Business Project of Ford

The electric and hybrid vehicle (EV/HEV) market is growing faster than ever. In 2023 alone, nearly 14 million electric vehicles were sold worldwide, marking a 35% year, on, year increase. In the United States, EV sales crossed 1.6 million units in 2024, reaching over 10% of market share, with a further 35% surge in Q1 2025.

This growth is fuelled by climate regulations, ESG priorities, government incentives, and consumer demand for cleaner transport. But along with this momentum comes a rising expectation: these vehicles must be safe. Any fault, especially involving high-voltage batteries, can damage both public trust and industry credibility.

Ford is a major player in this electrified transition. Its strategy includes fully electric models like the F, 150 Lightning, and plug-in hybrids such as the Ford Escape PHEV and Lincoln Corsair Grand Touring PHEV. These models help meet emissions targets while offering electric range without full dependence on charging infrastructure.

However, in late 2024, Ford uncovered a battery cell defect in these hybrids. Thermal venting incidents, traced to damaged separator layers within the battery, led to a formal NHTSA recall (24V, 954) of 20,484 vehicles.

This report investigates the root causes of the defect, its impact on stakeholders, and the strategic actions Ford must take. While no injuries occurred, the “Stop Safely Now” warning reflects a serious underlying risk. The issue intersects safety, operational, and reputational concerns, areas critical to Ford’s long-term brand value, ESG compliance, and ability to compete in the evolving EV landscape.

Ultimately, this consultancy project applies relevant frameworks to assess Ford’s challenge and offer solutions that align with its strategic goal: to lead in safe, sustainable electrified mobility.

Read more: Business Project of Apple Inc.

Challenge and Issues the Client is Facing

Ford is currently facing a serious safety issue linked to its plug, in hybrid electric vehicles (PHEVs), specifically the Escape and Lincoln Corsair models built between 2019 and 2024. The core problem lies in the high-voltage battery packs, where a manufacturing defect has caused damage to the separator layer between the battery’s internal components.

This damage can lead to internal short circuits, especially as the batteries age through repeated charging and discharging. When this happens, the vehicle may lose power and display a “Stop Safely Now” warning.

In extreme cases, the battery may release heat through thermal venting, which poses a risk of fire.

This issue prompted a global recall of 20,484 vehicles, 16,480 Escapes, and 4,004 Corsairs in the U.S. alone. The situation escalated through 2024, with field reports in Europe, followed by Ford launching an internal investigation in September. By December 20, 2024, the company formally filed recall 24V, 954 with NHTSA, and public notices were issued on December 31.

Ford then advised dealers to stop charging affected vehicles and sent owner notices by late January 2025. By February, seven battery failures and one suspected fire had been confirmed.

This is not an isolated case in the industry. Volvo, Hyundai and Kia, Nissan, GM, and Tesla have all faced battery recalls due to similar risks in the last few years.

The trend shows growing concern over lithium-ion battery safety, as EV adoption accelerates globally. Ford must act not only to fix the problem but to stay ahead of a rising wave of scrutiny.

This challenge touches multiple layers of strategic risk. The regulatory pressure is growing, with NHTSA introducing FMVSS 305a, a new rule aimed at battery safety standards that will phase in starting in 2025. Delays or errors in recall management can lead to legal action and financial penalties under U.S. law [15 U.S.C. § 1414].

The reputational risk is also high. Ford led all automakers in recall counts for 2025, with 89 recalls in total. This ongoing trend may erode trust in Ford’s EV innovation, especially as PHEVs are marketed as both safe and sustainable.

Other concerns include operational delays, vehicle production and deliveries are paused, and dealers require retraining. Supply chain quality is also in question, as the faulty battery cells came from Samsung SDI, prompting Ford to reconsider supplier oversight and contracts. Financially, the recall involves both software updates and possible battery pack replacements, while legal exposure continues to grow, with class action lawsuits already filed.

Looking forward, this challenge reflects a broader trend. Automakers are now investing in solid-state battery technology, AI-based safety monitoring, and thermal management systems to prevent such incidents. Proactive strategies like full pack replacement may become the new standard.

Purpose of the Report

The purpose of this report is to assess the operational, reputational, and stakeholder risks linked to the recent battery defect recall affecting Ford’s Escape and Lincoln Corsair plug-in hybrid models. These issues raise serious questions about safety, quality control, and brand credibility, especially as Ford pushes to expand its hybrid and electric vehicle offerings.

