Developing Leadership and Management Skills at BAT.

In this report “Developing Leadership and Management Skills at BAT” we discuss, In 2017, British American Tobacco (BAT), which is among the largest tobacco companies in the world, extended its operations in the global markets by acquiring Reynolds American, which is the second largest tobacco company in the United States.

The acquisition, valued at approximately $49 billion, established the largest publicly traded tobacco company in the world and advanced the presence of BAT in the profitable U.S. market. It also enabled BAT to acquire the full ownership of Reynolds’ next-generation products portfolio, which makes the company more competitive in a highly regulated and fast-paced industry.

Mergers and acquisitions of this magnitude require strong leadership. In addition to financial and strategic challenges, leadership needs to address cultural integration, employee uncertainty, expectations from stakeholders, and resistance to change. This report is concerned with the analysis of leadership in the BAT-Reynolds merger; leadership theories are used to investigate the strategies used to involve stakeholders, remove resistance, and finally, analyse how the performance of leadership affected the outcomes of the business.

Leadership Theories

Leadership in organisations has been researched through various theories that attempt to explain how leaders guide people through uncertainty and change.

One of the most widely discussed is transformational leadership, which emphasizes inspiring followers to be committed to a shared vision and go beyond routine tasks. It is commonly presented as a people-centred style that encourages innovation, motivation and long-term commitment. As shown in Figure 1: Transformational Leadership Model, leaders “model the way,” “inspire a shared vision,” and “enable others to act”.

This approach has been commended for fostering trust and creativity; however, it also presupposes that inspiration can itself overcome resistance. Some researchers suggest that it is a risk for becoming personality-driven and is ideal only when leaders are charismatic and credible. In a setting where structure and quick decisions are required, this can be perceived as vague or overly idealistic.

In contrast, transactional leadership emphasises structure, rules and rewards. It is founded on the view that people do their best when tasks are clear, and tied to incentives or penalties. As shown in Figure 2: Transactional Leadership Model, this style is based on external motivation, corporate structure, and short-term results. It can be effective in order to maintain order, ensure compliance and deliver measurable results in the short run.

However, critics note that it can make the company less flexible and less conducive to innovation, because employees may do only the minimum necessary to earn the rewards. By paying much attention to performance monitoring, this risks ignoring emotional reactions to change and deeper sources of commitment. In an environment where adaptability and innovation are paramount, this approach might obtain compliance, but not enthusiasm for long-term transformation.

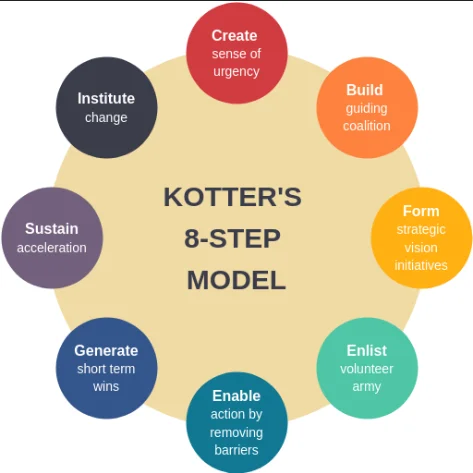

Another perspective is the 8-step Change Model introduced by Kotter 8 Step Change Model does not refer to leadership style but rather a roadmap on how to guide change. He claimed that leaders should create urgency, develop a coalition that works, have a clear vision, and sustain momentum. The first step is the urgency and the second step is to make change become a part of the culture. Its clarity is appreciated by its supporters, as step-by-step instructions can minimize the uncertainty.

Opponents, however, observe it to be too linear, presupposing that change flows well in one stage to the other. As a matter of fact, stages are overlapping, resistance does not disappear, and external shocks interfere with the plans. Some doubt whether it is top-down oriented in the current collaborative organisations.

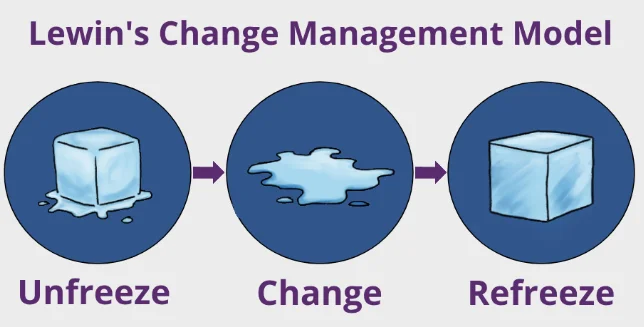

Another influential framework is Lewin’s Change Management Model which was one of the first efforts to explain how leaders direct their people through transition. Figure 4: Lewin’s Change Model, which has three steps: unfreezing, change, and refreezing into new stable patterns. It is an easy method that is simple to practice and commonly applied particularly to emphasize the psychological procedure of letting go of old habits and proceeding to the new ones.

