Financial Analysis of the Woolworth Group Limited

The report aims to conduct comprehensive financial analyses of the Woolworth Group Limited as an Australian Firm by focusing on the operational strategies. Woolworth Limited is the largest firm in Australia by sales and the employees count as the key player in the retail sector with a higher presence in New Zealand. Next, we will evaluate the firm’s core operations regarding the loyalty program through the financial scores.

The financial comparison indicates the Sales, Net Assets, and the Entire Market Position of the business that is affected by the entire strategic reports. The report provides a structured review of Woolworth Group Limited as offering valuable insights into the operational strategies and navigating the key complexities of the retail sector effectively.

Background:

Woolworth Group Limited was selected for the clear analysis due to the significant changes in New Zealand and the Australian Retail Markets where the firm operates its diverse brand portfolios regarding the supermarket. Big W and Everyday Rewards are the key market incidents to raise the cleared resources. The company’s main headquarters are in Sydney as the largest firm in Australia by sales and the number of employees. The company is public and related to the industry of retailing and was founded in the year 1924 by Percy Christmas and Ernest Williams.

The company’s internal analysis reveals the robust financial standing that is characterized by consistent sales growth and the operational effect. The financial year 2023 indicates that Woolworth reported sales of AUD 62 billion Reflecting the 5.6% enhancements from the past year. Woolworths’ Strategic Focus on the entire sustainability helps to align with the trends of global consumers and make the well-positioned activities with clear market dynamics.

Scope and Methodology:

The purpose of the study is to evaluate or analyze the operational strategies, market positioning, and financial performance by assessing the challenges and opportunities that the firm faces in the competitive retail industry. The report evaluates the sustainability initiatives, indicates the changing preferences, and maintains the overall strategy. The report indicates the strong operations, leading the detailed eras of the success, examining the important parties with the detailed eras of the success. The model offers the competitive dynamics and the industry structure to facilitate a Nuanced Understanding of the strategic positioning within the sector of retail. The data collection for this study will examine the primary and the secondary sources.

The company’s Australian Security Exchange and business news outlets will be examined to intake the current market insights and evaluate the market trends. The data’s growth and the multifaceted approaches ensure a clear analysis of the theoretical frameworks regarding the detailed eras of success. The study aspires to contribute valuable insights into the business for planning the competitive advantage and adapting the retail environment to the market demands and customer expectations.

Issues Identified:

The report examined the key issues from the analysis of the Annual Reports and the other Financial Information Reports with reliable activities. The comprehensive examination of the firm’s financial performance reveals the critical insights regarding the profitability liquidity, efficiency, and solvency that ensure the detailed eras of the success. Woolworth company reported a net profile of about 2.2 billion Demonstrating a solid profit margin of approximately 3.5% the reflection of the firm’s ability.

Woolworth Company demonstrated a debt-to-equity ratio of 4,12 in 2023 reflecting the prudent management regarding the finances with the lower reliance on debt financing. The firm’s potential liquidity challenge helps to manage the debt-to-equity ratio with the reflection of financial management, investing in technology, and sustainability initiatives to maintain the business roles.

Profitability Ratios:

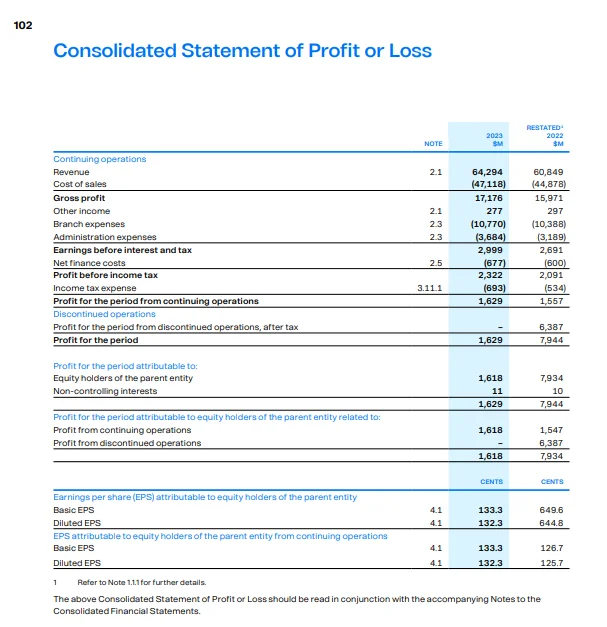

Gross Profit Margin = Gross Profit / Sales x 100 = 17,176 / 64,294 x 100 = 26.71

The company directly reported the gross profit margin as 26.71 which indicates the solid ability to manage the costs of production relative to the sales. The entire margin analyzes the key pricing strategies as well as the operational efficiencies that indicate the business’s financial health. The research focused on the practices of cost management and sales techniques.