This consultancy report aims to support Ford by offering strategic, evidence-based recommendations that can help the company restore consumer trust, improve its risk management systems, and strengthen its position in the growing hybrid/EV market. The analysis will also help Ford prepare for tighter battery safety regulations and evolving consumer expectations around reliability and sustainability.

This project asks one big question:

How can Ford handle battery safety problems and still stay strong in the hybrid car race?

The report uses smart tools to find answers. PESTLE checks outside forces like rules, money, and change. Stakeholder Analysis shows who has power and what they want. The Risk Matrix spots problems and shows how big they are. Six Sigma finds weak spots in the process. Together, these tools point the way, helping Ford stay safe, smart, and ready for the road ahead.

Stakeholder Analysis

When dealing with the battery defect recall in its plug-in hybrid models, Ford must think carefully about everyone involved, both inside and outside the company. This part of the report takes a closer look at the stakeholders using Mendelow’s Matrix. It explores how the recall affects each group and how Ford’s response can help rebuild trust and deliver value across its entire network.

Key Internal Stakeholders:

Inside the company, several teams play key roles. Engineering and Product Development design the hybrid systems. Quality Assurance tests parts to ensure safety. Manufacturing and Supply Chain manage battery assembly and work closely with suppliers.

At the top, Executive Leadership, including the CEO and EV heads, holds the most power, shaping Ford’s response and public communication. Service and Dealer Networks are also critical, as they implement software fixes and physical repairs on the front lines.

Interest is universally high within these groups. Engineers face pressure to find and fix the root cause. Dealers manage customer frustration and repair delays. Executives are accountable for results and reputation. Power, however, varies; executives command strategic direction, while engineers influence technical outcomes. Dealers hold tactical control at the customer touchpoint.

Key External Stakeholders:

Consumers are the most directly affected. Owners of impacted vehicles face disrupted EV use, safety risks, higher fuel costs, and lower resale value. Individually, their power is limited, but through social media, lawsuits, and advocacy, they can collectively pressure Ford’s public image.

Regulators like the National Highway Traffic Safety Administration (NHTSA) have strong power and interest. They can order fixes, impose fines, and call out delays. In this case, NHTSA is using the recall to push new safety rules (FMVSS 305a). Global watchdogs like the EU and China NCAP are also monitoring, signalling broader changes.

Investors and analysts, especially large shareholders, care about Ford’s finances and reputation. Recalls, delays, and lost EV trust can hit stock prices. These groups wield real power through votes and board influence, so keeping them satisfied is crucial.

Media and the public hold moderate power but high interest. Auto outlets and social media shape perception and can amplify backlash if Ford appears evasive or unprepared. Transparent communication will shape the media narrative.

Suppliers, especially Samsung SDI, are central. The defect was traced to a cell fabrication flaw. While not public-facing, their role in battery replacements and process fixes is key. They hold moderate power and must collaborate to avoid reputational fallout.

Stakeholder Power/Interest Mapping:

Using Mendelow’s Matrix, Ford must:

| High | High | Level of Interest | Low | ||

| Level of P | Manage Closely: Executives, NHTSA, and major investors | Keep Satisfied: Samsung SDI, international regulators | |||

| Low | Keep Informed: Consumers, media | Minimal Effort: Non-affected public, general press | |||

This model reveals the need for targeted engagement. Prioritizing regulatory transparency and shareholder assurance will stabilize Ford’s external standing. Simultaneously, consumer communications must be empathetic, timely, and proactive.

Strategic Implications and Value Creation:

Resolving the battery defect will help Ford rebuild trust among owners and the public. Internally, it creates urgency to strengthen supplier oversight and quality assurance. For regulators, it reaffirms Ford’s role as a responsible actor in a highly scrutinized industry. For shareholders, decisive action may restore confidence in Ford’s long-term EV strategy.

To align with stakeholder power and interest, Ford must reallocate resources toward technical fixes, transparent messaging, and regulatory compliance. The real challenge is not just repairing battery packs, it is restoring belief in Ford’s promise of safe, sustainable innovation.

Evaluation and Analysis:

Strategic Pressures and Risk Landscape

Ford’s recent recall of over 20,484 plug-in hybrid vehicles due to battery defects is not simply a quality issue; it is a strategic stress test. With electric vehicles (EVs) gaining global momentum, the risks tied to product safety, regulatory compliance, and brand integrity have never been higher. Using PESTLE and SWOT frameworks, this section critically evaluates the external forces and internal vulnerabilities shaping Ford’s position in the EV space.

