Data Driven Decisions for S & S Austen

S&S Austen is a retail bank that operates its branches in various regions like Cardiff, Oxford, and Edinburgh. Moreover, the report will present suggestions for a better city for future branch expansion and offer insights for the Marketing Manager to directly optimize the marketing strategies.

The dramatic growth post expansion indicates that the inherent technology like self-service machines and enhanced personalized services like additional adviser desks help to drive customer engagement and deposit terms in the future.

Read more: Data Driven Decisions for Greeting Health Limited

Purpose of Report:

The purpose of this report is to provide a detailed analysis of S&S Austen Bank’s retail banking operators around the high-street branches located in Oxford, Edinburgh, and Cardiff. The entire analysis will assess the overall progress of the brand in terms of the deposit volume, proceed with the value, and identify the best-performing saving services with the evaluation of the impact of current renovations.

The ruleset forms the analyses that will guide S&S Austen Bank’s management to develop informed decisions and proceed with the potential future investments in technology and the improvement of customer experience.

Report Structure:

First of all, the introduction sections evaluate the overview of the project’s objectives and goals, The section on the react plan outlines the approach to deliver the research, including the methods used for analysis and the execution of data analytics.

The key performance indicators are a section that can be used to measure the bank’s performance, align the expansion, and proceed with the data analytics with the contribution to the improvement in the future.

Project Plan for Delivering the Results:

The project will be delivered through a series of phases, and each phase targets the specific aspects of bank operations. The phases are designed to collect and analyze the data with the offering of actionable insights for the Bank.

The Collection of Data:

The 1st step in the project is to collect the related data from the three branches, namely, Oxford, Cardiff, and Edinburgh. The information on the total despot’s value as well as volume across the different dealing products are analyzed to collect data like current amounts, money-saving accounts, bonds, ISA, etc.

The information related to the age, level of income, and financial behavior of the customers offers the forewent interactions. The data on several customers visiting each brand before and then removing the entire practice in 2023. The data will obtain the entire practice, ensure the roles, and update the clear strengths.

Data Preparation and Cleaning:

When the data is collected, it will be cleared. The steps compel us to examine the accuracy and the consistency of data. The task involves removing duplicate records, handling the missing data by the records, and leading the overall satisfaction.

The data can be prepared by standardizing the formats, converting the changes, and depositing the values to similar formats. Aggregating data where necessary, like consolidating monthly data into the quarter summaries, can identify the related trends.

Data Analysis:

The core of the project lies in the analysis of data to offer meaningful insights, we will evaluate the title deposit volume and give a higher value for each acquired product in the overall deposits. The situations will help to identify the city that presents the best opportunity for brand expansion. Cardiff shows the higher deposit volume and value for ISAs.

The analysis will also focus on the relative performance of various services across the branches. Money-saving accounts are underperforming across the branches, so the bank could consider revising the terms, building interest rates, and promoting higher-performance services.

Data Vocalization:

To make the proper analysis more accessible to management, we will create a visualization that highlights the findings. Bar and Line graphs, heatmaps, and trend charts are illustrated to analyze the project of the Bank. The trend charts illustrate the impact of renovations on the deposit value and the entire volume over time.

Repairing:

Once the S&S Austen Bank’s comprehensive reports are written, then the detailed findings will be effective in evaluating the changes. The executive summary of top management, detailed analysis despite the value, and breakdown of the performance of each saving product, with the assessment of Oxford Bvrac renovations are important elements to report the data at the final stage.

Management Presentation:

The key insights from the data analysis, recommendations for the branch expansion based on the deposit’s performance, and suggesting the marketing campaigns targeting the higher performance with the key services are the important areas that motivate the project to reach the management level, Evaluation of Oxford Renovations with the strong application to other branches are the innovative techniques as presenting the project to management.

