Perfect Competition and Monopoly

The debate on whether perfect competition is always preferable to monopoly has always been one of the issues that have been vigorously discussed in the field of economic theory. On the two extremes of the oligopolistic spectrum lie perfect competition and monopoly. Each has its own characteristics, advantages, and disadvantages, which would make them appropriate tools and techniques in given economic conditions. Thus, in this essay, Perfect competition and Monopoly will be described, Some situations under which it will be better to prefer Perfect competition over Monopoly will be discussed and Some circumstances under which Monopoly might be better than Perfect competition will be discussed. Through applying economic theory and real-life cases, this discussion shall give a clear understanding of how each of the market structures has its pros and cons before coming up with a conclusion on the credence or otherwise of the statement: perfect competition is always better than monopoly.

Features of Perfect Competition and Monopoly

Perfect Competition

Perfect competition as a type of market with several characteristics, guarantees a high level of efficiency and the selection of the maximum degree of welfare. Here are the detailed characteristics:

Large Number of Buyers and Sellers:

In a situation where there are many firms involved in the production of a specific good; many consumers also; no single firm or consumer can monopolize the market. This is because the availability of such horde would make it impossible for individual participants to dictate the rate of price which brings about the pure competition equilibrium prices that reflect the aggregated supply and demand values.

Homogeneous Products:

Every product available for sale is described in detail and seems to be in the stock of every seller. It ensures that the consumer has no inclination towards a certain seller’s product as against the product of another seller; thus keeping competition rigid to the physical form/paper price. Said differently, manufactured goods, as well as agricultural products such as wheat or corn are examples of homogeneous products.

Free Entry and Exit:

The entry and exit of firms are relatively easy without much hindrance due to imperialism. In this way, the ease of entry and exit means the firms cannot maintain profits above the industry’s average level in the long run since entrants always lower prices. Some of barriers could be related to high mobility rates which may be attributed to low entry barriers such as; low initial capital required, no legislation hindering new entrants and availability of essential resources.

Perfect Information:

All traders possess all relevant information on the market situation including the prices, quality of products, and methods of manufacturing at the same time. This perfect information also rules out any possibility of arbitrage which allows prices to depend solely on the actual values of goods and services. For example, the current financial markets are relatively efficient because information travels fast hence everyone receives the information at the same time.

Price Takers:

Of the market structures, the perfectly competitive market structure is the one in which firms are price takers, that is, they cannot influence the price but have to accept the price determined in the market Since firms are price takers, they can sell as many units as they want at this price. This situation occurs because the quantities within the plane of operation of individual firms are relatively small in comparison with the total quantity in the market segment, and, therefore, each firm cannot affect the price. In a perfect market, if a firm attempts to determine a higher price it units suffer a risk that consumers will opt for other producers providing the same product at the going market price.

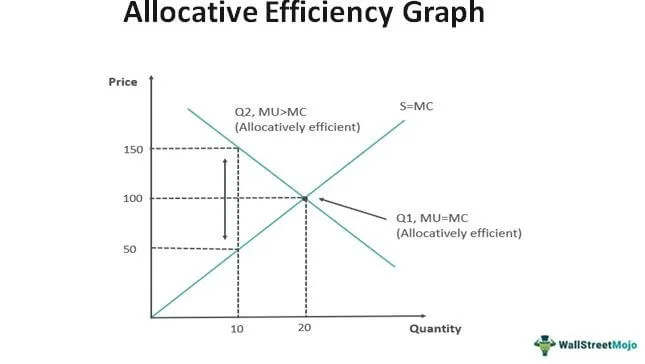

Some of the key characteristics of this market include price takers, where supply and demand forces set prices thus facilitating an effective utilization of the available resources whereby both consumers and producer’s gains are optimized. The following diagram illustrates this efficiency:

Monopoly

On the other hand a monopoly is a state of industrial size in which a single seller controls the entire market. Here are the detailed characteristics:

Single Seller:

In a monopolistic structure, the entire market is dominated by one firm in that it has the capacity to meet the entire market requirement of a given product. This singularity implies that in essence the firm is the market and thus leads in providing the market directions as far as pricing and output decisions of good and services are concerned. An example of this type might be a utility company that supplies electricity or water in a certain part of the country.