Operating Profit Margin = Operating Profit / Sales x 100 = 1,629 / 64,294 x 100 = 2.53

The firm’s operating profit refers to 2.53 which indicates the key challenge in controlling operating expenses regarding sales. The operating profit margin analyzes the key strategies of prices with the operational concerns that refer the financial health. The value indicates the profitability of the operations and highlights the need for improvement regarding the cost management strategies in support of sustainable growth.

Net profit Margin = Net Income / Sales x 100 = 1,618 / 64,294 x 100 = 2.51

Woolworths Group Limited has a net profit margin of 2.51% which refers to the clear and modest level of profitability after all the key expenses. The entire margin suggests the firm generate the sales and facing the challenge with net income. The value focuses on the control of cost and sales enhancement to raise profitability.

Return on Assets = Net Income / Assets x 100 = 1,618 / 33,648 x 100 = 4.80

The company’s ROA refers to the efficiency of the firm and utilizing the brand value to its success. The model refers to the need for improvements in the management of assets and the development of maximization of returns with the drive of long-term financial performance.

Liquidity Ratios:

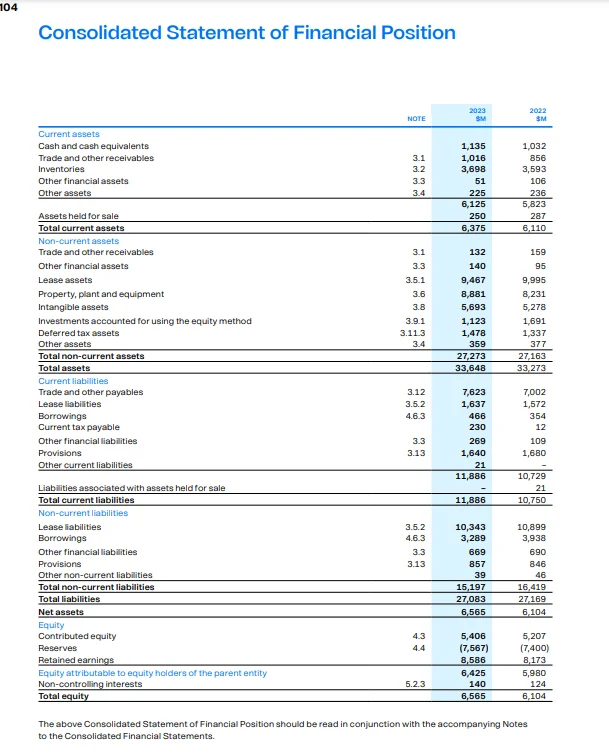

Current Ratio = Current Assets / Current Liabilities = 6,375 / 11,886 = 0.53

The firm’s current ratio is 0,.52 which indicates the potential liquidity issues and suggests the liabilities with the exceed of current assets. The ratio raises the issue regarding the firm’s ability to meet its obligations and improve liquidity with better asset management.

Quick Ratio = Current Assets – Inventory / Current Liabilities = 6,375 – 3,698/ 11,886 = 0.22

The company’s quick ratio is about 0.22 which refers to the significant challenges of liquidity. The ratio refers to the firm’s struggle to cover the short-term liabilities without any type of reliance on the sales of investors. The model indicates the management of cash flow and reduces the liabilities with the enhancement of financial stability.

Cash Ratio = Cash and Equivalents / Current Labilities = 1,135 / 11,886 = 0.09

The organizational cash ratio refers to the 0.09 that serves the constraints of liability. The low ratio suggests the firm has minimal cash available to cover the liabilities in the short term and raises concerns about meeting immediate financial obligations. The value improves the case reserves and financial management.

Solvency Ratios:

Debt to Equity Ratio= Total Debt/ Total Equity = 27,083 / 6,565 = 4.12

The firm’s debt-to-equity ratio is 4.,12 which analyzes the higher level of leverage and suggests the firms rely too heavily on debt financing compared to equity. It raises the financial risks and monitors the firm’s debt level with sustainable strategies for growth.