Data Analytics Execution:

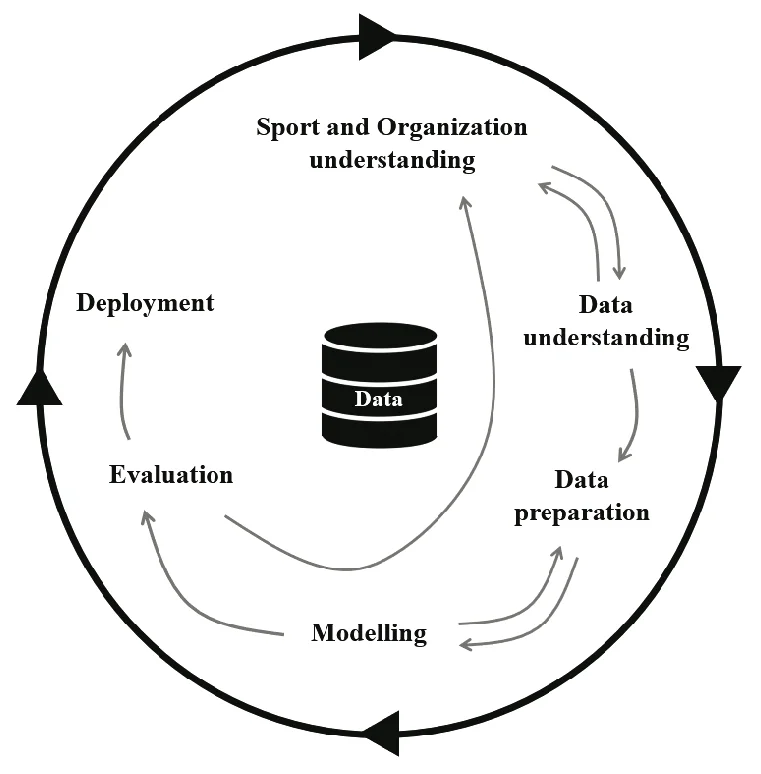

The CRISP-DM (Cross-Industry Standards Process for Data Mining)” is a framework that is widely used to evaluate large datasets and generate actionable business insights. Business understanding, data understanding, data predation, modeling, evaluation, and deployment are the broad concepts that evaluate the major changes to align the specific roles in the future.

Key Performance Indicators:

The Deposit volume and deposit value per Customer are the key performance indicators that allow the business or project to collect and analyze the relevant data. The percentage of customers using the specific saving product helps to offer insights with the having products as leading the operational terms.

The key performance enunciators or KPIs are the mergeable values that helps the business to track and evaluate the achievements of goals. The KPIS eraser the total number of deposits as made by accustomed refers the brands using the advanced successful terms.

- The Higher Deposit Volume usually indicate the greater engagement and the satisfaction with banking services. Tracking the terms helps the business to save habits and build trust in the institutions. If this value raises then it may suggest that the customers feel very confident in the desiring of larger amounts.

- The Percentage of Customers is another key performance indicate that exam how the customers are using the particular savings amount for the purpose of investment as compare to the total number of roles. It helps the business to explore the areas and proceed the im0rovments to manage the change.

- The Number of Customers Using Self-Service Machines is an indicator that tracks how many people use the services or machines in the branches as compare to going the teller. It helps to make the plan of future operations and increase overall efficiency.

Data Quality Issues and Key Remedies:

The process of data collection and integration for this project involves different challenges that can hinder the quality and data accuracy.

Missing or incomplete records are the most common proof in data sets. The incomplete data can occur due to technical errors and build interactions of the customers Missive values can affect the misleading of conclusions and the entire analysis terms.

Specific data quality Issues:

- During the preparation of S&S Austen Bank’s datasets, I encountered different specific data quality issues that needed to be addressed to ensure the entire analysis was reliable. My records had missed the deposit amounts for certain months across all the branches. This could be due to issues with reporting and incomplete transactions.

- While some deposit data were reported on the others and based on annual terms. The overall consistency creates challenges to performing the time-series relationships. Some customer records were managed to align the resources, lead the service categories, and determine incorrectly in the datasets.

- Inconsistent data formats is another issue that relate with the quality checking. Sometimes the same type of data like dates, currencies, and the names of customers can appear in the various formats across the system or records. For Instance, MM/DD/YYYY in one file and DD-MM—YYYY in another file that create issue for quality checking.