Unique Product:

The monopolist produces and sells a commodity in a market where there are no near equivalents available. The uniqueness of product for this type gives the monopolist high level of market power since consumer cannot easily change his/her preference if the monopolist decides to increase the prices. For instance, consider patented pharmaceuticals as examples of this kind of good; a particular medicine may have no viable substitute in the market during a certain period protected under a patent.

High Barriers to Entry:

There are several factors that helps the monopolist firm exercise its power in the market because new firms cannot easily enter the market. Such barriers may include high startup costs which are often capital intensive, legal formalities and conditions that limit entry, total control of resources that support production, and brand image that creates a lock in for consumers. For instance, the aerospace sector can be described as having highly significant entry barriers because of the immense investment and high levels of technology implementation necessary for the operation of the businesses in the sector.

Price Maker:

Normally, the monopolist would have a lot of control over the price since the market has no other supplier. This is normally achieved at the expense of output since, to attain the level of profits that can cover all firms’ costs, a monopolistic firm can set prices above marginal cost. In some cases, this kind of price control may lead to a level of profit which is more than the cost of production, this is because; For instance, vertical integration made it harder for competitors to undermine Microsoft’s superiority setting high and controlled prices for its Windows software for many years due to its strong position in the PC operating system market.

As a result of some winning the right to be the sole supplier in the monopolistic market, they will set high prices for their product and services thus a decline in the consumer surplus and possible inefficient outcomes.

Perfect Competition vs. Monopoly: Efficiency and Consumer Surplus

Efficiency in Perfect Competition

In perfect competition, there is efficiency in the allocation of goods and services and also productive efficiency. It relates to the concept of allocative efficient in which resources are utilized in the production process in the best way that can offer the highest satisfaction to the consumers and the producers or suppliers in the market. This is perhaps evident in the conditions that illustrate the interaction between the price and the marginal cost by the algebraic notation P = MC. Productive efficiency occurs when firms for instance in the production process explore the production possibilities frontier to establish the lowest point possible of opportunity costs. The equilibrium price is found where the demand and the supply curve cross, in this case point E where S = MC. The optimal level of smartphone consumption to attain this maximum total utility is Q1, at a price of 100, where the marginal utility equals marginal cost and allocative efficiency. Another point noted on the above graph is that initially, the opportunity cost of making more goods and services is greater than the marginal utility (MU > MC) till the optimum level of production (Q2) is achieved meaning that production will enhance welfare of the society. This VPV underscores the situation or state in which the market is most efficient at distributing resources, where supply and demand are at near parity.

Efficiency in Monopoly

Monopoly distorts the productive efficiency since firms have excess control over resources there is also allocative inefficiency. From experiences, the monopolist seeks to profit maximization where total quantity demanded equals marginal revenue (MR) and marginal cost (MC) though; it sets its price (P) higher than what prevails in the competitive market. This price is even higher than marginal product with respect to the meat component thus create a deadweight loss.

The diagram below illustrates the equilibrium in a perfectly competitive market:

The allocative efficiency-graph shows a market situation in which resources are proactively availed to consumers to ensure the maximum attainment of both consumers’ and producers’ surplus. The equilibrium price is found where the demand and the supply curve cross, in this case point E where S = MC. The optimal level of smartphone consumption to attain this maximum total utility is Q1, at a price of 100, where the marginal utility equals marginal cost and allocative efficiency. Another point noted on the above graph is that initially, the opportunity cost of making more goods and services is greater than the marginal utility (MU > MC) till the optimum level of production (Q2) is achieved meaning that production will enhance welfare of the society. This VPV underscores the situation or state in which the market is most efficient at distributing resources, where supply and demand are at near parity.

Efficiency in Monopoly

Monopoly distorts the productive efficiency since firms have excess control over resources there is also allocative inefficiency. From experiences, the monopolist seeks to profit maximization where total quantity demanded equals marginal revenue (MR) and marginal cost (MC) though; it sets its price (P) higher than what prevails in the competitive market. This price is even higher than marginal product with respect to the meat component thus create a deadweight loss.

