Customer Experience Strategy of Nike

In India, the fast-growing Gen Z driven market, Nike is expanding its presence. This report critically evaluates Nike’s customer experience (CX) strategy in India, more specifically on customer centricity, journey mapping, CX performance metrics, and launching into the Omni channel to promote long term brand loyalty and keep headlines positive.

Read more: Customer Experience Strategy of Heineken

Task 1 – Role of Customer Experience & Centricity in Nike’s Success:

Customer Experience (CX) is defined as all interactions between a customer and a brand during all points of a journey. It covers rational and emotional responses in pre-purchase, purchase and post purchase stages.

CX consists of three elements: emotional impact, functional usability, and social identity. As product parity is high in the fashion and sportswear industry, consistently providing a personalized, omnichannel CX helps foster loyalty.

Impact of CX on Business Performance:

Multiple dimensions of business performance are directly supported by effective Customer Experience (CX). This first increases customer satisfaction, which then creates loyalty and repeat purchases.

High satisfaction of Nike customers is achieved via seamless app interfaces, instant support and engaging in store experiences. In particular, they are very important in India as digital savvy Gen Z rules the roost in urban markets.

Secondly, CX improves customer retention. A study states that experience is responsible for 73% of purchase decisions. Early product drops and personalized fitness content from Nike helps to reduce churn and increase Customer Lifetime Value (CLV).

CX also impacts brand equity. According to a model, emotionally evoking brand experiences produce quality perceptions and strong brand associations.

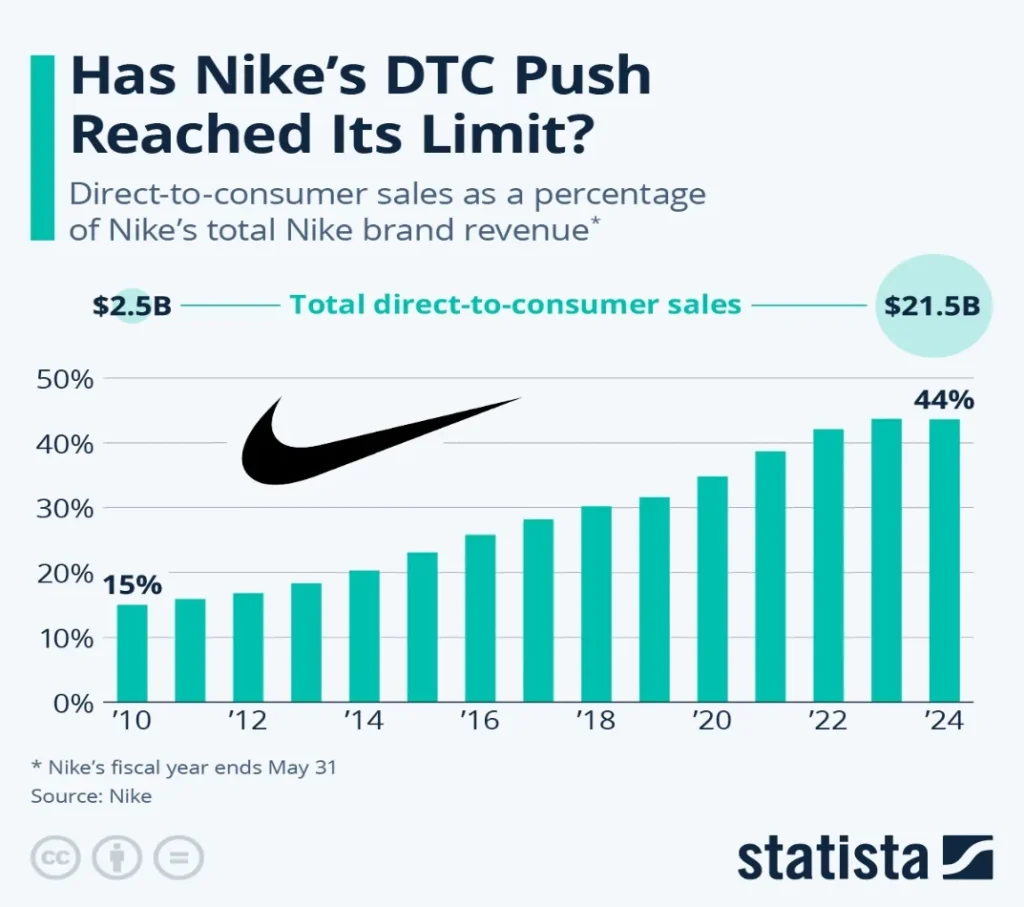

DTC strategy has been a game changer when it comes to Nike’s finances. DTC revenue accounted for 40% of total revenue in FY2023 ($21.3 billion). With this model, Nike can manage the customer journey, enhance margins and CX using customer data. DTC has great potential for growth with India’s e-commerce expected to reach $150 billion by 2026.