Mapping the External Pressure:

Ford is facing tough external pressure.

Politically, the landscape has shifted fast. In December 2024, U.S. regulators passed FMVSS 305a, a tougher rule on EV battery safety. It signals more than compliance. It shows that regulators expect companies like Ford to stop problems before they happen.

Economically, the strain is growing. Ford has already planned to spend $570 million on other recall-related issues. While this specific battery recall affects fewer cars, it adds to investor fear. In Q2 2025, Ford took a $570 million hit for another defect. Adding more recalls raises serious concerns about the company’s control and reliability.

Socially, consumer trust is falling. In 2023, one in every five cars sold was electric. Buyers now expect EVs to be not just clean but also safe and solid. Ford’s recall undercuts that belief. Many owners have voiced anger in forums, saying they no longer trust Ford’s hybrid models.

On the technology side, there’s a mixed picture. Ford has smart tools like AI-based diagnostics, but the fact that battery separator defects slipped through suggests the systems aren’t working well enough. At the same time, rivals like Toyota and Tesla are working on safer, state batteries, setting new standards Ford is not yet meeting.

Legal threats are also growing. Lawsuits in the U.S. and Canada claim Ford ignored early signs of trouble. These aren’t just about money; they tell a story that Ford is slow and hides problems. That hurts the company’s public image and could lead to forced buybacks or expensive settlements.

Environmentally, this recall damages more than Ford’s brand. It slows down EV adoption. If people stop trusting hybrids, it harms global climate goals. That puts Ford under fire from regulators, investors, and environmental groups alike.

Exposing Internal Vulnerabilities:

Inside the company, Ford has both power and problems

Its strengths include a strong brand, big EV investments, and a wide dealer network. These help. But its weaknesses are serious. In 2025 alone, Ford issued 89 recalls, more than any other carmaker. That shows a deep issue in quality control.

The battery flaw proves this weakness. Samsung SDI, Ford’s battery supplier, failed to catch key problems in the separator material. A better, quality process, like Six Sigma, might have found these earlier. This isn’t just bad luck. It shows a weak system inside Ford’s quality checks.

Still, there’s an opportunity to improve. People still want reliable hybrid cars. If Ford leads with honesty, safety, and smart tech, it can recover. AI-based tools, better heat control, and live battery tracking could help if used now.

But the threats are rising. Rivals are setting higher quality bars. If Ford slips again, it risks more lawsuits, lower trust, and lost investors.

Risk Evaluation and Quality Failures:

The battery defect in Ford’s Escape and Corsair plug, in hybrids, is a textbook case of a low, low-probability, high, high-severity risk. Ford stated that only 0.3% of battery packs are likely to fail, yet those failures can stop the vehicle or even lead to thermal venting.

This kind of risk demands immediate and strategic mitigation, not just technical fixes, but a full evaluation of the quality systems that failed to prevent it.

Before and After the Recall:

Pre, recall, the likelihood of failure was low, but the impact was severe, vehicle disablement or fire risk. It was of low frequency, high danger. After Ford’s software patch and hardware screening, the likelihood may be reduced, but the severity remains unchanged. The event remains “high risk,” especially in the eyes of regulators and consumers.

This highlights a major weakness that Ford did not catch the defect early in production or testing. Thermal venting reports emerged in mid-2024, but the recall was not filed until December 20. That delay magnified exposure, especially with public lawsuits now pending.

What Failed and Why?