Debt to Asset Ratio = Total Debt / Total assets = 27,083 / 33,648 =0.80

Woolworths company’s ratio of debt-to-asset is 0.80 which indicates that 80% of the firm’s assets are financed by debt. This ratio evaluates the significant leverage and potential financial threat to suggest the firm’s heavy reliance on borrowed funds.

Equity Ratio = Total Equity / Total Assets = 6,565 / 33,648 = 0.19

The company’s equity ratio is 0.19 which indicates that 19% of the firm’s assets are financed by equity. The low ratio indicates the reflection of the higher reliance on debt and raises the financial risks that impact the business operations. The new investments also affect the company’s financial health.

Efficiency Ratios:

Asset Turnover Ratio = Sales / Average Total Assets = 64,294 / 33,648 = 1.91

The firm’s asset turnover ratio is 1.91 which refers to the higher use of assets to make more sales. The ratio analyzes that the firm effectively leverages the assets with the derivation of the sales and creates a positive sign for operational efficiency.

Inventory Turnover Ratio = COGS/ Inventory = (47,118) / 3,698 = (12.74)

The company’s inventory turnover refers to the significant issues with the management of inventory. The company’s unsold products help to indicate the invention strategies that are crucial to raising operational efficiency and reducing overall costs.

Woolworths Group Limited examined the strong profitability and the clear position of solid liquidity regarding the rising cost and the management of inventory. Woolworths Group Limited developed strong profitability as well as an effective market position regarding the modernizing of store infrastructure. Woolworths currently owns the supermarkets and the programs of loyalty that maintain the entire commitments with a clear tendency regarding the advanced practices of the business. Woolworths company opened the first store with a nominal investment or equity of 185,000 Euros and 85,000 shares as offered to the public.

Analysis:

The report examined the qualitative analysis with Woolworths Group Limited regarding the financial ratios that highlight the strengths and the weaknesses as affecting the business performance. The company’s Return on Equity ROE refers to the 14% of the effective use of shareholders’ equity for generating profits and is bolstered by the company’s ability to examine the competitive advantage, the firm’s current ratio evaluates that the liquidity position ensures the meeting short-term obligations and determine the efficient resource utilization with the adoption to managing the stock levels with the alignment of consumer demands. The firm’s supply chain tends to examine the Debt-To-Equity Ratio, giving significant investments, and evaluation of the digital investments with the detailed eras of the success. For Example, the company’s Woolworth’s ROE of 14% is commendable lower than the average sector of 16% which recommended the improvement of operational efficiencies. Furthermore, competitors like Coles Group have a similar market positioning with slightly higher intake to the ratio of liquidity.

The term indicates that Woolworths to raise its cash management practices and stay competitive. Woolworths Group Limited demonstrates its strengths with profitability and liquidity to address the challenges regarding the margin pressure and the management of the broad capital. The firm must address the operational efficiencies, lead the strategic investments, and indicate the financial ratios to inform Strategic Decision-Making in the dynamic retail environment. Woolworth Company is an international retail firm to investigates change, examines success, and boosts the detailed eras of success.

Recommendations:

Based on the financial position, strengthening the supplier relationship is the broad category that helps to mitigate the margin pressure from the enhancement of the input costs. Woolworths should focus on the enhancements of relationships with the suppliers through negotiating better terms and the collaboration on the pricing strategies with the secure and the favorable purchasing conditions. The company’s streamlined supply chain helps to stream the commitments, build eco-friendly practices, and lead the range of sustainable products.

The company should enhance its sustainability initiatives and attract a broader customer base with the alignment of long-term market trends. Woolworths company should improve the proper investigation of the balance sheet and the net income that helps to coordinate the business values and examine the cleared roles.

Conclusion:

Woolworths Group Limited Stands as a formidable player in the Australian as well as New Zealand Retail Markets which demonstrates strong profitability with solid liquidity positions. The firm faces challenges regarding the margin pressures from rising input costs and the need to raise the operational plans. The firm’s strengthening the supplier relationships and investing the technology to indicate the success. Woolworths can address its weaknesses and capitalize on its strengths with sustainable and reliable tools. The company’s strategic recommendations are aimed at raising financial performance and ensuring long-term growth with the enhancement of the competitive landscape.