Nevertheless, it has been criticized as being too dynamic in a constantly changing world. Moreover, the concept of refreezing appears to be too far-fetched when the ever-present regulatory, technological and cultural pressures on organizations to change are taken into consideration.

Although the staged logic remains a valuable guide, it is arguably inadequate in providing enough room to the iterative and continuous nature of change in the modern setting.

There is no single leadership theory that provides a full response to management of change. Transformational leadership is vision-oriented, but may lack organization, whereas transactional leadership is compliance-related, yet may suppress creativity.

The model by Kotter is structured and fails to recognize the non-linear, chaotic attribute of change. Lewin places strong emphasis on the human factor, but at times over-simplifies. Scholars indicate that leaders need to combine styles and balance between vision and structure.

BAT Leaders can deal with both rational and emotional aspects by incorporating transformational inspiration, transactional clarity, and model approaches such as Kotter and Lewin.

BAT Reynolds Acquisition

The acquisition of Reynolds American by British American Tobacco (BAT) in July 2017, was one of the largest tobacco deals in history, at a value of around $49 – $49.4 billion for the 57.8% of Reynolds that BAT did not already own. Each Reynolds shareholder was offered $29.44 in cash and 0.5260 BAT shares, a design that enabled BAT to increase its global scale while fully entering the American market.

BAT located the deal as a strategic move to form the world’s largest listed tobacco and next-generation product (NGP) company with exposure in both developed and emerging markets, and at least $400 million in cost synergies per year within three years.

The acquisition, however, came with major challenges. Just days after completion, the U.S. Food and Drug Administration (FDA) initiated a new reducing nicotine framework, changing the regulatory risk dramatically.

Subsequent scrutiny of menthol and flavoured products further undermined valuations in the sector and increased uncertainty. Integration also required aligning the culture and governance structures of a UK-listed multinational with a U.S.-based company, while accelerating investment in brands like Vuse and glo in order to play in the innovation race.

Leadership, therefore, required a need to reassure investors, manage regulatory pressures, deliver on promised synergies, and keep employees and stakeholders engaged.

Leadership in Change

Leadership influenced the way BAT handled the Reynolds integration, but the manner in which direction was established and actions taken reveal weaknesses and strengths. The vision was clearly framed by the CEO as the deal represented an opportunity to “accelerate our ambition to transform tobacco”, linking scale in the U.S. with a faster advance into next-generation products.

This is in line with the transformational leadership concept of conveying an inspiring vision that motivates followers. Yet vision on its own is easily turned into rhetoric without practical systems to support it. To counter this, management pegged the acquisition to certain targets, such as $400m in synergies within three years and EPS accretion in year one, reflecting a transactional approach in the deal, highlighting measurable results.

The balance between inspiring rhetoric and hard financial promises ensures that leaders recognised the importance of finding the right mix between tone and discipline, although some commentators suggest that such a heavy emphasis on investor messages can narrow leadership towards financial control as opposed to cultural integration.

The integration was designed through an aligned operating model that integrated Reynolds into the US division of BAT and streamlined processes in procurement, development, and corporate functions. This shows a clear effort to instil systematic structures along the 8-step model of Kotter where leaders set steps, establish a sense of urgency and integrate change into systems.

The leadership also took the next step of altering the governance structure: by January 2019, all regions, such as the U.S., were reporting straight to the CEO, with the COO removed. This new reporting model is consistent with the point that during high-change periods in the organization, the leaders are supposed to eliminate barriers and speed up the decision-making process.

Skepticists, however, can contend that excessive centralization can result in drowning out of regional voices, a threat in the cross-border merger where cultural understanding matters.

Communication with stakeholders was a visible priority. On the 25th July 2017, BAT publicly referred to the deal as “transformational” and emphasised that integration had already commenced and reiterated the plan for synergy. Shareholders were involved via a special meeting and detailed filings, and leaders were soon responding to the FDA’s new nicotine framework announced just days after closing.

This exhibits an attempt towards Kotter’s principle of not losing urgency and responding to external shocks. However, much of the messaging was aimed at investors and regulators and not employees, so there remained open questions about whether internal stakeholders were equally engaged. Transformational leadership emphasizes that followers require emotional connection and empowerment, and not financial or regulatory assurances.

Implementation was not entirely successful. The milestones in integration were realized in phases to harness synergies progressively with transaction discipline. In 2018-2019, the company reoriented its message to a more general vision of “transforming tobacco/A Better Tomorrow”, maintaining the rhetoric of transformation.

The appointment of Jack Bowles as CEO in 2019 provided continuity in new categories and the use of a leadership transition to redefine strategy. However, there is a question of cultural fit throughout the UK-U.S. merger. The model by Lewin indicates that leadership is more centered on unfreezing rather than entrenching fundamental change.