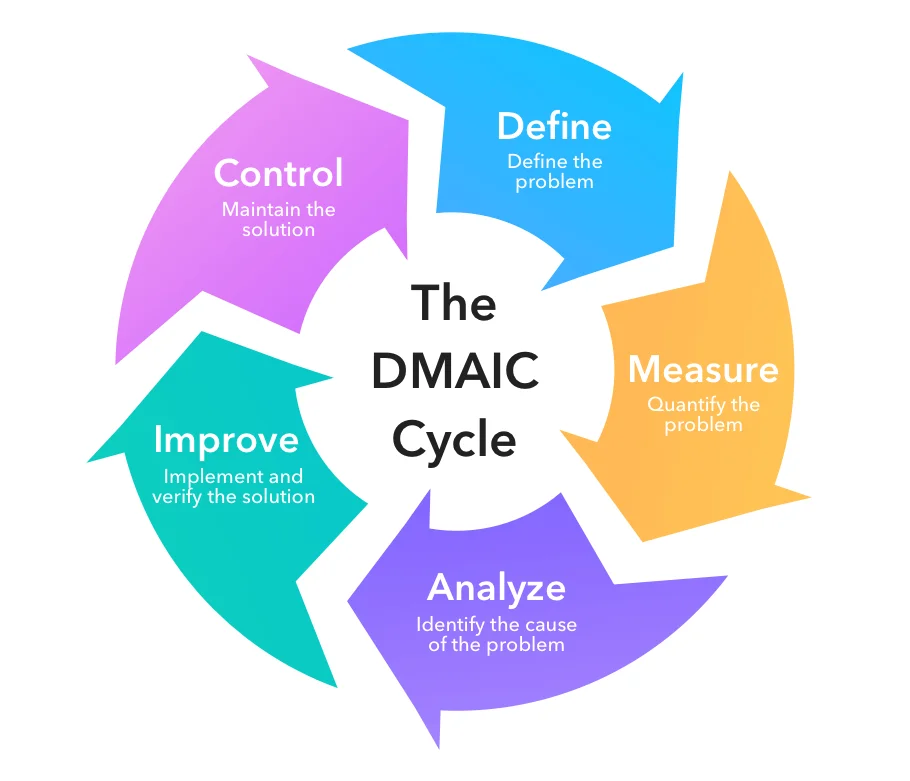

Using the DMAIC method (Define, Measure, Analyze, Improve, Control), we can track where Ford’s quality assurance broke down:

Had these tools been applied before mass production, Ford might have caught early warning signs, especially since cell separator flaws are known failure modes in lithium-ion chemistry.

Ford vs. Industry Leaders in Safety and Recall Strategy:

Ford’s response to the Escape and Corsair battery defect stands in contrast to how other major automakers have handled similar safety issues. Based on available industry data, companies such as GM, Hyundai, and Volvo acted with greater speed and scope.

This section critically compares Ford’s actions to those of its peers, focusing on timelines, technical fixes, supplier handling, and customer impact, to highlight missed opportunities and the strategic consequences.

Timeline and Speed of Action:

Ford began observing thermal venting events in April 2024, with three reported cases in Europe. However, the formal recall (24V-954) was not submitted until December 20, 2024, and public notification followed on December 31.

This timeline reflects an eight-month delay from the first known incidents to official recall, during which safety risks remained unresolved and customer confusion increased.

By comparison, Hyundai recalled 82,000 Kona EVs built between 2018 and 2019 for battery cell defects, a decision based on early identification of risks tied to the battery pack. Similarly, GM recalled 70,000 Chevy Bolts in 2020 after battery fires, showing a faster and broader risk mitigation approach.

These cases suggest that Ford was slower to act, despite evidence of high-severity outcomes such as vehicle shutdown or potential fire.

Root-Cause Analysis and Technical Fixes:

Ford traced the failure to separator damage in Samsung SDI’s battery cells, which could cause internal shorts over time. The proposed remedy, a software update to detect abnormal battery behavior and selective battery replacements, is cautious and limited in scope.

In contrast, GM chose full battery pack replacements for all affected Bolt units, likely due to similar concerns about cell manufacturing defects. This proactive move reduced future risk and demonstrated a visible commitment to customer safety.

Ford’s partial approach may be perceived as cost-driven rather than consumer-focused, especially in light of growing safety expectations.

Customer Communication and Public Trust:

Customer sentiment around Ford’s recall has shown signs of frustration and distrust, with owners told not to plug in their vehicles while waiting for a fix. In practice, this temporarily removed the core functionality of a plug-in hybrid. Public messaging was handled through standard recall notices and dealer instructions, with little emphasis on customer experience or public assurance.

Hyundai, in contrast, launched clear recall announcements and expanded support efforts, creating a stronger public narrative of responsibility. Ford’s silence on broader safety commitments, even as class-action lawsuits were filed in the U.S. and Canada, allowed legal pressure to shape the public conversation.