- Thew customer records or transaction detailed that have not been updated overtime can become more outdates. For Instance, the customer might have changed their number or contract information but the data was =never updated in new system.

- The Incorrect data entry or human errors. Such as manual data entry mistake like misplaced the decimals and election of wrote category. These errors may seem the minor individually but can lead to mislead the insights when scaled across the large data volumes.

Data Analysis:

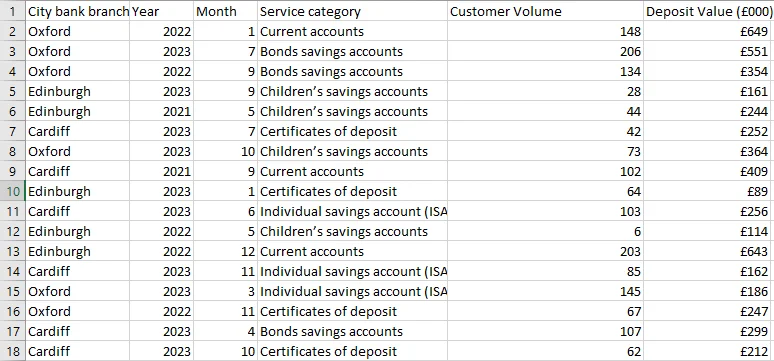

Table 1 Data Analysis of Bank Branches

| City bank branch | Year | Month | Service category | Customer Volume | Deposit Value (£000) |

| Oxford | 2022 | 1 | Current accounts | 148 | £649 |

| Oxford | 2023 | 7 | Bonds savings accounts | 206 | £551 |

| Oxford | 2022 | 9 | Bonds savings accounts | 134 | £354 |

| Edinburgh | 2023 | 9 | Children’s savings accounts | 28 | £161 |

| Edinburgh | 2021 | 5 | Children’s savings accounts | 44 | £244 |

| Cardiff | 2023 | 7 | Certificates of deposit | 42 | £252 |

The tables define the overall analyses of total customer volumes and the deposit of value on a monthly and yearly basis. Carded Customers, Oxford Customers, Edinburgh Customers, and the estimations of total customers that run the entire operations.

The table represent that the customer value as well as the deposit value for each brand can be analyzed the total customers can total deposit values are summed to proceed with the data from each branch. The table offers the snapshot of deposit activity across the three city bank branches like Oxford, Cardiff, and Edinburgh.

Oxford shows the higher volume of customers pipeclay in July 2023 with 206 customers using the bond savings account through the despite value. Edinburgh’s data highlight the decrease in customer volume from 44 in May 2021 to the September 2023 as 88.

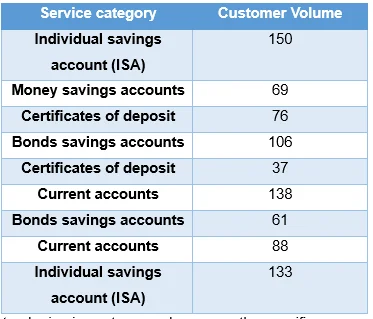

Table 2 Service Category

There has been a steady rise in customer volume over the specific years, with Oxford showing the highest growth. The deposit value has risen cognately across all the branches, and Cardiff has been relatively stable despite values, but growth was slower as compared to Oxford and Edinburgh.

Table 3 Branches and Related Accounts

| City bank branch | Year | Month | Service category |

| Cardiff | 2021 | 5 | Certificates of deposit |

| Cardiff | 2021 | 9 | Bonds savings accounts |

| Oxford | 2021 | 3 | Current accounts |

| Oxford | 2021 | 7 | Individual savings account (ISA) |

| Oxford | 2021 | 11 | Certificates of deposit |

The table evaluates the performance of each service category, like current accountings, monthly saving accounts, bond saving accounts, and children’s saving accounts with the total deposit values.

The data shows that the advanced operations with the better value remain lower as compared to other key categories that have arisen in the past.