Resistance and Stakeholders

Many centres of resistance emerged, and leaders had to manage all of them. The post-deal restructured process within the company involved the reduction of 2,300 jobs in 2019, which, of course, created concern, resistance, and the possibility of losing quality people if not managed carefully. Previous studies have found that downsizing is marked by the “survivor syndrome,” in which the remaining staff members become insecure and disengaged if they are not supported by communication and participation.

Just days after the deal was struck, the FDA, with its nicotine plan, came on the scene, altering the rules for cigarettes and promoting alternatives. This is in alignment with Lewin’s model: when the external environment causes an “unfreezing,” leaders should quickly respond and shepherd people through the change.

The pressure on menthol and youth vaping by public-health groups is consistent with the perspective of the social actor theory that social actors may be as powerful as shareholders. Investors also acted as another source of resistance, reacting to regulatory headlines with sudden share price drops. The Kotter model focuses on the need to achieve quick victories to retain investor confidence, but in this case, business executives were more likely to count on targets to create synergy by themselves, which could seem shortsighted.

What did leadership do? They possessed a synergy ambition (US$400m in three years) and instilled a sense of discipline into procurement and product development. Second, they also canceled out the position of a COO, thus making regions report to the CEO, which aligns with transactional control but excludes local feedback, which is critical in the stakeholder theory.

Nevertheless, with the FDA licensing tobacco-flavored Vuse Alto, regulators showed their readiness to modify the portfolio and collaborated with the company to make sure the product complies. Kotter would explain that this is a halfway job because trust needs two-way communication, redeployment opportunities, and observable indications that the culture was being rejuvenated.

Lastly, there was scenario planning. The suggested menthol ban stayed years and was not lifted until January 2025 That brings to the fore, that leadership in areas where stakeholder settings are complex are not about big, one-time solutions but continuous balancing of control, vision, and adaptation.

Business Performance Impact

The choices taken after the Reynolds deal affected performance, both negatively and positively. In the short run, the management achieved its promises; the annualised cost synergies of US$400m were realised a year prior to what was projected in 2019, which is a sign of high execution discipline. That aligns with a transactional model where noticeable targets and a focus on tight controls are the key factors for achieving quick wins.

Earnings per share increased, margins widened, and debt leverage decreased from 4.0x to 3.5x – demonstrating how management applied financial discipline to stabilise the enlarged group. This is exactly where Kotter’s early wins to build credibility come in.

But the longer term revealed the limits of relying on short-term gains. By 2023, BAT wrote down about £25bn on its US cigarette brands, which was evidence of the value of the traditional portfolio declining in the face of regulatory and consumer pressure.

Lewin’s model is a reminder that failure to adapt fully in this “refreeze” stage results in problems of change stalling, and in this case, the early focus of leadership on efficiency was not sufficient to provide for structural decline.

On innovation, the shift towards smokeless products was more transformational. The A Better Tomorrow vision was also directly linked to FDA approvals, such as the approval of Vuse Alto in 2024. By mid-2025, Smokeless had contributed nearly 18.2% of the revenue and helped the US market begin to grow once again. This reflects a combination of transformational framing and adaptive leadership: framing a long-term narrative and adapting the portfolio to the cues of the regulators.

Nevertheless, the rise of the price of legal vapes, as well as the ongoing expansion of the illegal ones is a lesson that adaptation is always weak and incomplete. Even though the company has managed to stay competitive through sticking to its vision, the outcomes suggest that the efforts to balance short-term disciplines with the necessity to renew the company have been a major risk factor.

Conclusion and Recommendations: Developing Leadership and Management Skills

The BAT-Reynolds case gives an insight into the level of influence of headship in causing radical change. Nothing was wrong with the leaders having a clear vision in place and reaching initial goals. They provided the savings of 400 million earlier than it was anticipated, paid off the debt, and soothed the investors.

They combined hard financial discipline with uplifting language on change in many aspects. But weaknesses were revealed in the deal. The emphasis on financial performance contributed to the increased difficulty of uniting the two cultures of companies and creating lesser confidence in employees. Top of this, new nicotine regulations and menthol sales threats demonstrated the ability of the most well-thought plans to be shaken by the new regulatory alterations.

Even as the switch to smokeless products accelerated and increased the revenue base, the 25bn write-down in the U.S. indicated the risk of new dependence on legacy assets without a more widespread renewal.

In the context of further mergers or changes, leaders have to balance between the short-term discipline and flexibility in the long-term perspective. First, there must be visible investment in people, redeployment, reskilling, and two-way communication to maintain trust that is accompanied by financial goals.

Second, the governance systems should be capable of being both nimble and, at the same time, provide localized feedback, without over-centralization. Third, scenario planning must be proactive, but not reactive, particularly in regulated sectors. Lastly, vision should be connected with tangible behaviours: culture change has to be made as measurable as cost synergies.