Supplier Management and Regulatory Engagement:

The battery defect originated in Samsung SDI’s manufacturing process, but Ford has not disclosed any renegotiated supplier terms or quality mandates. By contrast, companies like Toyota are known for early-stage supplier integration and long-term quality control systems, which may explain their absence from recent large-scale battery recalls.

Meanwhile, the NHTSA’s ability to fine Ford, up to $65 million if late reporting is proven, adds regulatory weight to what was already a high-risk event.

Compared to its peers, Ford’s strategy was slower, quieter, and less decisive. From recall timing to technical fixes, Ford leaned toward caution rather than leadership.

In a market now defined by safety expectations, delay, and vague communication, it costs more than they do. The lesson is clear: future credibility depends on speed, clarity, and control, not just compliance.

Limitations of Secondary Data Analysis:

This project relied solely on publicly available secondary data, which introduced several significant limitations. One major gap was the lack of access to Ford’s internal documentation, such as quality assurance audits, supplier performance reports, or executive meeting records.

These internal sources would have revealed how decisions were made and whether early warnings were missed. Instead, the analysis depended on recall filings, media summaries, and investor reports, which present filtered, post-event narratives. Moreover, media sources tend to emphasize failures, especially in safety-sensitive sectors like EVs, which may lead to bias. Public discussion of battery defects often lacks technical nuance or context, potentially skewing interpretation.

For example, while the failure rate was reportedly low (~0.3%), headlines focused on the fire risk rather than statistical rarity. Another key challenge was estimating future impacts. Long-term brand damage, shifts in consumer loyalty, or financial recovery cannot be predicted confidently using secondary sources alone. Investor reactions fluctuate with multiple variables, macroeconomic trends, tariffs, or unrelated recalls, which makes isolating this event’s direct financial cost speculative at best.

It’s also possible that Ford’s decisions, which appeared slow or reactive, may have followed a cautious, compliance-driven strategy. The recall process, starting with field data in April 2024 and ending with a public announcement in December, could be interpreted not simply as delayed, but as legally calculated. Automakers operate under complex federal reporting timelines. Ford may have waited for lab-confirmed root-cause analysis before notifying regulators, which, while conservative, aligns with avoiding false positives or incomplete fixes.

From a legal or engineering standpoint, this approach could be justified. Yet from a consumer or investor perspective, the timeline invites criticism. Similarly, supplier involvement adds complexity. Samsung SDI’s role in cell defects complicates direct blame. Ford had to balance supplier accountability, legal liability, and recall logistics. Depending on the stakeholder viewpoint, Ford’s handling might be framed as risk-averse and compliant, or as slow and opaque.

This contrast underscores the difficulty of assigning simple judgments using only external viewpoints. The reality is that different stakeholders, regulators, investors, and owners would likely interpret Ford’s recall differently based on their priorities.

Methodologically, the analysis used the Risk Matrix and Six Sigma DMAIC frameworks to evaluate severity and process failure. These were chosen due to their clear structure, industry relevance, and compatibility with the limited data.

The Risk Matrix helped classify the battery defect as “low likelihood, high severity”, a high-risk scenario needing urgent attention. Six Sigma’s DMAIC structure aligned well with Ford’s process: the problem was defined, root causes identified (separator damage), and corrective steps planned (software update, battery swap).

However, this framework assumes structured data inputs, which were largely unavailable. FMEA (Failure Mode and Effects Analysis) was briefly referenced to prioritize risks (RPN scoring), but was not fully applied due to missing inputs like process detectability logs. Similarly, Bowtie Analysis, which visualizes risk events and mitigation barriers, was excluded because it requires precise sequencing and causality data. Without internal QA documentation, applying such detailed tools would have risked over-interpretation or error.

For stronger future analysis, access to Ford’s internal data would be key. Defect rate logs, showing how many battery packs failed by batch or location, would sharpen risk models. Supplier audit records, especially from Samsung SDI, could reveal if early issues were spotted or missed.

Customer feedback, like satisfaction surveys or Net Promoter Scores after the recall, would give clearer insight into brand damage. A timeline of internal decisions, when Ford found the issue, launched checks, and told stakeholders, would show if delays were planned or signs of deeper problems. Without this data, the report relied on outside sources, which help but don’t tell the full story.

Recommendations and Conclusion

Recommendations:

Strengthen Supplier Quality Audits Using Six Sigma:

Ford must tighten control over its battery suppliers, especially Samsung SDI. The recent recall shows a gap in early defect detection during battery cell production. To fix this, Ford should demand statistical process control data from its suppliers and require Six Sigma-level consistency.