Customer-Centricity:

Strategic orientation of aligning products, services, and processes around the changing needs and desires of the customer is called customer centricity. To do this, companies are forced to look at business from the customer journey perspective, where they have to personalize, empathize and respond.

This strategy is localized in India. Geo targeted content, regional product availability and language support through the Nike App makes sure that the product is relevant to India’s fragmented consumer base. Additionally, Nike’s digital fitness platforms NTC and NRC combine health, lifestyle, and brand engagement to create a deep loyalty among Gen Z consumers who seek holistic wellness experiences.

Nike’s Competitive Advantage via CX in India:

Nike’s CX strategy in India is consistent with the global consistency and local relevance, which secures its competitive advantage.

To add emotional and cultural connect, the brand has connected with Bollywood and regional sports personalities – cricketers and fitness influencers. Indian festivals and cricket seasons are also used for campaigns.

In its strategy, the company provides a balanced mix and a combination of flagship stores in urban centres, mobile app experiences, and strategic e-commerce tie ups with large platforms such as Flipkart to cover maximum terrain and maintain consistent service quality.

This seamless integration benefits Indian Gen Z for they are known to switch between digital and physical channel with ease.

Moreover, Nike leverages sustainability as a differentiator. Indian youth who are environmentally conscious resonate with initiatives like “Move to Zero”. Gen Z’s ethical preferences align with in-store recycling bins and product lines with sustainable materials (such as Space Hippie sneakers) that boost emotional brand value.

Three Critical Success Factors in Nike’s CX Strategy:

Corporate Culture:

Nike’s internal culture is the fuel for its CX leadership. Based on innovation, diversity and customer obsession, Nike enables employees to think from the customer’s perspective. As evidenced by ‘Consumer Direct Acceleration’ strategy where cross functional teams work together towards delivering superior CX.

Strategy & Process:

Agile supply chains and real-time data analytics underpin Nike’s DTC first approach which enables rapid personalization and demand forecasting. In India, functional and emotional dimensions of CX are enhanced by fast delivery and localized product curation through local warehousing and dynamic inventory tools.

Metrics & Measurement:

The effectiveness of CX is monitored by Nike through Net Promoter Score (NPS) and app-based engagement metrics. These tools are used in India to track sentiment across different customer segments.

Task 2 – Gen Z Persona & Customer Journey Map:

Nike in India: Market Context:

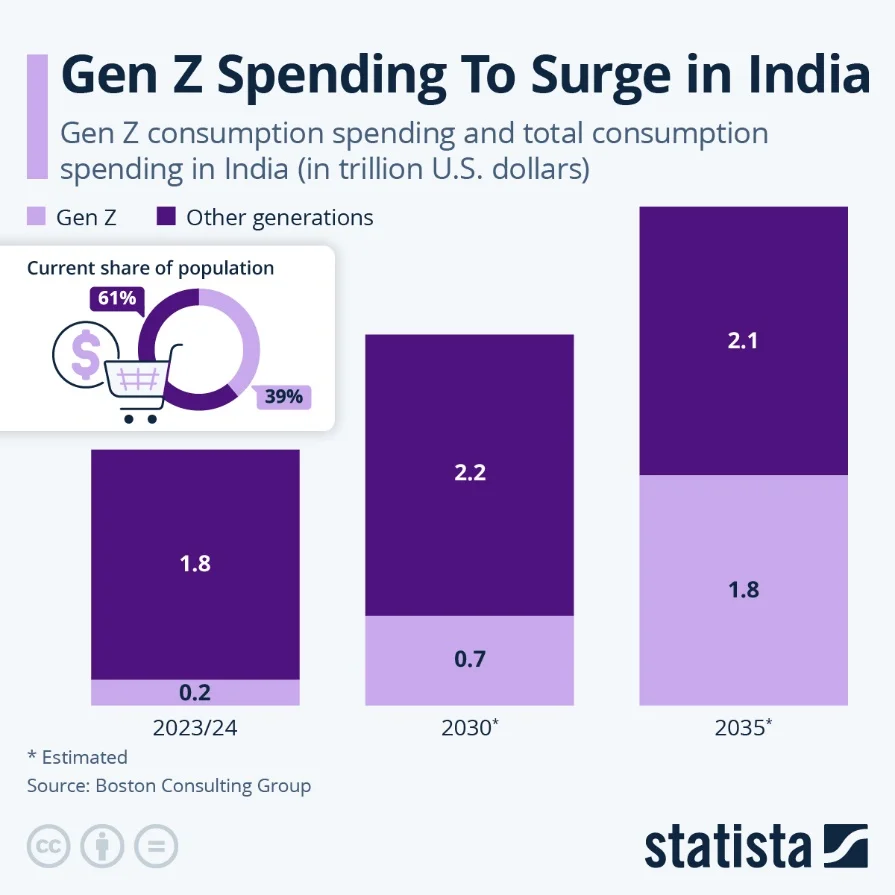

Sportswear is one of the most promising growth markets in India, as the country’s rising health awareness, rising disposable income, and growing affinity for international fashion brands are expected to fuel the growth of sportswear.

India has one of the world’s largest Gen Z cohorts with over 65% of the population under the age of 35. This segment is digitally native, socially connected and values authenticity, experience and innovation.

Nike’s re-entry into the Indian market with RJ Corp is a direct to consumer (DTC) retail, digital engagement, and premium urban play.

As the fitness industry in India is expected to grow at a CAGR of 9.6 percent by 2027, and the number of mobile internet users in India is more than 700 million, Nike is well placed to meet the mobile first, style conscious and socially aware Gen Z audience through omnichannel experiences and personalized digital touchpoints.

Gen Z Consumer Persona for Nike:

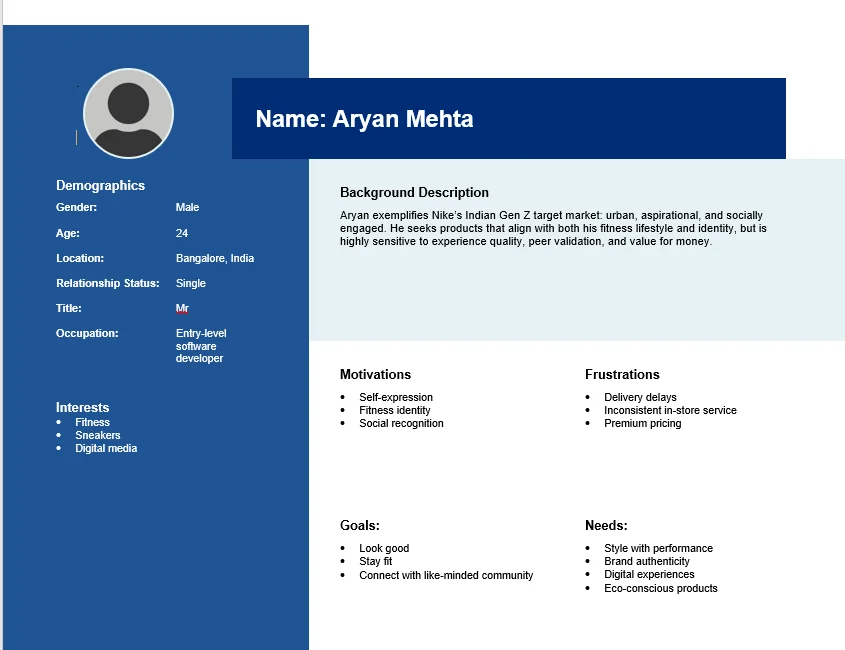

It is a journey through Aryan’s emotional stage from discovery to brand loyalty, and it shows how the needs evolve. With his digital preferences, expectations for fast service and immersive brand engagement, his needs are for streamlined mobile first CX.