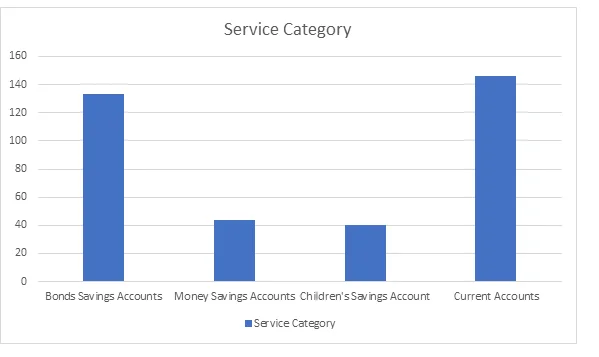

I will resend the graphical analysis of the data for S&S Austen Bank retail branches located in Oxford, Cardiff, and Edinburgh. The key areas of the entire focus are the trends in customer volume and the deposit values across the possible sites. Comparison of Deposit Value Transactors Over Time:

Key Findings and Interfaces:

The most effective and notable feature in the chart is the significant upward spike in Oxford’s despot value that started in the middle of 2023. The growth suggests that the bank’s renovation and overall expansion efforts had a positive impact on its entire deposits. Cardiff shows that the stray’s growth in deposit value helps to include form 2021 and generate 2022.

Service Categories:

The current accounts, Money saving accounts, ISAs and Bonds Saving Accounts, and Children’s Saving Accounts are important to proceed the better plans.

All of these accounts have a smaller customer volume and broad deposit values, which could reflect the detailed roles and tax efficiency. The surge aligns with the typical retail banking model where the checking of accounts is the most commonly used product.

The surge in ISA deposits toward the end of resources. The most profitable services for the bank are Money Savings and Current Accounts, which should be the primary focus for future marketing terms.

Assessing the Impact of the Oxford Branch:

The Oxford brand’s deposit value remained relatively flat and showed a slight increase during the first half of 2023. Moreover, there was no major surge in the despots, indicating the branch was not expecting the significant terms to lead the operational forms.

Overall Analysis:

To offer a comprehensive understanding of the data trends, I will summarize the key patterns as covered in previous charts, Oxford is the best terms that show the growth in consumer volume as well as the value of the expansion in 2023.

There is a nonviable increase in ISA despite this toward the end of 2022. The entire term suggests that the growing interest in saving products is likely to be driven by microcopies like inflation and rising interest rates with the leveraging of targeted marketing campaigns.

Conclusion and Recommendations: Data Driven Decisions for S & S Austen

I will summarize the key conclusion based on the analysis and the core findings presented in section 3, The primary goal is to address the three main project objectives that were raised by the Retail Banking Manager, also marking the strategic suggestions for the future.

Key Conclusion:

Oxford has shown the most significant growth in deposit value following the renovations and the expansion in 2023. The introduction of self-service machines and additional adverse desks to analyze the positive impact on customer engagement. Cardiff’s performance is the same but lacks the rapid growth in Oxford. Edinburgh’s performance is somewhat effective through the less dynamic as compared to Cardiff and Oxford.

Impact of Oxford Branch Expansion:

Replicating the Oxford Renovation Model, investing in Brand Modernization, and focusing on higher-performance saving accounts are important to improve the roles. All of these categories should be the focus of S&S Austen Bank’s marketing campaigns. The significant increase in ISAs toward the overall end of the methods promotes the benefits in the climate of rising interest rates.

These products show moderate performance, and there is a potential for growth in developing the target campaigns for the parents. The bank should continue to invest in online and mobile banking portals to fulfill the demand for younger and tech-savvy customer support.

Recommendations:

S&S Austen Bank should consider the following steps to better utilize the resources. The company should invest in predictive analytics, improve data integration, and advance reporting tools. S&S Austen Bank will help to drive the mobile integration. Real-time analytics empower the branch manager to make the most effective use of resources in the future.

Multiple issues that get by the banks through the quality checking of data such as inconsistent data formats, outdated or stale data, and incorrect data entry or the human errors that affect the business values and its cleared roles to proceed the change. The banking sector should improve the data quality issues by developing the real-time information and better panning roles in the future.

The company should expect more sophisticated reporting tools that will enable the bank to gain clear and deep insights from the data as it collects the interactive dashboards, which offer real-time analytics on branch performance and update the customer deposits within the board terms.