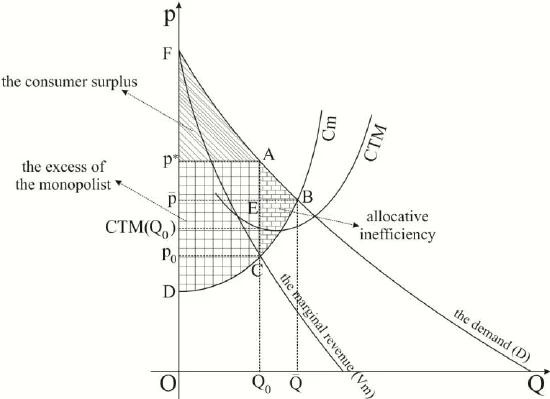

The following diagram illustrates the inefficiency in a monopolistic market:

Graph clearly depicts the actual or relative market price of monopoly as compared to the price possible under perfect competition. On the diagram, it illustrates the demand curve (D), the marginal revenue curve (MR), and the marginal cost curve (MC). In the perfect competition market, the demand Q and P0 is obtained where Mc intersects the demand curve; thus maximizing the consumer surplus (area FAD). However, do note that a monopolist sets the price at P* in comparison to P1 and supply Q0 in contrast to Q1 where MR= MC resulting in allocative inefficiency- the shaded area BEC. The monopolist makes excess profits of amount area PP0EB at the cost of dead-weight loss which is incurred to the consumers, area FAP. Such inefficiency contributes to the social loss given that the possible trades which may be mutually beneficial to both the buyer and the seller are not actually effected.

Advantages of Perfect Competition over Monopoly

Consumer Surplus Maximization

This is particularly true of perfect competition because it is assumed to generate the highest level of consumer surplus. Competition leads to a state where the price level is generally low and the range of products and services offered come closer to the relevant cost level. This leads to a more satisfying level of consumption for the consumer as well as improved welfare.

Loss of Efficiency in Monopoly

The distinction between product differentiation and monopolies is that monopolies display a loss of efficiency by offering a lesser quantity and a higher price when compared to perfectly competitive firms. The prices attained are higher hence less consumer surplus while the output is lower hence could not meet the demand of the market.

Example: The Telecommunications Industry

One of them is the telecommunications industry is one of the most appropriate examples. While competition is healthy among service providers it leads to reduced prices, increased quality of service as well as increased instigation of new services. Although there is a general lack of geographic dispersion, many markets remain concentrated with one provider, particularly in rural areas which are served by telecommunications utilities where prices are comparatively high, services less than stellar, and there is hardly any encouragement for competition.

When Monopoly Might Be Preferable to Perfect Competition

However, there are circumstances where a monopoly may be useful, though perfect competition as mentioned has the following benefits: These are natural monopolies, and such situations where undertaking a large capital investment together with scale economies are required.

Natural Monopolies

A natural monopoly is defined as the market that can be serviced only by one producer because the cost of producing the goods or service over the market is cheaper when produced by this monopolist instead of dispersing the market into many agents or firms. Such assets include and exclude public amenities such as water, electricity, and transport among others.

Investment and Innovation

It is also possible for monopoly to be preferred whenever there is need for massive capital investment in areas such as research and development. For instance, the bureaucratic nature of industries such as the pharmaceutical firms tends to be monopolistic in nature because of patents when it comes to certain drugs. Such patents enable the firm to recover the initial costs incurred in researching and developing new products, and in this way, to finance ongoing innovations. If firms were allowed to freely compete with generic products, they do not have the motivation to advance and create new products because they cannot control the market for the entire period that it would take to recover the costs of development.

Conclusion

Altogether, thus, perfect competition, despite keeping many advantages, which indicate the high efficiency in usage of resources and the maximum indicator of consumer’s surplus, is not always preferable compared to other market structures. Monopolies are good where there are natural monopolies, especially in large industries that call for huge investment in research and development. Of course, one major shortcoming of monopolistic Markets is that they are likely to be inefficient and there will be a loss of consumer’s surplus, hence there is usually a need for surveillance by the authorities to ensure that the monopolists do not take advantage of their position to exploit the customers.

Consequently, it cannot be said that the proposition: “Perfect competition is always better than monopoly” is completely accurate. All these market structures have their own appropriateness in different industrial and economic setting situations. Thus, it is only when the strengths of both doctrines of perfect competition and monopoly are compared and their weaknesses realized that policies favorable to economics welfare can be set in place bearing in mind that while competition is healthy in most scenarios, monopoly could have some merits of worth taking under certain circumstances.