Customer Journey Map:

| Stage | Needs | Activities | Feelings | Opportunities for CX Improvement |

| Awareness | Trendy, reliable brand | Follows Nike on Instagram, sees ads on YouTube | Excited, curious | Leverage regional influencers, use local languages |

| Consideration | Right product fit | Browses Nike App, compares reviews on Myntra & Reddit | Confident, cautious | Integrate AI-based size guides & personalized feeds |

| Purchase | Smooth, secure checkout | Shops via Nike App; UPI payment | Satisfied, impatient | One-click checkout; localized payment options |

| Post-Purchase | Delivery, after-sales support | Tracks order, shares product photos online | Anxious, proud | WhatsApp chatbot support; shipping status alerts |

| Loyalty | Belonging, exclusivity | Uses Nike Training Club, joins sneaker drops | Motivated, loyal | Gamified fitness goals, exclusive rewards in-app |

Analysis & Strategic Recommendations:

Aryan’s customer journey is one of the many patterns that Gen Z consumers in India exhibit: digitally driven, emotionally engaged, and community seeking.

In spite of strong Nike’s app ecosystem, Aryan has pain points such as delayed deliveries and lack of consistency in every other experience that happens in the stores.

A study states that after one bad experience, 32 % of consumers stop interacting with a brand, and they emphasize the importance of having consistent service.

To enhance CX for Aryan and similar consumers, Nike should:

- Improve Last-Mile Delivery:

- Partner with hyperlocal logistics platforms (e.g., Dunzo, Delhivery)

- Implement real-time tracking via WhatsApp or SMS alerts

- Personalize App Experiences:

- Use AI to deliver custom feeds, size suggestions, and workout plans

- Integrate regional languages and cultural content to enhance relevance

- Build Community-Driven Engagement:

- Launch localized Nike Run Club challenges in Indian cities

- Introduce a tiered loyalty program (e.g., points for steps, workouts, purchases) to gamify health and lifestyle

- Localize Promotions:

- Offer festival-based drops (e.g., Diwali sneaker packs)

- Run city-specific micro-campaigns with local influencers or athletes

Task 3 – CX Metrics Evaluation:

Measures and quick calculations of the effectiveness and quality of interactions between a brand and their customers within several touchpoints are known as Customer Experience (CX) metrics.

Lemon and Verhoef 2016 describe the threefold purpose of evaluation of current state of customer satisfaction, identification of improvement areas and alignment of CX efforts with broader strategic objectives.

Industry Overview of Metrics:

Different industries use a range of CX metrics to measure different aspects of customer perception. They include Net Promoter Score (NPS) which measures willingness to recommend, Customer Satisfaction (CSAT), Customer Churn Rate (CRR) which tracks attrition, Customer Effort Score (CES) which measures how easy it is for customers to interact with a brand and Customer Lifetime Value (CLV) which estimates the long-term financial contribution of a customer. Metrics that are most relevant depend on business objectives, customer behaviour and market dynamics.

Selected Metrics for Nike India:

Customer Lifetime Value (CLV):

Net profit attributed to the entire future relationship with a customer is called CLV. Factors like purchase frequency, average order value and customer lifespan are considered. Understanding CLV is critical for a brand like Nike, which is DTC focused. It aids in:

- Resource Allocation: Determine how much to spend on acquiring and keeping customers.

- Personalization: Tailoring marketing efforts based on the predicted value of customer segments.

For India’s growing Gen Z demographic, mobile first approach and a penchant for digital interaction, the use of Nike App to provide personalized experiences can be a game changer for CLV.

Exclusive product launches, fitness tracking and community forums not only increase engagement but also promote repeat purchases, thereby extending the customer lifespan.

Customer Effort Score (CES):

CES stands for Customer Effort Score, it measures how easy it is for customers to interact with a brand, this includes activities like walking through the website, making a purchase or resolving an issue. Higher customer loyalty is associated with a lower effort score. It is important for Nike India to focus on CES because:

- Intuitive Navigation and Quick Load Times: The Nike App is designed to be intuitive and have quick load times, which appeals to the tech savvy Indian youth.

- Provide in App Chat Support: This can help reduce the number of calls to the support desk and improve the overall customer experience.

Justification & Challenges:

These two metrics are especially applicable for Nike India’s context. By providing strategic insight into the long-term revenue potential of Gen Z consumers, CLV enables Nike to focus on high value segments with precision.