It can also increase its incoming inspections, using tools like X-ray scans or charge-cycle stress tests, before the packs go into vehicles. This directly responds to stakeholder concerns raised in Section 5, especially those of consumers and regulators who expect stronger safety assurance.

This recommendation supports Ford’s goal of producing safe and high-quality EVs. It also aligns with Total Quality Management (TQM) principles seen in Toyota’s practices, continuous checks to prevent rather than correct problems.

The strength of this approach is its focus on prevention. However, it will take time and money to fully implement, and may slightly slow down production in the short term. Still, it’s a worthwhile investment to avoid future recalls.

Use Predictive Analytics to Catch Failures Before They Happen:

Ford should invest in AI-powered diagnostics to spot battery problems before they reach the customer. Real-time data from battery systems, such as voltage, temperature, or cell resistance, can feed into AI models that predict early signs of failure. This supports Six Sigma’s “Analyze” and “Improve” phases by focusing on root causes and solutions.

Predictive systems will help Ford improve both quality and brand trust. Customers want EVs that are safe and reliable. Regulators want to see risk managed before it turns into harm. This tool gives Ford an edge over competitors, especially in a market that is increasingly focused on safety and technology.

One limitation is that AI models can be hard to interpret; engineers must understand how the system makes its predictions. So, Ford must also invest in model explainability and training.

Improve Crisis Communication and Recall Transparency:

Rebuilding trust is not just about fixing the hardware; it’s also about how Ford talks to its customers. Ford should improve its recall messaging: explain the issue clearly, provide regular updates, and acknowledge customer frustrations. Compensation tools such as extended battery warranties, free fuel cards, or temporary loaner vehicles will help show accountability.

This approach addresses customer and media concerns noted in the stakeholder section. It also supports ESG goals by putting fairness and safety first. The cost is moderate, but the return in goodwill is high. Still, it may not fully fix reputation loss; some customers may never return.

But showing openness and effort helps reduce long-term brand damage. Companies like GM have used such tools effectively when replacing faulty Bolt battery packs.

Create an EV Risk and Quality Task Force:

Ford should create a dedicated EV Risk Management Team that includes engineers, quality leaders, and supplier liaisons. This group would oversee battery quality across the lifecycle, from sourcing to customer use, and act fast when problems appear. Having a specialized team ensures that lessons from this recall are not lost or repeated.

This solves a major issue: Ford’s late response in this case suggests a slow internal escalation process. A task force would shorten the response time and give Ford a central unit responsible for safety governance.

It also aligns with investor concerns about operational risk and regulatory exposure. The main trade-off is added internal overhead, but this is small compared to the cost of crisis management. Ford’s long-term strategy depends on credibility, and this unit could protect it.

Launch a Safety-Focused Brand Recovery Campaign:

Lastly, Ford should invest in rebuilding its public image. This includes a campaign that highlights safety innovations, recalls its past EV wins, and outlines future promises. Consumers need to hear what Ford is doing to make EVs better. This also gives the company a chance to frame the recall as a turning point, not a failure.

This campaign supports Ford’s strategic goal of EV leadership and builds emotional loyalty with customers. Regulators and investors will also see that Ford is being proactive, not defensive. The cost of marketing and messaging is low compared to the recall expenses already incurred. One limitation is that brand recovery takes time. However, if the message is clear and honest, it can help Ford regain lost ground.

Conclusion: Business Project of Ford

Ford’s recall of nearly 20,484 plug-in hybrid vehicles due to battery defects presents a serious challenge. It raises concerns around product quality, supplier control, and customer trust. As shown through the evaluation and stakeholder analysis, the issue has triggered financial, legal, and reputational risks that must be managed with care.

The recommendations offered, better supplier audits, predictive analytics, transparent crisis handling, an EV risk team, and a brand campaign, directly address these risks. Each one supports Ford’s broader goals: safe, reliable electrification, ESG leadership, and long-term customer loyalty.

Solving this issue isn’t just about fixing batteries. It’s about showing the market that Ford learns fast, adapts well, and leads with integrity. The recall can become a strategic turning point, but only if followed by clear, sustained action.

One important area for future research is how Ford can use AI to not only detect defects but also guide design decisions. With the right systems and culture in place, Ford can turn today’s setback into tomorrow’s advantage.