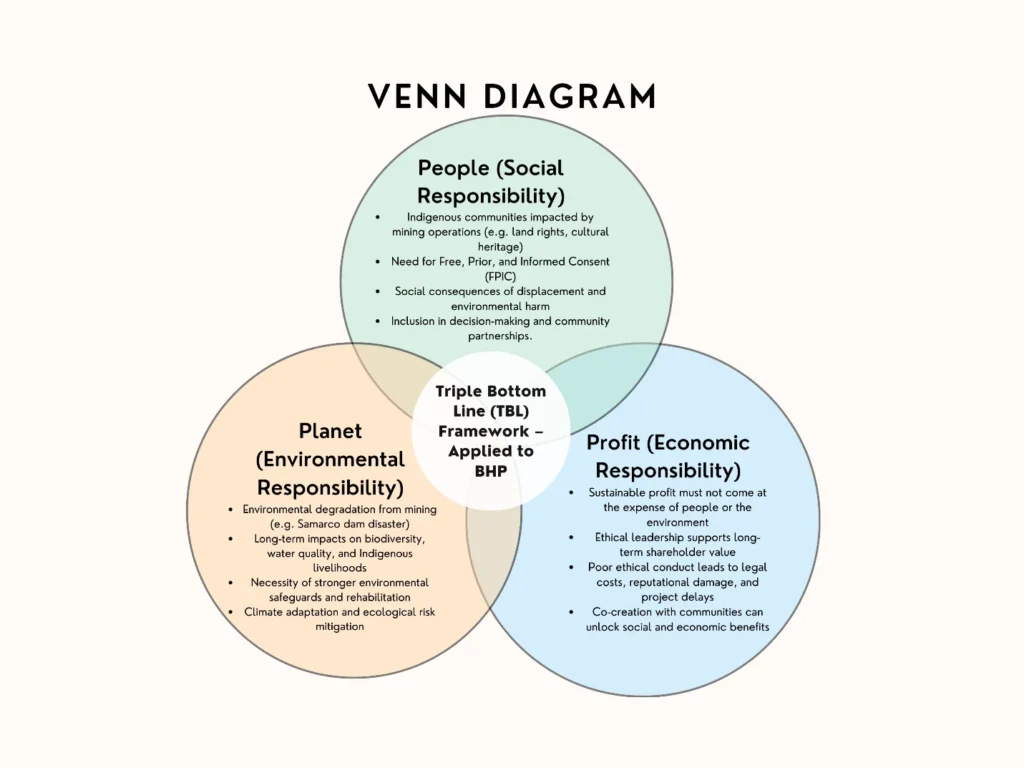

The Triple Bottom Line (TBL) framework is a useful tool for critically examining BHP’s ethical responsibilities along the three key sustainability dimensions of People, Planet and Profit (Elkington, 1997).

People:

BHP’s activities directly impact Indigenous communities whose cultural heritage and wellbeing are often placed at risk by extractive operations. Failures in the social dimension of TBL, as in the case of ethical shortcomings, include lack of full community consent or destruction of sacred sites. These are communities that are often underrepresented in corporate decision making, a source of justice and inclusivity concerns.

Planet:

The Samarco dam disaster revealed BHP’s weakness in environmental dimension. This resulted in thousands of ecosystem destruction and contamination, and long-term environmental degradation which undermines biodiversity and public health. In the case of TBL approach, it requires far stronger environmental due diligence, preventive risk controls and active rehabilitation efforts than what BHP had demonstrated.

Profit:

BHP has been economically successful but sustainable profit cannot be achieved at the expense of people or planet. The TBL model is based on integrated reporting and decision making that includes long term social and environmental value in addition to shareholder returns.

In addition, Carroll’s CSR Pyramid supports this analysis. While BHP has met its economic and legal responsibilities, the ethical and philanthropic—such as improving Indigenous wellbeing and cultural respect—have been less evident in practice. True ethical leadership is beyond compliance; it is about proactively making a positive contribution to the affected communities.

What BHP Is Currently Doing?

BHP’s stakeholder engagement policies and frameworks for Indigenous inclusion have formalized its ethical commitments. BHP (2023) states that the company’s “Our Requirements for Community” standard lays out expectations for engagement, social impact assessments, and grievance mechanisms. Moreover, BHP adopts the International Council on Mining and Metals (ICMM) principles and references Free, Prior and Informed Consent (FPIC) in its policies, which commits BHP to respect Indigenous peoples’ rights.

Moreover, BHP’s Australian Reconciliation Action Plan includes cultural training, employment opportunities for Aboriginals and procurement projects with Aboriginal businesses. In addition to community partnership programs and long-term social investment strategies like the BHP Foundation, which funds Indigenous governance projects around the world, the company’s engagement reporting includes community partnership programs.

However, these initiatives were not consistently applied in practice by BHP. The Resolution Copper dispute and legacy issues in Brazil are cases where consultation efforts have on occasion been more procedural than participatory.

In addition, independent audits of the real impact of stakeholder engagement are constrained, as the company communicates ethical aspirations in sustainability reports. There is ethical intent, but it is not deep in some high-risk jurisdictions.

Leadership Recommendations:

BHP Group has to embed stakeholder rights and ethical values in the highest levels of decision making to reinforce ethical leadership. The first is for the board to adopt a dedicated Indigenous Advisory Committee that reports directly to the board on cultural impacts and stakeholder concerns. It would institutionalize Indigenous voices in governance and guarantee they will inform core business strategy, not just community relations.

Second, BHP should require external, third-party audits of stakeholder engagement in projects that could have cultural or ecological harm. Such reviews, published alongside financial reports, would be a very serious signal of commitment to ethical accountability if they were transparent.

Third, ethical leadership needs to be owned by the executive level. As part of CEO and senior leaders’ compensation packages, they should be held to specific ESG linked performance targets including Indigenous engagement outcomes. Ethical performance is aligned with corporate incentives and moral accountability is reinforced from the top down.

Last, BHP should abandon compliance-based approaches to invest in co creation of projects with Indigenous communities. This participatory model fosters long-term trust, social equity, and mutual benefit.

These recommendations are in line with best practices of ethical leadership, which include transparency, inclusivity, and integrity. These are not optional values for a global mining leader; they are strategic imperatives.

Evaluation of Ethical Response: Executive Leadership and Governance of BHP Group

BHP’s ethical response to Indigenous rights issues has progressed in terms of policy development but is inconsistent in execution. Frameworks such as FPIC and ICMM principles are adopted as a sign of awareness of global expectations, while real world controversies reveal the gaps between policy and practice.

Proposed ethical leadership reforms such as board level Indigenous representation and independent engagement audits would improve governance and credibility. If implemented, these changes would enable BHP to move from reacting to acting in regards to managing the ethical risks, and therefore increase its social license to operate.

Perhaps most critically, embedding ESG performance in executive accountability would transform ethical leadership from a reputational safeguard to a strategic driver. Adopting these reforms could enhance stakeholder trust, increase ESG scores, and decrease social conflict litigation and project delays.

In summary, BHP’s ethical response is promising, but to fulfil the requirements of contemporary leadership, intent must be coupled with systems that deliver measurable and community endorsed outcomes.