The real time interaction quality that can be captured at CES is ideal for a market where mobile UX is a major factor in brand loyalty.

However, challenges remain. To accurately measure CLV across online and offline platforms, it is challenging to have a fragmented retail ecosystem. Similarly, CES may not be interpreted consistently across Indian regions and devices.

To solve these problems, Nike needs to create a unified CX dashboard that combines customer data from apps, stores, and third-party platforms.

At the same time, regular in-app surveys or WhatsApp based feedback loops can help you get dynamic customer insights, which in turn can help you get better measurement accuracy and CX responsiveness.

Task 4 – Omni-Channel Strategy Evaluation:

Nike’s Market Position:

As a leading sportswear and lifestyle brand, Nike is known around the world as one of the most valuable apparel brands. The brand is designed to occupy an aspirational space within India’s young urban youth, predominantly Gen Z’s, consumers who are looking for performance driven but style focused products.

Partnership with RJ Corp’s Sports Station has enabled Nike to reappear in India with its physical presence and it has flagship stores in Bangalore and Delhi among other cities. At the same time, it effectively matched Nike’s robust online and mobile ecosystem (powered by Nike App and Nike.com) in a market forecasted to become over $40B online fashion retail by 2027.

Omni-channel Strategy Description:

An advanced omni-channel framework is created by Nike that blends digital innovation with physical retail. Third party e-commerce channels such as Flipkart and Myntra expand reach to urban India, complementing its core platforms of Nike App, SNKRS and Nike Training Club (NTC).

Features like personalized in app offers, real time product availability and augmented reality (AR) try on experiences powered by the tools such as Nike Fit are tightly integrated through these channels.

Nike uses app enabled product scanning, QR codes to digital catalogs and mobile based checkout in store. The ‘phygital’ integration of this ensures that customer journeys are seamless, allowing the users to seamlessly switch between browsing online to buying in store and the other way around without any friction.

Seamless Experience Evaluation:

In India, Nike’s Omni channel is the combination of personalization, accessibility and speed. From real time inventory management and cloud-based analytics to synchronizing stock availability across channels, this brand takes full account of every point of this ever-challenging paradigm.

Nike is able to engage Indian consumers in culturally relevant ways through operational practices such as localized push notifications based on geography, browsing behaviour, and event triggers.

For instance, the brand has leveraged city specific sneaker drops and event invites through the app to create exclusivity and emotional engagement with Gen Z users. Moreover, 24/7 support is provided by customer service chatbots and WhatsApp integration for post purchase interactions.

Features such as click and collect, easy return, mobile first UX design all help to support process efficiency and help Indian consumers have the same seamless experience on their mobile devices as in flagship stores. This is in line with the research that suggests that 73% of Indian online shoppers prefer the brands which provide seamless omni-channel experience.

Challenges & Solutions:

Although, Nike has these strengths, it is hindered by structural inefficiencies in its omni channel delivery in India. Outside metro areas, rural–urban digital infrastructure gaps, fragmented last mile logistics and regional differences in delivery speed create disparities in delivering consistency of customer experience.

To overcome these this, Nike has increasingly forged new relationships with regional logistics providers to keep up with last mile delivery and initiated opening up local warehousing to cut down delivery delays.

This also helps in better distribution of inventory across online and offline outlets using AI driven demand forecasting. Seeing that the alignment of digital CX expectations with supply chain agility can enable Nike’s Omni channel strategy to scale in India’s diverse and fast-growing retail landscape.

Conclusion:

The customer experience strategy of Nike in India reveals how to come up with global innovation, local adaptation, and digital integration that led to brand success. Nike provides an example of the successful combining of global innovation with local relevance when it comes to their customer experience strategy in India.

Gen Z consumers expect numerous things best served through direct consumer relations with the product, digital personalization, mobile first approach, and Nike has done all those in line with the emerging consumer segments preferences. Both strategic forecasting and operational efficiency can be beneficial using Customer Lifetime Value and Customer Effort Score.

Another strong aspect that this company offers is the omnichannel strategy of blending technology, retail, and logistics. But though challenges with infrastructure remain, the way ahead towards scalable excellence in CX is looking for regional partnerships and using AI in forecasting.